Key Points:

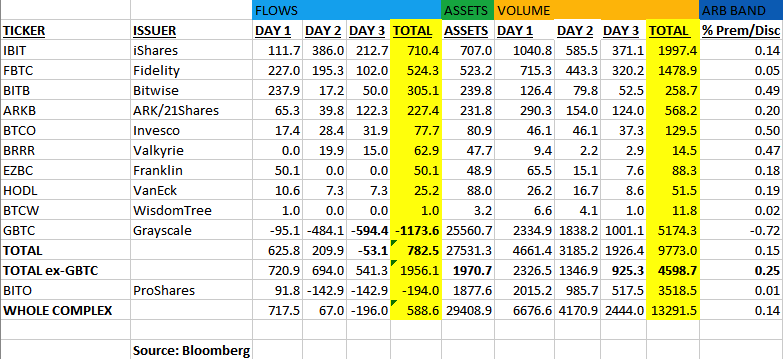

- Spot Bitcoin ETF inflow saw a positive market response, drawing $782 million in three days, signaling strong investor interest.

- New ETFs accumulate $2 billion in assets and $4.5 billion in trading volume, counteracting a $1.2 billion decline in GBTC’s asset value.

In a notable development, Bloomberg ETF analyst Eric Balchunas revealed that the recently launched spot Bitcoin ETFs have garnered substantial attention from investors.

Read more: Bitcoin Spot ETF and Futures ETF: Differences To Make The Right Investment Choice

Spot Bitcoin ETF Inflow Gains Strong Investor Response With $782 Million

On the third day post-launch, the total spot Bitcoin ETF inflow into the market reached an impressive $782 million, signaling a positive response to the nine related ETF products introduced.

The combined assets under management (AUM) for these innovative products now stand at $2 billion, with a robust trading volume of $4.5 billion, indicating both market activity and a heightened interest in the new offerings.

Interestingly, the market also observed a decline in the asset value of the largest Bitcoin trust, GBTC (Grayscale Bitcoin Trust), by approximately $1.2 billion. However, the stellar performance of the new ETFs effectively mitigated this impact.

Despite the high trading volumes for GBTC, a CoinShares report revealed net outflows of $579 million last week. The conversion of GBTC to an ETF format, though a recent development, did not shield it from market dynamics.

Early estimates from JP Morgan disclosed a drop in spot Bitcoin ETF inflow, reaching around $200 million on the second day of trading, following an impressive debut with $629 million on January 11. This trend follows the entry of eleven Bitcoin ETFs into the U.S. stock market, boasting a total asset under management of $27.9 billion—a significant milestone for the cryptocurrency industry after years of regulatory challenges.

Among the new entrants, ETFs by BlackRock and Fidelity have emerged as leaders, attracting nearly $500 million and $423 million, respectively, in the initial two days of trading, according to brokerage estimates. The market now closely watches the ongoing developments and investor sentiments surrounding these dynamic offerings.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |