Spot Bitcoin ETFs Inflow Reaches $38.45 Million With Increasingly Positive Signals

Key Points:

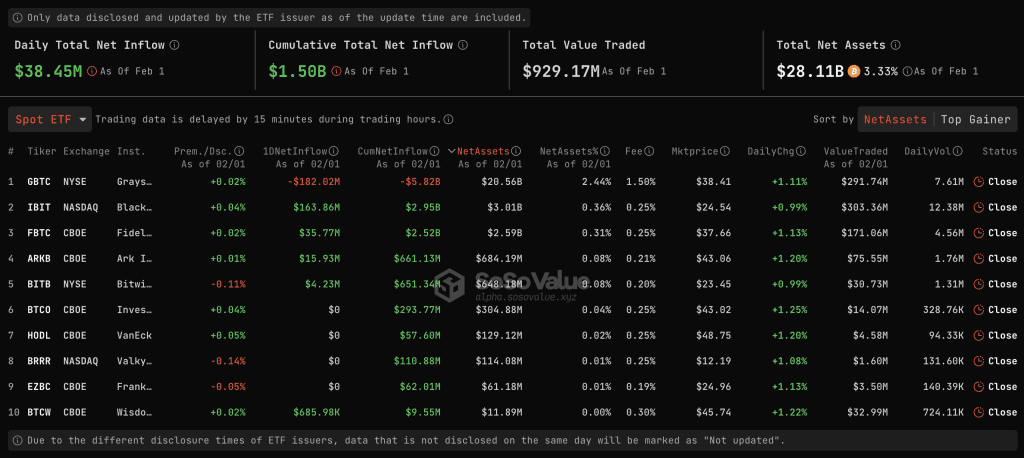

- Spot Bitcoin ETFs inflow shows continued positive momentum, marking a fifth consecutive day of net inflow at $38.45 million on February 1.

- Despite Grayscale’s GBTC experiencing a $182 million outflow, BlackRock’s IBIT leads with a $163.86 million daily net inflow, and Fidelity’s FBTC attracts $35.77 million.

- BlackRock’s IBIT overtakes GBTC in spot Bitcoin ETF volumes, signaling a shift.

Spot Bitcoin ETFs inflow saw $38.45 million on February 1, marking the fifth consecutive day of positive movement, according to data from SoSoValue, a leading market analytics platform.

Read more: Bitcoin Spot ETF and Futures ETF: Differences To Make The Right Investment Choice

Spot Bitcoin ETFs Inflow Shows Fifth Consecutive Day of Positive

While Grayscale‘s GBTC experienced a single-day net outflow of $182 million, the remaining nine Bitcoin spot ETFs exhibited robust investor interest, recording a total net inflow of $220 million. BlackRock’s IBIT emerged as a leader in daily net inflow, attracting $163.86 million, while Fidelity’s FBTC saw a substantial net inflow of $35.77 million.

Fidelity‘s official website disclosed that the net assets of Fidelity Wise Origin Bitcoin (FBTC) reached approximately $1.34 billion, with a total circulating share of 61,525,000.

BlackRock’s IBIT Overtakes GBTC as Bitcoin Trading Sees Fluctuations

In a significant development, BlackRock’s IBIT overtook GBTC for the first time on Thursday, ending Grayscale’s 14-day dominance in spot Bitcoin ETF daily volumes. Earlier in the week, both BlackRock’s and Fidelity’s spot Bitcoin ETFs were closing in on GBTC’s daily trading volume.

As of now, Bitcoin is trading at $43,200, showing a 1.8% increase in the past 24 hours. However, the leading cryptocurrency remains down around 12% since spot Bitcoin ETFs began trading, indicating the market’s ongoing fluctuations despite the recent positive trends in spot Bitcoin ETFs inflow.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |