BlackRock Bitcoin ETF Ads Are Now Attracting Attention On Google Search

Key Points:

- Google now allows ads for “crypto trusts” in the US, signaling a shift in its crypto advertising policy since 2018.

- With the recent SEC approval for US-spot Bitcoin ETFs, BlackRock Bitcoin ETF ads are emerging on Google Search.

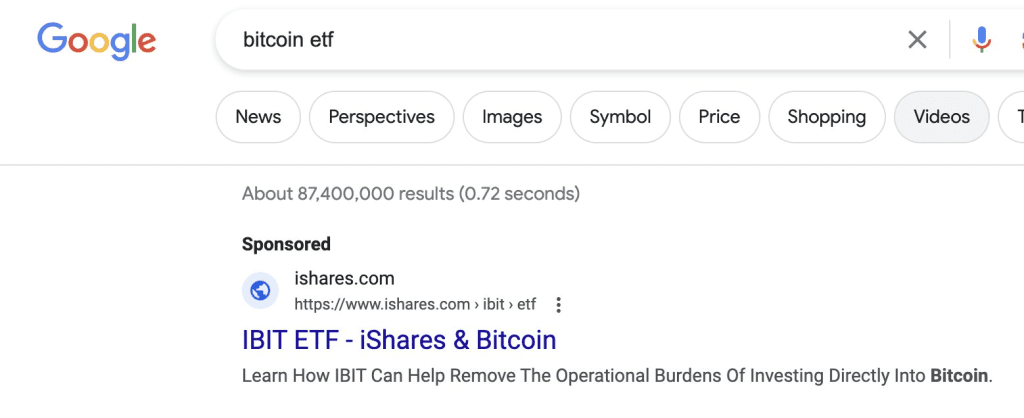

In a significant move, Google has updated its advertising guidelines, allowing “crypto trusts” to showcase their products in the US. Right now, BlackRock Bitcoin ETF ads have also appeared on Google Search.

Read more: Bitcoin Spot ETF Applications: A Comprehensive List of All Companies, Including Wall Street

BlackRock Bitcoin ETF Ads Surface on Google Search

The revised policy, introduced in December 2023, specifically permits ads for “crypto trusts,” enabling investors to trade shares in trusts holding substantial crypto assets. This marks a notable shift in Google’s crypto policy, last updated in 2018.

The recent update aligns with the US Securities and Exchange Commission’s approval of 11 entities to list US-spot Bitcoin ETFs earlier this month. Google’s platform, known for its extensive reach and high search volume, is now open for advertisers seeking to promote crypto-related products. However, advertisers must undergo certification to comply with Google’s rigorous requirements.

The impact of this development is underscored by the transformation of the Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF. Notably, 10 other institutions, including BlackRock and Fidelity, have received approval to include spot BTC ETFs in their investment portfolios.

In a notable manifestation of confidence in the market, BlackRock Bitcoin ETF ads are already surfacing on Google Search. The BlackRock iShares Bitcoin Trust (iBIT) ETF has amassed over $2 billion in holdings, holding more than 52,000 BTC. This surge in holdings coincides with Bitcoin’s price reaching $43,000.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |