Key Points:

- Bitcoin ETF requirements are being released by the SEC in preparation for a launch in January 2024, providing a new investment avenue.

- The SEC’s insistence on cash transactions over Bitcoin in-kind redemptions raises concerns for retail investors.

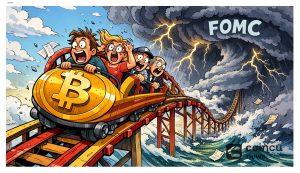

In a significant development, Bitcoin ETF requirements are being released in preparation for a January 2024 launch, resolving the longstanding uncertainty surrounding their introduction.

SEC’s Bitcoin ETF Requirements Raise Concerns for Bitcoin ETFs

However, the U.S. Securities and Exchange Commission (SEC) has imposed Bitcoin ETF requirements, which can be said to be a turning point, insisting on cash transactions instead of the standard in-kind redemptions using Bitcoin, potentially increasing costs for retail investors.

According to Fortune, this departure from the Bitcoin ETF requirements is raising eyebrows, considering that in-kind transactions are the standard practice for other ETFs.

The SEC’s decision to bar ETF issues from utilizing Bitcoin for in-kind redemptions, opting for cash transactions instead, diverges from its approval of a gold ETF in 2014, where in-kind transactions involving physical gold bars were considered more efficient.

Cash Transactions Pose Challenges for Bitcoin ETF Investors

The SEC‘s rationale behind this stance appears to be unusually rooted in viewing Bitcoin as a novel and potentially manipulable asset. The agency aims to minimize opportunities for self-dealing by market makers and ETF issuers. However, the likelihood of such manipulation remains uncertain, especially considering that a federal appeals court previously rejected this argument, prompting the SEC to lift its block on Bitcoin ETFs.

In a related development, Coinbase, a leading cryptocurrency exchange, plans to appeal the SEC’s rejection of its proposal for a new digital asset framework.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.