Key Points:

- Singapore and Hong Kong vie for dominance in the $5 trillion tokenization market by 2030, competing to establish themselves as regional hubs.

- Hong Kong updates guidance, allowing tokenized funds and bonds for retail investors, following the successful issuance of a $102 million digital green bond.

- Singapore plans to have a robust consumer protection regime for cryptocurrencies while fostering a facilitative regulatory environment for tokenization by next year.

Singapore and Hong Kong, perennial rivals for the title of Asia’s fierce race premier financial hub, are extending their competition to the burgeoning realm of tokenization fortune.

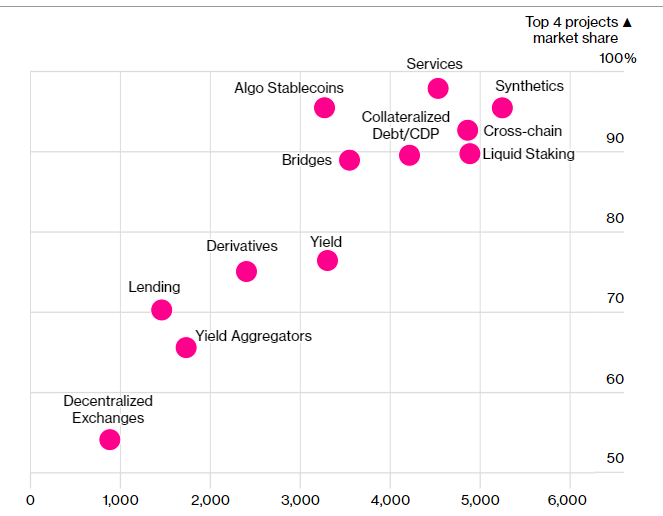

Citigroup forecasts the tokenization market could surge to $5 trillion by 2030, encompassing digital representations of tangible assets like bonds, real estate, and private equity. Advocates argue that tokenization enhances liquidity for traditionally illiquid assets, expanding buyer pools and refining price discovery.

Despite skepticism surrounding the nascent sector, both cities are vying to establish themselves as regional hubs for tokenization, anticipating its potential growth. Singapore and Hong Kong recently updated guidance to facilitate the tokenization of funds and bonds for retail investors, aligning with its year-long initiative to cultivate a crypto hub. In February, the city made waves by selling HK$800 million ($102 million) in the inaugural digital green bonds, positioned as the world’s first government-issued tokenized green bond, utilizing Goldman Sachs’ GS DAP platform.

Balancing Consumer Protection and Tokenization Facilitation

Julia Leung, the CEO of Hong Kong’s Securities and Futures Commission, expressed the city’s willingness to broaden access to the wider investing public as the crypto landscape evolves gradually. On the other side, Ravi Menon, the head of Singapore’s central bank, outlined the nation’s intention to establish a stringent regime for cryptocurrency consumer protection while fostering a highly facilitative regulatory environment for tokenization.

Menon highlighted ongoing experiments by traditional financial institutions in Singapore, leveraging blockchain and tokenized assets to streamline back-office operations, manage risks more effectively, and enhance the seamlessness of capital-market transactions. While both jurisdictions differ in their approach to retail-investor crypto trading, the competition is fierce for the potential tokenization opportunity, offering a glimmer of optimism for blockchain enthusiasts amid the challenging crypto landscape of 2022 and the ongoing uncertainties in 2023.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.