BlackRock Ethereum Trust Successfully Registered, ETH Exceeds $2000

Key Points:

- BlackRock Ethereum Trust successfully registered in Delaware, fueling Ethereum’s value surge.

- Speculation arises about a potential spot Ethereum ETF application by BlackRock.

- Ethereum broke $2,000, generating enthusiasm among investors and raising hopes for further gains.

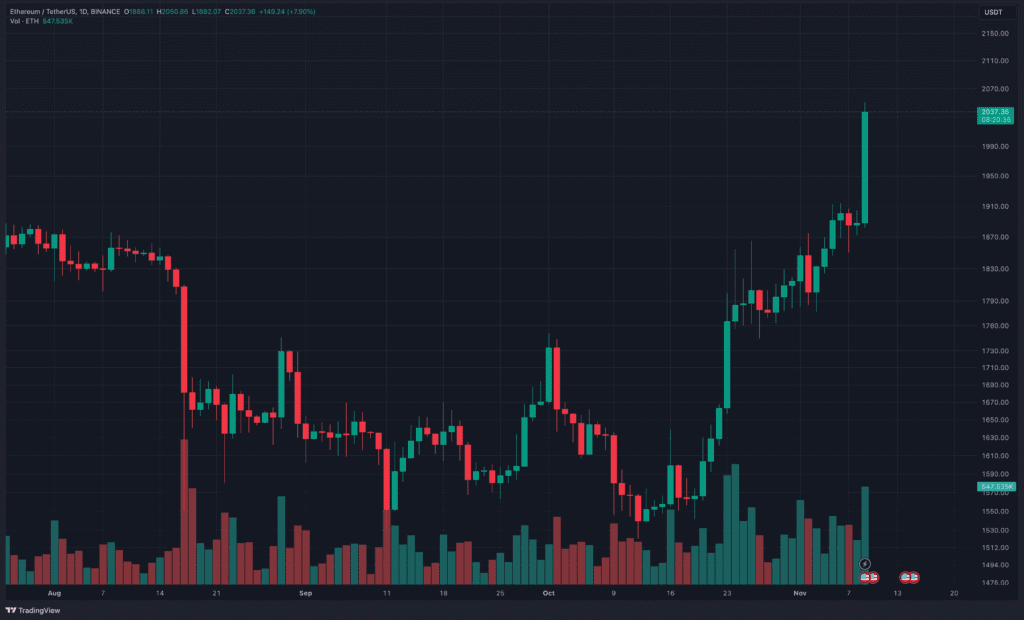

On November 9, BlackRock, the renowned $9 trillion asset manager, successfully registered the iShares Ethereum Trust in Delaware. This move has had a profound impact on Ethereum’s value, driving it to levels unseen since April.

BlackRock Ethereum Trust Registration Spurs Optimism

The registration of the BlackRock Ethereum Trust is seen as a major vote of confidence in the cryptocurrency, potentially ushering in a new wave of institutional investors into the Ethereum market.

Notably, BlackRock’s previous move with the iShares Bitcoin Trust was to register it in a similar manner, seven days before filing an ETF application with the U.S. Securities and Exchange Commission (SEC). Analysts are speculating that BlackRock might soon file for a spot Ethereum ETF, following the pattern it established with Bitcoin. This prospect has fueled anticipation of a wave of applications from other major asset managers.

The SEC’s lack of approval for a spot Bitcoin ETF in the U.S. has not dampened optimism and enthusiasm surrounding the product, resulting in Bitcoin reaching an 18-month high. The news of an open approval window for BlackRock and several other applicants has further fueled this enthusiasm. BlackRock’s interest in offering an ether-based product is expected to generate similar excitement for Ethereum, the second-largest cryptocurrency by market cap.

Ethereum Breaks $2,000 Amid Speculation of Ether ETF Filing

ETH has surpassed the $2,040 mark, even though it’s currently priced at $2,037 at the time of writing. This milestone represents a crucial breakthrough for ETH, while Bitcoin aims for the $38,000 target. The Ethereum community received this news as a promising sign for their investments.

Additional details regarding BlackRock Ethereum Trust and its implications are expected to further bolster Ethereum’s value. As long as there is no substantial loss in Bitcoin, the upward trajectory of ETH’s price is anticipated to continue.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.