Possible Reasons For Spot Bitcoin ETF Rejection: The Market Will Return To Bearish In 2024!

Cryptocurrency enthusiasts have been eagerly expecting the approval of a series of spot Bitcoin exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC) this January. The crypto community, however, faces the potential risk of spot Bitcoin ETF rejection, introducing an element of uncertainty into the market. Let’s dig deeper into this issue before the market fluctuates this week.

But first, we need to learn about the spot Bitcoin ETF.

What is a spot Bitcoin ETF?

Exchange-traded funds (ETFs) play a pivotal role by offering investors a diversified basket of securities traded on the stock market. These investment instruments typically mirror the performance of a specific index, sector, industry, or asset. An exemplary instance is the SPDR S&P 500 ETF Trust, which meticulously tracks the performance of the top 500 publicly traded companies in the United States. [read more]

Taking this concept a step further, the rise of Bitcoin ETFs is garnering attention as a new frontier in the investment world. A Bitcoin ETF is a financial instrument listed on the stock market designed to primarily invest in Bitcoin as an asset. Unlike traditional ETFs that track conventional securities, a Bitcoin ETF allows investors to gain exposure to the cryptocurrency’s performance without the need to directly purchase or hold the digital asset themselves. [/read]

A key distinction lies in the structure of Bitcoin ETFs, particularly the differentiation between spot ETFs and other traditional ETFs. A spot ETF invests directly in Bitcoin at its current market price, meaning the fund holds actual BTC and closely tracks the real-time price of the digital asset. This ensures that the value of the ETF remains in sync with the fluctuating market value of Bitcoin, providing investors with a convenient avenue to gauge the cryptocurrency’s performance without delving into the complexities of direct ownership.

Read more: Bitcoin ETF: Potential Investment Opportunity In Bitcoin With Less Risk

Reasons why spot Bitcoin ETF rejection may occur

Regulators are faced with numerous concerns that could impact their decision-making process. We will explore the key reasons why spot Bitcoin ETF rejection could occur, ranging from risk management to legal issues.

- Lack of Risk Management

- Security and Confidentiality

- Rug Pull of the SEC

- Price Control

- Lack of Transparency

- Legal Issues and Non-compliance

- Money Laundering Risk

- Market Size

- Potential U.S. Pressure

One primary concern for regulators is the ability to manage risks associated with the volatile nature of the Bitcoin market. If regulators perceive that the market lacks stability or liquidity to mitigate risk effectively, it may lead to the rejection of the ETF.

Regulators may reject ETFs if there are apprehensions regarding the security and confidentiality of storing and trading Bitcoin. Concerns about potential hacking or loss can significantly influence regulatory decisions in the rapidly evolving digital asset landscape.

Recent reports have raised questions about the Security and Exchange Commission’s (SEC) stance on Bitcoin ETFs, with some interpreting the SEC’s non-voting status as a potential “rug pull.” The SEC has consistently warned retail investors about the risks associated with digital assets, including cryptocurrencies, meme stocks, and nonfungible tokens (NFTs). This ongoing caution may impact the regulator’s approach to approving Bitcoin ETFs.

Concerns about the ability to control the price of Bitcoin and the risk of market manipulation are significant factors for regulators. While Bitcoin has become a mature trading instrument, concerns persist about the potential impact of minor market events or price rigging. The approval of a spot Bitcoin ETF in the U.S. is anticipated to have substantial implications for the underlying price action, especially considering the nation’s staggering national debt.

Insufficient transparency in the operation of the market and the involvement of counterparties can lead regulators to underestimate and reject the ETF. Transparency is crucial for regulatory confidence, ensuring that market participants understand the processes and mitigate potential risks.

Regulators may opt out if there are legal issues or non-compliance with regulations. Ensuring that the ETF is in full compliance with established rules and regulations is essential for regulatory approval.

The risk of money laundering in the market is a significant concern for ETF management agencies. Recent incidents, including terrorist activities, have heightened the United States’ focus on combating money laundering. The recent fine imposed on Binance for money laundering-related issues adds to the regulatory scrutiny.

If the Bitcoin market is perceived as too small or insufficient to meet the requirements of an ETF, regulators may be hesitant to approve it. The market’s size and maturity are crucial factors in determining its suitability for hosting an ETF.

There is speculation that the U.S. government may exert pressure on the SEC not to approve Bitcoin ETFs, possibly due to concerns about the insufficient collection of Bitcoin. The geopolitical implications of such a decision could impact the global cryptocurrency market.

Read more: Spot Bitcoin ETF Approval Timelines and Key Dates

BTC price reaction when spot Bitcoin ETF rejection occurs

Immediate Market Response

The current price of Bitcoin has managed to stay above $43,000 amid recent fluctuations driven by market “rumors.” However, if the spot Bitcoin ETF rejection occurs, experts anticipate a potential market downturn. The term “bloodbath” is used to describe the expected reaction, indicating a significant sell-off.

Bitcoin’s struggle to rally beyond $45,000 in the past few weeks may intensify as short-term holders, alongside miners, seek to capitalize on profits. The rejection could lead to a decline in Bitcoin prices, potentially reaching the next psychological support range situated between $35,000 and $39,000. This scenario reflects the market‘s sensitivity to regulatory decisions and the influence of short-term profit-taking.

Spot ETF Fever Impact

Bitcoin has experienced upward momentum in recent months, attributed to the anticipation and excitement surrounding spot ETFs. The cryptocurrency rallied from approximately $25,000 in mid-September, with increasing volumes and leverage amplifying market dynamics. The current sell-off indicates the possible liquidation of leveraged long positions in response to market uncertainty.

Confirmation of the spot ETF rejection by the SEC may trigger a further decline, with $35,000 emerging as a potential support level. In the absence of confirmation, Bitcoin could return to the $44,000 area, awaiting additional announcements that may sway market sentiment.

Bitcoin CME Gap Considerations

Another notable aspect considering Bitcoin’s price dynamics is the presence of a visible CME gap in the range of $39,000-$40,000. The CME gap refers to the disparity between the closing price of a Bitcoin futures contract on the Chicago Mercantile Exchange (CME) and the opening price of the subsequent contract on the following trading day.

The 24/7 nature of the cryptocurrency market versus the business-hours schedule of the CME creates these gaps. Investors often monitor CME gaps as potential indicators of Bitcoin’s future price trends. However, it’s crucial to note that the closure of a CME gap doesn’t guarantee a corresponding move in the predicted trend.

Comments from experts on the possibility of spot Bitcoin ETF rejection

In response to the recent spot Bitcoin ETF rejection, industry experts share varied perspectives on the regulatory landscape and potential future developments.

Markus Thielen, head of research at crypto platform Matrixport, expressed his belief that all current ETF applications “fall short of a critical requirement.” Thielen highlighted the perspective of Gary Gensler, Chairman of the SEC, stating that Gensler sees the industry as requiring more stringent compliance measures.

However, Alex Thorn, head of research at Galaxy Digital, countered Thielen’s arguments, deeming several points in the Matrixport report “nonsensical.” Thorn referenced Grayscale’s recent court victory and mentioned that Galaxy Digital, in partnership with Invesco, has proposed its own spot Bitcoin ETF.

“That all ETF applications still lack a critical requirement. here they are apparently referring to the fact that the issuers all have surveillance sharing agreements with coinbase but “coinbase is only 11% of the spot market.” apparently, they missed the DC Circuit Court of Appeals ruling which negated this question, which first of all said that surveilling futures markets was sufficient because futures and spot prices were “mathematically indistinguishable. (other commodity ETFs also surveil futures.)

Matrixport also says the SEC is suing coinbase so they are bad choice — future ETF applications should also include, they write, “Kraken, OKX, ByBit.” the SEC is also suing Kraken, and the idea that these would be good but for the omission of OKX & ByBit is strange,” Thorn stated.

Matrixport co-founder Jihan Wu defended Thielen’s report, stating his conviction that approval for a spot Bitcoin ETF is “inevitable” at some point in the future.

Lucas Kiely, chief investment officer of digital wealth platform Yield App, viewed the recent dip in Bitcoin’s price as a “buying opportunity.”

In a post dated January 6 on X (formerly Twitter), the SEC’s Office of Investor Education reiterated a warning to retail investors about the risks associated with digital assets, including meme stocks, cryptocurrencies, and non-fungible tokens (NFTs).

The SEC’s looming January 10 deadline to rule on a proposal by Ark Invest and 21Shares has prompted speculation among industry watchers. Stefan Rust, CEO of data provider Truflation, echoed the sentiment that Gensler has not signaled readiness to greenlight a Bitcoin ETF, emphasizing the ongoing challenge for governments and regulators to exert control over cryptocurrencies.

Chase White and Joe Flynn, analysts at Compass Point Research & Trading, shared in a December 15 note that recent meetings between fund issuers and the SEC support their base case for January spot Bitcoin ETF approval. However, they acknowledged the possibility that the SEC may choose to delay the approval, asking Ark Invest and 21Shares to refile the application for additional review time.

Contrary to this view, Scott Johnsson, general partner at Van Buren Capital, expressed confidence in approval occurring between January 8 and January 10, asserting, “There’s no more bullets in the SEC’s gun.”

In response to recent speculation fueled by Bloomberg’s report indicating that the SEC has yet to vote on Bitcoin ETFs, Bloomberg analyst Eric Balchunas has provided insights into why concerns of a potential “rug pull” are unlikely.

Balchunas emphasized that historically, the SEC has never conducted a formal vote on either the rejection of spot Bitcoin ETFs or the approval of Bitcoin futures. Instead, these decisions have been made through “Delegated Authority.” He clarified that applying the same approach would align with the ongoing process, particularly since the initiative has been primarily driven by the 10th floor, referring to the SEC’s leadership, following the recent Grayscale court win.

Addressing the speculation of a potential negative vote, Balchunas cast doubt on SEC Chairman Gary Gensler opposing approval. He argued that Gensler, who has directed significant effort from SEC staff to collaborate with 11 spot Bitcoin ETF issuers through multiple rounds of comments, would lack a substantive reason to deny approval. Balchunas highlighted Gensler’s recent directive to have these ETFs ready for launch on January 11.

However, the analyst tempered expectations by stating that even with these considerations, certainty about approval remains elusive until the SEC officially announces its decision. Balchunas drew a parallel to sports analysis, comparing the situation to how ESPN refrains from declaring a team’s victory until the game concludes, regardless of the current score.

Is there still an opportunity for investors after the spot Bitcoin ETF rejection?

Price reductions may be limited

Grayscale CEO Michael Sonnenshein has injected optimism into the market, pointing towards a strong long-term growth for Bitcoin. Sonnenshein suggests that if the ETF gets the green light, it could tap into an estimated $30 trillion of advised wealth, thus broadening Bitcoin’s investor base significantly. However, amid this bullish sentiment, CryptoQuant issues a cautious warning of a potential immediate ‘sell the news’ reaction, expecting a decline to around $32,000 next month.

CryptoQuant’s prediction is grounded in the idea that traders’ unrealized profits may reach a point that historically triggers market corrections. Perhaps they also suggest that a rejection of the spot Bitcoin ETF approval might limit price declines above $35,000.

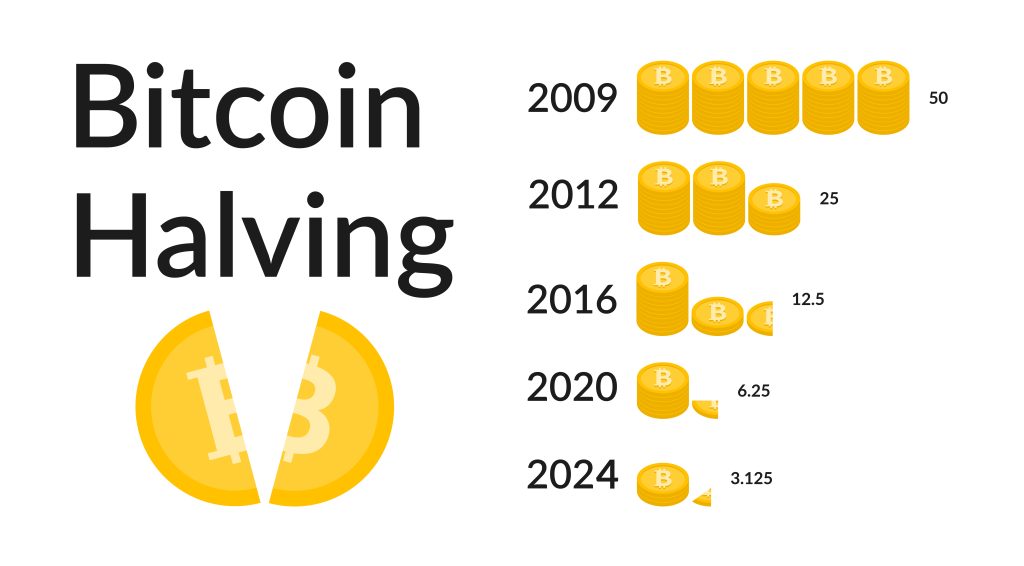

The Bitcoin halving event is still pending in April

Shifting the focus to historical trends, a study of previous Bitcoin halving events reveals intriguing patterns. The period following the 2012 halving event witnessed a remarkable BTC price surge, and the subsequent four years after the 2016 event saw an astonishing 3000% rise in the cryptocurrency’s value. Similarly, after the 2020 halving event, Bitcoin reached its all-time high of $69,000 a year later. This underscores the Bitcoin halving event’s role as a key driver for fund inflows into the crypto market, propelling both Bitcoin and altcoins to new price highs.

The Bitcoin halving event, occurring every four years, plays a crucial role in regulating the maximum supply of BTC by halving block rewards to miners. Following the 2020 event, the reward was halved from 1,250 units to 625 units. The upcoming event is set to further reduce the reward to 3,125 units.

Sell the news

The cryptocurrency market is currently at a crossroads, with analysis presenting conflicting views on Bitcoin’s immediate future. A potential “sell the news” reaction after the ETF decision and the impending Bitcoin halving event adds layers of uncertainty to the market.

If the spot Bitcoin ETF rejection occurs, the first half of 2024 might witness a bearish wave, with subsequent effects from the Bitcoin halving event potentially changing the landscape later in the year. Investors are advised to tread cautiously as the market braces for significant developments in the coming months.

Conclusion

The SEC is poised to make a significant decision regarding the approval of Bitcoin ETFs, with major players like BlackRock, Fidelity, Invesco, and Franklin Templeton awaiting the outcome. This decision holds substantial implications not only for crypto-focused entities but also for these financial behemoths, signaling a broader shift in the investment landscape.

If the SEC were to reject Bitcoin ETFs once again, it would mark a formidable obstacle for renowned fund giants that have been vying to tap into the cryptocurrency market. The prospect of such a denial has raised concerns among investors, as the market may experience a pronounced short-term impact. However, experts suggest that in the long term, Bitcoin remains an enticing investment prospect for both traders and financial institutions worldwide.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |