DTCC Website Went Down After IBTC Ticker Suddenly Removed, BTC Falls To $34K

Key Points:

- DTCC website went down as the IBTC ticker vanished, dashing BlackRock’s Bitcoin ETF hopes.

- The initial DTCC listing fueled speculation of approval and a Bitcoin surge above $35,000.

- Uncertainty around cryptocurrency ETFs and SEC approval remains a crucial factor for the crypto market.

Excitement for BlackRock’s proposed iShares Bitcoin Trust, a spot bitcoin exchange-traded fund (ETF), faced a setback as the IBTC ticker mysteriously disappeared from a key listings database of Depository Trust and Clearing Corporation (DTCC), triggering a Bitcoin price drop.

Vanishing Ticker Shakes BlackRock’s Bitcoin ETF As DTCC Website Went Down

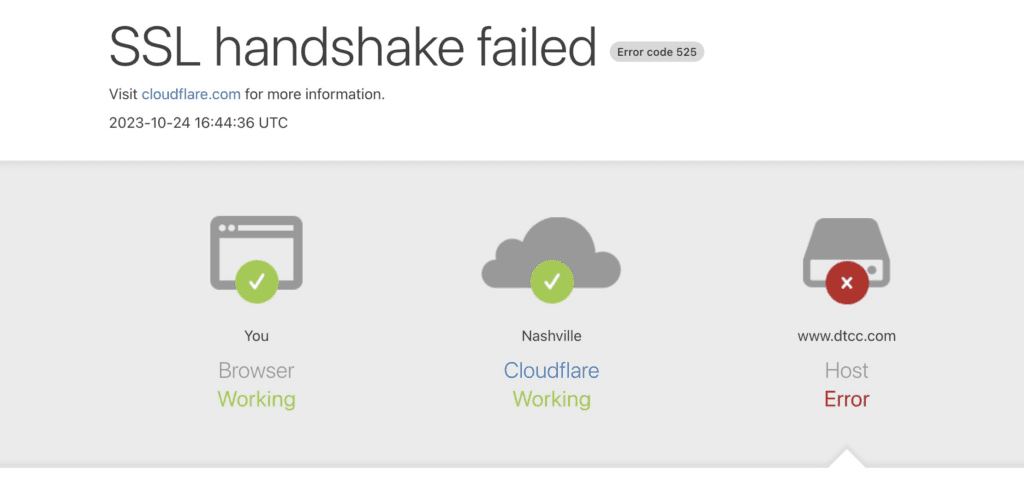

Adding to the intrigue, the DTCC website went down after the IBTC listing vanished, underscoring the crypto market’s sensitivity to any signs of an SEC-approved spot Bitcoin ETF.

This rollercoaster began on Monday when the DTCC added BlackRock’s iShares Bitcoin Trust with the IBTC ticker symbol to its reference database. This move fueled speculation that approval for the world’s largest asset manager’s spot bitcoin ETF was imminent, causing Bitcoin to surge to over $35,000.

However, the next day, IBTC was unceremoniously removed from the DTCC’s listings without explanation. The abrupt removal not only dashed hopes for imminent approval but also sent Bitcoin tumbling back below $34,000.

Crypto ETF Uncertainty Amplified by IBTC Ticker

The vanishing IBTC ticker symbol highlights the regulatory uncertainty surrounding cryptocurrency ETFs in the United States. Despite growing interest and anticipation for such investment vehicles, the SEC’s stance on these offerings remains a crucial and unpredictable factor affecting the crypto market.

The fate of BlackRock’s Bitcoin ETF seems to be having a strong impact on Bitcoin prices, and the development of the DTCC website went down. Currently, BTC is still the asset with the largest capitalization in the crypto market.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.