US Congressman Warren Davidson Wants SEC Chair To Resign In 2024

Key Points:

- US Congressman Warren Davidson intensifies efforts to oust SEC Chairman Gary Gensler, citing corruption concerns and proposing policy changes in 2024.

- The SEC dismisses 42 cases due to a noted “control deficiency,” revealing internal access to memos. The move raises questions about the agency’s internal oversight.

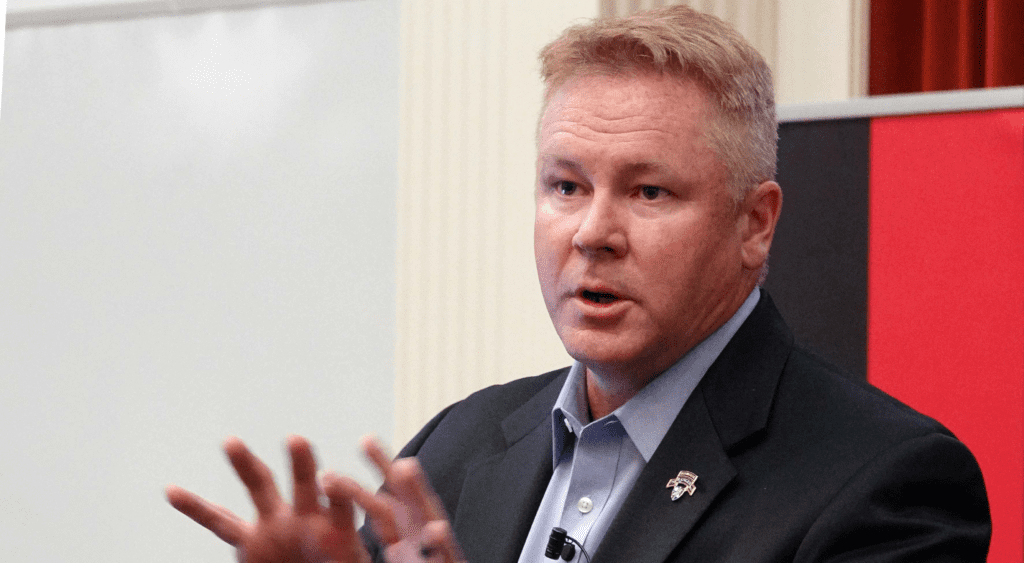

In a bold move, US Congressman Warren Davidson is intensifying his efforts to remove Gary Gensler from his position as chairman of the Securities and Exchange Commission (SEC). Citing recent criticisms directed at the agency, Davidson emphasized the need for change in 2024.

Read more: Gary Gensler Bitcoin Stance Remains Stable: It’s Not A Security

US Congressman Warren Davidson Pushes for Gensler’s Ouster Amid SEC Controversy

“2024 will be a great time to fire Gary Gensler, pass the SEC Stabilization Act, hold the SEC accountable for its corruption, and end the accredited investor rule that protects deal flow for the donor class,” he said.

US Congressman Warren Davidson, a vocal critic of the SEC’s handling of cryptocurrency, previously lambasted Gensler‘s leadership. He referenced a recent court ruling in favor of Grayscale, deeming Gensler’s actions “arbitrary and capricious.”

Recent events have added fuel to the fire, with the SEC dropping 42 cases within its administrative legal system. The agency attributed the mass dismissal to a “control deficiency,” acknowledging that officials in the enforcement division had accessed internal memos and drafts.

Gensler faced intense questioning from the House Financial Services Committee, with Republican lawmakers seeking explanations on the SEC’s policies regarding climate-related disclosures and cryptocurrency regulation.

Adding to the complexity, Davidson raised concerns about central bank digital currencies (CBDCs), labeling them a threat to Western civilization. He argued that CBDCs, by their nature, could turn currency into a tool for coercion and control, advocating for their outright ban.

As the call for Gensler’s removal gains momentum, the SEC finds itself under increasing scrutiny, with potential legislative changes on the horizon.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |