Bitcoin Options Frenzy: $100M Call Bets As Bulls Charge Back

Key Points:

- Bitcoin surges above $44,000, experiencing a 4% increase in the last 24 hours.

- Ethereum sees a divergence in trend with a block trade of over $100 million buying puts.

- Solana’s token SOL rises 8.5% in the last 24 hours, surpassing $80 and becoming the fifth-largest cryptocurrency by market capitalization.

Bitcoin options frenzy results in block trades of over $100 million. ETH sees divergence, while SOL rises 8.5% to become fifth-largest crypto.

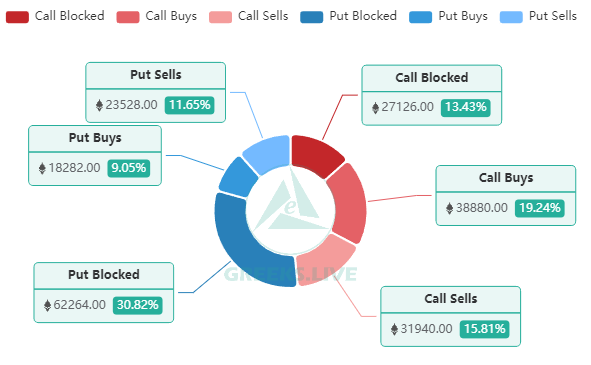

Bitcoin has surged back above $44,000, marking its highest value in over a week and experiencing a 4% increase in the last 24 hours, resulting in block trades of over $100 million in call options in the past hour. This has led to rallies in all major term IVs.

Coinglass data reveals that this breakout resulted in more than $33 million worth of BTC short liquidations within the past day.

However, analysts suggest that the leading cryptocurrency may face heightened selling pressure due to the majority of its circulating supply being in a profitable state.

Bitcoin Options Frenzy: $100M Call Bets

In contrast, Ethereum (ETH) has experienced a divergence in trend, with a block trade of over $100 million buying puts earlier in the day. Currently, long positions are concentrated on Bitcoin (BTC), while shorts continue to dominate on ETH.

As Bitcoin exceeded 44,000, the stock price of Bitcoin mining machine manufacturers Canaan Technology and Ebang rose as much as 32% and 34%. The North American Bitcoin mining companies Marathon and Bitfarms have seen more than 500% gains this year.

Meanwhile, Solana’s token SOL has seen a significant rise of 8.5% in the last 24 hours, surpassing $80. Its total market value has now exceeded $34.3 billion, propelling SOL to become the fifth-largest cryptocurrency by market capitalization, overtaking XRP.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.