Key Points:

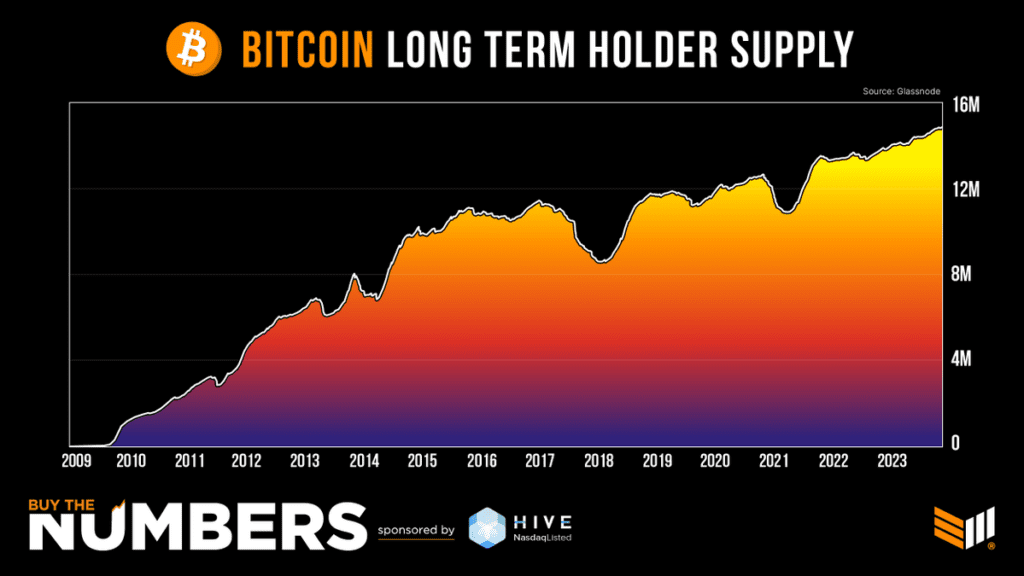

- Despite recent market volatility, Bitcoin long term holders, exhibit unwavering confidence in the cryptocurrency.

- The amount of BTC held in long-term storage has reached an unprecedented 14.83 million.

- While Bitcoin’s overall supply increases, the percentage held by low-time preference investors remains at a record level.

In a remarkable turn amidst Bitcoin’s recent market fluctuations, data from HIVE Digital Technologies reveals an extraordinary trend among long-term holders.

Bitcoin Long Term Holders Defy Volatility

Despite the cryptocurrency’s notorious volatility, these steadfast investors are demonstrating unyielding confidence, leading to a historic surge in the amount of Bitcoin long term holders.

Often referred to as “hodlers,” these individuals and entities, including notable names like Microstrategy and Grayscale, form the bedrock of Bitcoin’s ecosystem. Renowned for resisting panic selling during market downturns, their resilience is proving crucial in navigating the current period of uncertainty.

As we enter 2023, the Bitcoin long term holders supply has reached an unprecedented milestone, totaling an astounding 14.83 million BTC. This surge serves as a testament to the unwavering belief in Bitcoin’s intrinsic value and its potential to revolutionize the financial landscape.

Record-Breaking Surge Amid Market Uncertainty

Remarkably, despite the continuous increase in overall Bitcoin supply, the percentage of BTC held by low-time preference investors remains at a record high. This data surfaces at a time when the cryptocurrency markets are experiencing prolonged periods of low volatility, attributed to the absence of favorable catalysts, challenges in sustaining a crypto ecosystem, and a general lack of interest among retail investors for tokens.

In essence, the resilience of Bitcoin long term holders not only defies market uncertainties but also underscores their profound belief in the enduring value and transformative potential of Bitcoin.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.