Key Points:

- SEC’s implicit acknowledgment of Ether as a commodity signals a potential breakthrough for spot ETFs.

- Ethereum’s evolving status navigates regulatory nuances, influencing investment landscapes.

- Analyst notes SEC’s action as a strategic move, setting the tone for potential Ether ETF approvals in 2024.

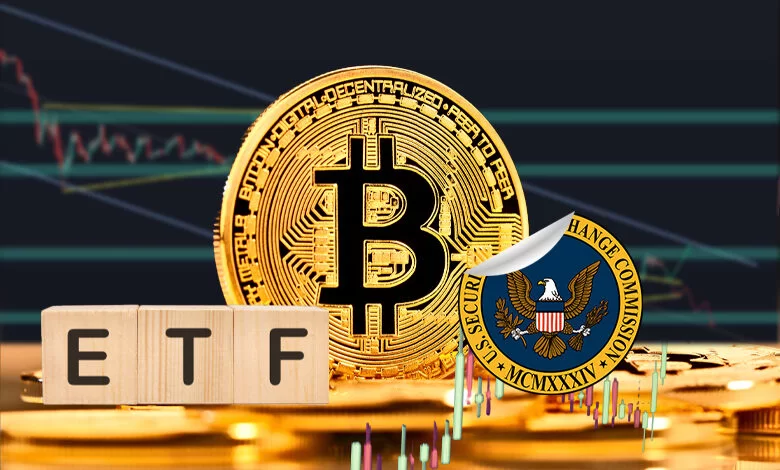

SEC has tacitly acknowledged Ether ETF as a commodity, clearing the path for potential approval of spot Exchange-Traded Funds (ETFs) this year.

Seyffart highlighted the SEC’s approval of Ether futures ETFs in October 2023, emphasizing that the regulatory body did not contest Ethereum’s classification during the ETF registration process with the Commodity Futures Trading Commission (CFTC). Seyffart explained, “The SEC has approved Ethereum futures ETFs. So again, Gary Gensler will not explicitly say whether Ethereum is a security or a commodity, but in their action, by approving those Ethereum futures ETFs, they’re implicitly accepting those Ethereum futures as commodities futures.”

SEC’s Ether ETF Approval Unravels Dynamics!

The first Ether futures ETFs debuted on October 2, with nine funds hitting the Chicago Board Options Exchange from firms like ProShares, VanEck, Bitwise, Valkyrie, Kelly, and Volshares. Seyffart warned that the SEC might face legal challenges and be compelled to delist futures ETFs if Ether were deemed a security, as the classification determines distinct legal requirements, tax implications, and regulatory obligations.

Highlighting the potential conflict between the SEC and CFTC, Seyffart suggested, “If they call Ethereum a security, it’ll be going against their sister regulator, CFTC. That’s why I think we could see potential Ethereum ETFs approved this year as well.”

The SEC faces a critical decision deadline in May 2024 for spot Ether ETFs from VanEck, ARK 21Shares, and Hashdex, with subsequent deadlines in the following months. The outcome will shape the future landscape for Ether, as regulatory clarity becomes paramount in navigating the evolving crypto investment space.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |