DeFi is an open financial market that is growing very quickly. The application of Real World Assets to this market opens up huge investment opportunities for financial institutions. Today, let’s find out with Coincu the top 10 best Real World Assets coins in 2024 through this article.

Overview of Real World Assets (RWAs)

The crypto market paved the way for the birth of RWAs

The blockchain market, a burgeoning industry brimming with developmental potential, currently faces the challenge of translating theoretical promise into practical applications in real life. While the technology holds immense promise, its integration into tangible, everyday scenarios remains somewhat limited. Particularly, the application of blockchain or crypto technology in real-world scenarios is still in its nascent stages.

One notable exception is the rapid growth of decentralized finance (DeFi), a revolutionary open financial market. Since its inception in 2018, DeFi has witnessed remarkable growth, boasting a Total Value Locked (TVL) of approximately $51 billion. Although this figure may seem modest in comparison to traditional financial markets, it underscores the feasibility and rapid development of an open finance system.

Demand is tied to the real world economy

In its peak phase, the DeFi market reached a value of just under $180 billion, a noteworthy achievement considering its humble beginnings. However, when juxtaposed with the traditional market’s staggering $900 trillion valuation, the DeFi market appears minuscule.

This vast discrepancy prompts a crucial question: why not leverage blockchain technology to bring a portion of the immense value of real assets onto the decentralized ledger? Enter a grand plan: numerous blockchain projects are actively developing products designed to bridge this gap.

These innovative solutions aim to facilitate users from traditional financial backgrounds accessing crypto and blockchain technology seamlessly. Simultaneously, they empower DeFi enthusiasts to tap into real-world assets, diversifying their investment portfolios and potentially maximizing profits.

The landscape is rife with projects seeking to make this vision a reality. Their initiatives focus on creating products that ease the transition for traditional financial users, opening doors to the world of crypto and blockchain. Furthermore, these projects enable DeFi participants to stake their claims in real assets, a strategic move toward diversification and enhanced profitability in their investment strategies.

What are Real World Assets?

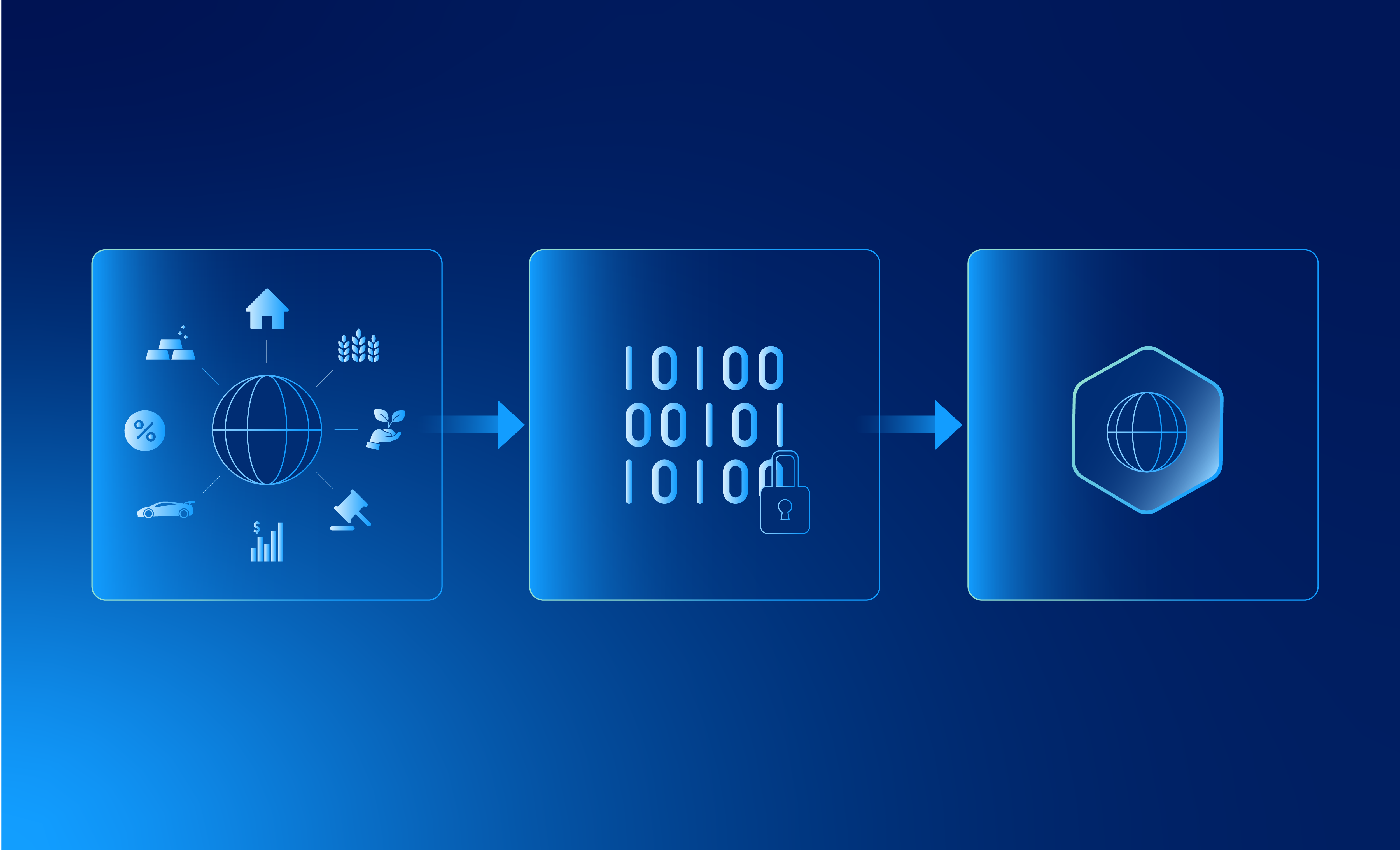

RWA is real assets integrated with blockchain

RWA encompasses tangible assets like real estate, stocks, bonds, commodities, and currencies, representing assets with intrinsic value. Initially limited to government bonds, the concept of Real World Assets has evolved significantly. In contemporary financial landscapes, the integration of blockchain technology has allowed for the digitization of a myriad of real-world assets with substantial value and liquidity.

This includes, but is not limited to bonds, stocks, precious metals, works of art, and fund certificates. Through the process of tokenization, these assets are transformed into digital counterparts, and individuals holding these tokens effectively own the corresponding assets in the physical world.

Tokenization of RWA facilitates easier transactions

Tokenized Real World Assets operate seamlessly on the blockchain, enabling easy online transactions such as buying, selling, renting, and loaning. This transformative process is aptly termed Real World Assets Tokenization (RWAT). This novel approach not only facilitates on-chain trading, similar to conventional tokens, but also extends the functionality of real-world assets in the digital realm.

One of the key advantages offered by RWAs is heightened liquidity, a feature that significantly enhances interoperability between the blockchain environment and the tangible world. Investors can seamlessly navigate between traditional financial instruments and decentralized platforms, unlocking new avenues for financial participation.

Outlook for the RWA market in 2024

Following a challenging year in 2022 marked by a bearish trend, the cryptocurrency market has exhibited signs of recovery in 2023. While the future of market behavior remains unpredictable, numerous indicators point towards a favorable outlook for cryptocurrencies in 2024. Notably, institutional investors are increasingly expressing a keen interest in the digital asset space, signaling a potential shift in the financial landscape.

Various projects are dedicated to addressing critical issues such as scalability, security, and efficiency. Simultaneously, the use cases and global adoption of cryptocurrencies by everyday users are on the rise. The tokenization of real-world assets, encompassing assets like real estate, stocks, and precious metals, gains traction as blockchain technology enables seamless and secure transactions.

The intersection of DeFi and RWAs is a noteworthy trend that has seen a resurgence in 2023. The recovery of the DeFi sector contributes significantly to the development of RWAs, creating a symbiotic relationship between these two innovative domains. As the crypto market gains momentum, the promise of explosive growth in DeFi during 2024 becomes increasingly evident.

Top 10 best Real World Asset coins in 2024

MakerDAO: MKR & DAI

Overview

In 2014, MakerDAO pioneered a revolutionary borrowing platform, introducing the stablecoin DAI. Simplifying its functionality to that of a bank, MakerDAO allows users to deposit collateral in exchange for cash, with the platform’s native token, MKR, representing DAI.

Addressing the challenge of capital efficiency from the outset, MakerDAO enables users to deposit various assets, avoiding the necessity of selling assets while still accessing funds. MKR and DAI are the best Real World Asset coins in the DeFi market.

RWA applications

In a recent move to diversify its asset portfolio, MakerDAO expanded the backing of stablecoin DAI beyond cryptocurrencies by introducing RWA. The current valuation of RWA in MakerDAO’s holdings stands at an impressive $2.5 billion. Notably, this expansion into real-world assets positions MakerDAO as a dynamic player in the DeFi landscape.

MakerDAO also unveiled plans to create a tokenized product based on government bonds. The proposal aims to establish an off-chain Exchange-Traded Fund (ETF) managed by MakerDAO. This innovative tokenized version will operate on the blockchain, promoting collateral support activities on platforms such as Aave when required.

Maple Finance: MPL

Overview

Unlike conventional platforms that cater primarily to individual users, Maple Finance has set its sights on creating a credit capital market for larger entities, requiring a minimum loan amount of $1 million, subject to stringent protocol moderation. While initially concentrating on organizations within the cryptosphere, Maple Finance has learned valuable lessons from past debt defaults.

As a proactive measure to mitigate risks associated with crypto-centric entities, the project has diversified its focus to include markets beyond the crypto space. This puts MPL on the list of the best Real World Asset coins that users choose.

RWA applications

A notable development in Maple Finance’s evolution is the launch of a liquidity pool dedicated to trade receivables. The newly introduced USDC stablecoin pool provides organizations with the opportunity to secure cash advances while benefiting from discounted tax rebates and funding programs, such as the Employee Retention Credit (ERC) offered by the U.S. Internal Revenue Service (IRS).

The liquidity pool targets an annualized yield of 10%, requiring a minimum investment of $500,000 in USDC and a 45-day lockup period. Access to the pool is restricted to accredited investors, including institutional asset managers and DAO treasuries. Compliance with rigorous know-your-customer (KYC) and anti-money laundering checks is mandatory, ensuring a secure and transparent environment for participants.

Polymesh: POLYX

Overview

Polymesh is a trailblazer, being the first permission-based, public Layer 1 blockchain meticulously designed for regulated assets, with a primary focus on security tokens and real-world asset markets. By doing so, Polymesh unlocks the gateway to a plethora of new financial tools, seamlessly addressing challenges pertaining to governance, identity, compliance, security, and payments. The POLYX project’s native token is one of the best Real World Asset coins, with excellent performance.

A distinctive feature of Polymesh lies in its rigorous identity verification process, a mandatory step for all participants on the chain. Whether it’s issuers, investors, stake participants, or node operators, each entity involved in Polymesh must undergo a comprehensive identity verification process. Underpinning Polymesh’s architecture is the versatile Substrate module, which provides a foundational framework that empowers developers to build a blockchain.

RWA applications

Polymesh is a dedicated solution for Real World Assets, adeptly addressing challenges related to governance, authentication, compliance, and security within this unique asset class. At the heart of Polymesh’s ecosystem is the POLYX token, which serves as both the fuel and transaction fee for the blockchain. Notably, over 400 million POLYX tokens are currently staked on the network, supporting the operation of 42 nodes.

The staking and node validation system not only fosters network security but also underscores the decentralized nature of Polymesh, ensuring that active participants play a crucial role in the platform’s governance and transaction processing. Given its institutional-grade nature, Polymesh operates as a licensed blockchain network. As a result, all participants, spanning issuers of security tokens, investors, and those engaged in staking or operating nodes, must undergo a comprehensive identity verification process.

Centrifuge: CFG

Overview

Centrifuge is a prominent player, particularly in the realm of RWA. Leveraging the power of blockchain technology, Centrifuge aims to bridge the gap between traditional assets and the blockchain, unlocking new possibilities for market accessibility. Centrifuge’s platform is designed to seamlessly bring real-world assets onto the blockchain, facilitating the creation of applications that enhance accessibility to these assets within the market.

One of the key features of Centrifuge is its commitment to facilitating direct connections between borrowers and lenders, thereby contributing to the decentralized nature of DeFi. At its core, Centrifuge’s vision is to merge real-world assets with the decentralized financial ecosystem, thereby reducing the cost of capital for small and medium enterprises. By doing so, the platform not only empowers SMEs with more affordable financing options but also addresses the dynamic nature of the cryptocurrency market.

RWA applications

As the DeFi landscape continues to evolve, Centrifuge stands out with an impressive track record, having facilitated the support of nearly $500 million in total asset value. The platform’s Total Value Locked (TVL) has surged to over $250 million, marking a significant threefold increase since the inception of 2023. Centrifuge’s remarkable growth is not only reflected in the substantial value of the assets it supports but also in its consistently high ranking within the RWA niche.

At the heart of Centrifuge’s ecosystem is the CFG token, which serves as the governance token for the platform. CFG plays a pivotal role in administering and operating the network, providing a mechanism for users to participate in decision-making processes. Furthermore, CFG is instrumental in distributing rewards to liquidity providers (LPs) and validators within the Centrifuge network.

Goldfinch: GFI

Overview

Goldfinch has positioned itself as a key player in increasing the adoption of RWAs. Focusing its efforts on lending to emerging markets, particularly in Asia, Goldfinch has set its sights on supporting startups that have transitioned past their initial stages and are generating their first revenue. GFI is also the top choice of institutions, and it promises to be one of the best Real World Asset coins that could explode in 2024.

What sets Goldfinch apart from other on-chain lending protocols like MakerDAO, AAVE, and Compound is its departure from the conventional requirement of over-collateralization with crypto. Goldfinch allows borrowers to secure loans based on their creditworthiness. Instead of pledging crypto assets as collateral, borrowers can leverage their creditworthiness, evaluated by a network of “backers” and auditors associated with the Goldfinch protocol.

RWA applications

Ondo Finance: ONDO

Overview

In the past, Ondo Finance was a project in the Liquidity As a Service (LaaS) segment that allowed projects to rent abundant liquidity from users. However, the downtrend came, and this business was no longer as attractive as when DeFi exploded and Ondo Finance shifted to the RWA industry. Ondo Finance has carved a niche for itself as a robust protocol operating within the RWA space.

One of Ondo’s key contributions to the DeFi space lies in its role as a stabilizing force for investment returns. In a market characterized by volatility stemming from various factors, Ondo provides a reliable framework for investors to exchange profits and risks intelligently. The project’s native token is ONDO, it also integrates many features that help it enter the list of the best Real World Asset coins.

RWA applications

Ondo Finance’s product portfolio is a testament to its commitment to promoting synergy between DeFi and TradFi. The platform’s innovative offerings include:

- USDY: USDY stands as a tokenized representation backed by short-term US Treasury bonds and bank deposits. Designed to be an interest-bearing Stablecoin, USDY is pegged to the US dollar, providing stability in the volatile DeFi market while offering users the opportunity to earn interest.

- OUSG: Users engaging with OUSG deposit USDC into the platform, which is then converted into USD to acquire assets such as US government bonds or corporate bonds. OUSG allows the protocol and users to share profits collaboratively, with users retaining the flexibility to reclaim their USDC at any time.

- OMMF: OMMF facilitates user access to the US Money Markets, offering investment opportunities in one of the world’s largest and most liquid markets, the foreign exchange market. This product exemplifies Ondo Finance’s commitment to diversification and intelligent capital deployment.

- OHYG: Targeting high-yield corporate bond ETFs, OHYG allocates a portion of funds to both USDC and USD, ensuring liquidity.

- Flux Finance: Akin to Compound V2, Flux Finance enables users to earn profits by depositing stablecoins into the protocol and vice versa.

Pendle Finance: PENDLE

Overview

Pendle Finance is making waves with substantial changes following a recent investment infusion from Binance Labs. The platform, known for facilitating directional bets on yield movements in the market, has introduced a game-changing RWA product. This move is aimed at tapping into the immensely fertile yet largely untapped billion-dollar market.

Pendle Finance operates on a unique system where yielding assets are categorized into Principal Tokens (PT) and Yield Tokens (YT). This innovative approach provides users with the flexibility to earn either fixed or variable yields through Pendle’s v2 Automated Market Maker (AMM). And of course, PENDLE is also one of the best Real World Asset coins that we chose for 2024.

RWA applications

Pendle Finance has entered the realm of RWA, introducing two distinct assets: sDAI from Spark Protocol and fUSDC from Flux Finance. As users deposit their sDAI and fUSDC into Pendle Finance, they gain access to additional profit avenues, showcasing the platform’s role as a facilitator for decentralized yield generation.

- sDAI, a product of Spark Protocol within the Maker DAO ecosystem, offers a unique proposition to holders. By depositing sDAI into Pendle Finance, users can automatically accumulate a 5% interest over time. Spark Protocol, known for its diverse product range, including Flash Loan, eMode, and Isolation Mode, continues to provide innovative solutions for profit generation within the DeFi space.

- fUSDC, an asset affiliated with Flux Finance and situated in the Ondo Finance ecosystem, brings another dimension to Pendle Finance’s RWA approach. Lenders can earn interest on their Stablecoins by depositing them into the Flux Finance protocol. The profitability of stablecoins is derived from exposure to real-world assets through Ondo Finance, including government bonds and corporate bonds.

Synthetix: SNX

Overview

Synthetix, a pioneering DeFi platform established in 2017 and built on the Ethereum blockchain, has been making waves in the decentralized finance space by offering users the ability to mint and trade synthetic assets. These synthetic assets, functioning as price-based derivatives, encompass a diverse range, including cryptocurrencies and Real World Assets such as gold, stocks, and currencies.

The platform has become a key player in the DeFi ecosystem, witnessing a remarkable surge in trading volume. With transactions amounting to hundreds of millions of USD daily, Synthetix has solidified its position as a go-to platform for users seeking exposure to synthetic derivatives.

RWA applications

Synthetic tokens (SNX), as a concept, revolutionize the way real-world assets are represented and traded within the decentralized ecosystem. By creating synthetic versions of traditional assets, users can access a diverse range of financial instruments.

This innovation empowers DeFi participants to engage in activities such as options trading, margin trading, and futures contracts, all while interacting with real-world assets. This is how SNX deserves to be on the list of the best Real World Asset coins in 2024.

Ribbon Finance: RBN

Overview

Unlike traditional finance, where Structured Products refer to financial tools strategically crafted by combining various derivative products, Ribbon Finance’s DeFi Structured Products take this concept to new heights.

The primary objective is to provide users with a platform that not only maximizes profits but also mitigates risks effectively throughout the investment process. The amalgamation of derivative products, lending, and the Options Dex Aevo sets Ribbon Finance apart as a comprehensive and user-centric protocol.

RWA applications

Ribbon Finance is setting ambitious goals within the DeFi realm, aiming not only to generate profits for small investors but also to establish itself as a trusted cross-chain financial tool for a broader audience. The protocol distinguishes itself through a suite of tools designed to gain a competitive edge, particularly in comparison to other Real World Assets.

- Theta Vault: Profit-focused strategy (ETH and WBTC).

- Covered Call: Vault Insurance Fund.

- Strike Selection & Expiry: Choose when to execute the price and expire the option.

- Technical Architecture: Technical Architecture.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.