Real world asset tokenization refers to the process of converting physical or tangible assets into digital tokens on a blockchain or distributed ledger.

This concept emerged with the advent of blockchain technology, particularly in the context of cryptocurrencies like Bitcoin and Ethereum. Tokenization allows for the representation of ownership or rights to real-world assets in a digital form, making them more easily tradable, divisible, and transferable.

What Is Real World Asset Tokenization?

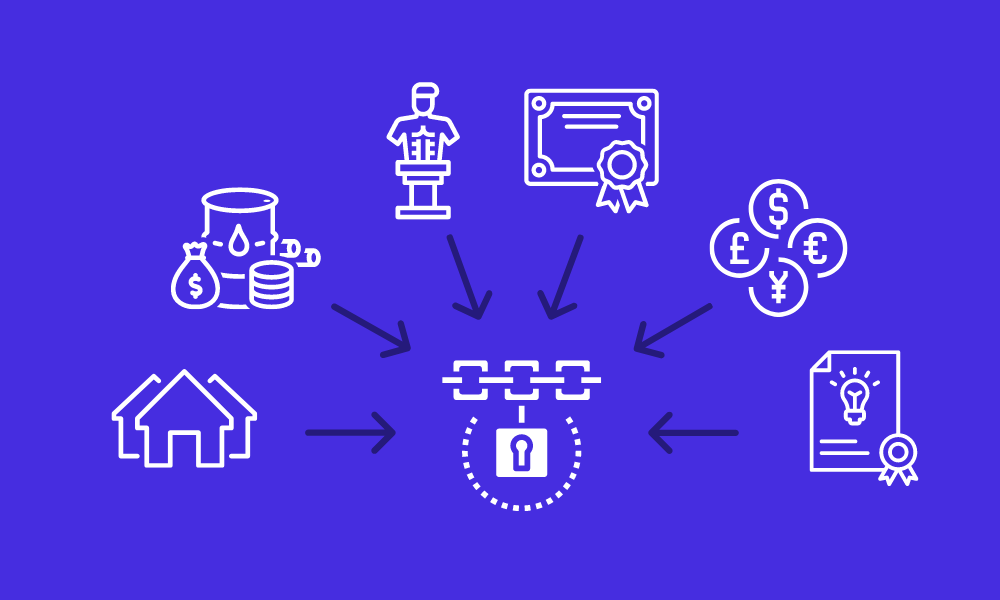

In the rapidly evolving landscape of blockchain technology, Real-world asset tokenization are emerging as a groundbreaking solution, revolutionizing the representation and exchange of physical and traditional financial assets. These blockchain-based digital tokens encompass a diverse range of assets, including cash, commodities, equities, bonds, credit, artwork, and intellectual property.

The Transformative Power of Asset Tokenization

The essence of asset tokenization lies in its ability to redefine how assets are accessed, exchanged, and managed. By leveraging blockchain and distributed ledger technology, real-world asset tokenization introduces a paradigm shift in the traditional financial system, unlocking a plethora of opportunities for both blockchain-powered financial services and a myriad of non-financial applications. This transformative journey is underpinned by the principles of cryptography and decentralized consensus.

Recognized as one of the most promising applications of blockchain technology, asset tokenization holds the potential to reshape nearly every facet of human economic activity. Its impact is poised to extend far beyond the realm of finance, reaching into various sectors and industries. The future of finance is envisioned to be on-chain, featuring a decentralized landscape where numerous blockchains seamlessly support trillions of dollars worth of tokenized RWAs.

Redefining Finance through Decentralized Tokenized Assets

Envisioning this future, experts foresee a scenario where hundreds of blockchains will converge on a common substrate, constituting a robust foundation for the tokenized economy. This foundation will be built on blockchain and distributed ledger technology-based networks, interconnected through a universal interoperability standard. Such a standardized approach ensures seamless communication and collaboration across diverse blockchain ecosystems, fostering a more efficient and interconnected global financial infrastructure.

The implications of this transformation are profound, offering a democratized and inclusive financial landscape. Tokenized RWAs enable fractional ownership, making high-value assets accessible to a broader range of investors and increasing market liquidity. Moreover, the decentralized nature of blockchain technology reduces reliance on traditional intermediaries, streamlining the transfer and management of assets.

Kinds of Real World Asset Tokenization

Real-world asset tokenization can take various forms, covering a wide range of tangible and intangible assets. Here are some common kinds of real-world asset tokenization:

- Real Estate Tokenization

- Art and Collectibles Tokenization

- Commodities Tokenization

- Financial Instruments Tokenization

- Tokenized Securities

- Intellectual Property Tokenization

- Tokenized Debt Instruments

- Tokenized Venture Capital

- Tokenized Real Assets Funds

- Carbon Credits Tokenization

- Description: Involves representing ownership or investment in real estate properties through digital tokens on a blockchain.

- Benefits: Increases liquidity by allowing fractional ownership, lowers barriers to entry, and enables efficient and transparent property transactions.

- Description: Tokenizing ownership of artworks, collectibles, or rare assets to enable trading and fractional ownership on blockchain platforms.

- Benefits: Expands access to the art market, facilitates transparent provenance tracking, and enhances liquidity.

- Description: Involves representing ownership or investment in physical commodities such as gold, silver, or oil through blockchain-based tokens.

- Benefits: Enhances liquidity, enables fractional ownership, and streamlines commodity trading processes.

- Description: Tokenizing traditional financial instruments like stocks, bonds, and derivatives, converting them into digital tokens on a blockchain.

- Benefits: Facilitates faster and more transparent trading, allows for fractional ownership, and potentially reduces transaction costs.

- Description: Tokenizing ownership of securities, including shares of companies or investment funds, on a blockchain.

- Benefits: Improves market accessibility, reduces administrative burdens, and enhances transparency in ownership records.

- Description: Tokenizing ownership or licensing rights of intellectual property such as patents, trademarks, or copyrights.

- Benefits: Enables creators to monetize their intellectual property more efficiently, facilitates licensing agreements, and ensures transparent royalty distribution.

- Description: Representing debt instruments, such as loans or bonds, through digital tokens on a blockchain.

- Benefits: Streamlines debt issuance processes, enhances transparency, and potentially broadens the investor base.

- Description: Tokenizing ownership in venture capital funds or startup equity, allowing for easier transfer and management of ownership stakes.

- Benefits: Improves liquidity for early-stage investors, enables fractional ownership, and streamlines the fundraising process for startups.

- Description: Creating funds that invest in a diversified portfolio of tokenized real-world assets, providing investors exposure to various asset classes.

- Benefits: Offers diversification, liquidity, and accessibility to a range of assets within a single investment vehicle.

- Description: Tokenizing carbon credits to enable transparent trading and investment in carbon reduction projects.

- Benefits: Facilitates the financing of sustainable projects, enhances liquidity in the carbon credit market, and encourages environmental conservation.

These are just a few examples, and the potential for real-world asset tokenization extends to various other assets, depending on technological advancements, regulatory developments, and market demands. Each kind of tokenization comes with its unique benefits and challenges, and the landscape continues to evolve as the technology matures.

The Ways Real World Asset Tokenization Are Used?

Real-world asset tokenization refers to the process of representing ownership or rights to physical assets on a blockchain in the form of tokens. This can be done using blockchain technology, typically through smart contracts, to create digital tokens that represent ownership, value, or specific rights associated with a tangible asset. Here are several ways in which real-world asset tokenization is used:

- Real Estate Tokenization

- Art and Collectibles

- Commodities Tokenization

- Company Equity and Securities

- Intellectual Property

- Energy and Renewable Assets

- Fractional Ownership: Tokenizing real estate allows investors to buy and sell fractional ownership of properties. This enables a broader range of investors to participate in real estate investments, making it more accessible.

- Liquidity: Tokenization can enhance liquidity in the real estate market by making it easier to trade property tokens on secondary markets, reducing the traditional barriers to entry and exit.

- Cost Efficiency: Tokenization can streamline the real estate transaction process, reducing paperwork, and associated costs.

- Fractional Ownership: Tokenizing art and collectibles allows multiple investors to own a portion of a valuable piece. This opens up investment opportunities to a wider audience.

- Authentication and Provenance: Blockchain can be used to verify the authenticity and provenance of art and collectibles by recording the history of ownership and transactions.

- Fractional Ownership: Similar to real estate, tokenization allows investors to own fractions of commodities, such as precious metals, making it more feasible for smaller investors.

- Supply Chain Efficiency: Tokenization can be used to track and trace commodities throughout the supply chain, providing transparency and reducing the risk of fraud.

- Equity Tokenization: Startups and established companies can tokenize their equity, allowing for the issuance of digital shares on a blockchain. This facilitates fundraising through Initial Coin Offerings (ICOs) or Security Token Offerings (STOs).

- Dividend Payments: Smart contracts can automate dividend payments to token holders, streamlining the distribution of profits.

- Royalties and Licensing: Tokenization can be applied to intellectual property, enabling creators to tokenize and sell shares of their royalties or licensing rights directly to investors.

- Protection of Rights: Blockchain can help in tracking and protecting intellectual property rights by recording ownership and usage rights on an immutable ledger.

- Energy Tokenization: Renewable energy projects, such as solar or wind farms, can tokenize their assets to raise funds and provide investors with a share of the project’s revenue.

- Carbon Credits: Tokenizing carbon credits allows for more efficient trading and tracking of carbon offsets on a blockchain.

The Importance of Stablecoins in Real-World Asset Tokenization

Stablecoins play a crucial role in the real-world asset tokenization process, providing stability, liquidity, and accessibility to the digital assets market. Real-world asset tokenization involves representing physical assets, such as real estate, commodities, or other tangible assets, as digital tokens on a blockchain. Stablecoins, which are pegged to the value of traditional fiat currencies or other stable assets, bring several key benefits to this process:

- Price Stability

- Reduced Volatility Risk

- Facilitating Transactions

- Global Accessibility

- Compliance and Regulation

- Smart Contract Integration

Stablecoins are designed to maintain a stable value, often pegged to a fiat currency like the US Dollar or a basket of assets. This stability reduces the volatility associated with many cryptocurrencies, making real-world asset tokenization more attractive to investors. Investors and stakeholders can have confidence in the value of their digital assets, fostering trust and broader adoption.

Traditional cryptocurrencies like Bitcoin and Ethereum are known for their price volatility. When it comes to tokenizing real-world assets, this volatility can be a deterrent for both issuers and investors. Stablecoins mitigate this risk, providing a reliable medium of exchange without the significant price fluctuations commonly associated with other digital assets.

Stablecoins enable seamless and efficient transactions within the digital ecosystem. When tokens representing real-world assets are paired with stablecoins, it simplifies trading and ensures that the value of the assets remains consistent throughout the transaction process. This ease of transfer and reduced friction can contribute to increased liquidity in tokenized markets.

Stablecoins can be used as a bridge between traditional financial systems and blockchain-based assets. Since they are typically pegged to widely recognized fiat currencies, stablecoins facilitate the onboarding of institutional and retail investors into the tokenized assets space. This global accessibility can lead to increased liquidity and a more diverse pool of participants.

Stablecoins often pegged to fiat currencies, can assist in meeting regulatory requirements. By using stablecoins in real-world asset tokenization, issuers can adhere to existing financial regulations, making it easier to navigate legal frameworks. This compliance helps build legitimacy and encourages institutional involvement in the tokenized assets market.

Stablecoins can be seamlessly integrated into smart contracts, enabling programmable and automated transactions. This feature is particularly useful in real-world asset tokenization, where complex agreements and conditions can be encoded into smart contracts, providing transparency and efficiency in the management of tokenized assets.

Stablecoins serve as a foundational element in the tokenization of real-world assets, addressing issues related to volatility, liquidity, and regulatory compliance. Their stability and compatibility with existing financial systems make them a key enabler for the widespread adoption of tokenized assets across various industries.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |