Key Points:

- The Federal Reserve considers a Fed interest rates cut in March, driven by seven months of favorable inflation reports, says Chicago Fed President Goolsbee.

- Goolsbee and Chair Powell highlight the need for sustained positive inflation data

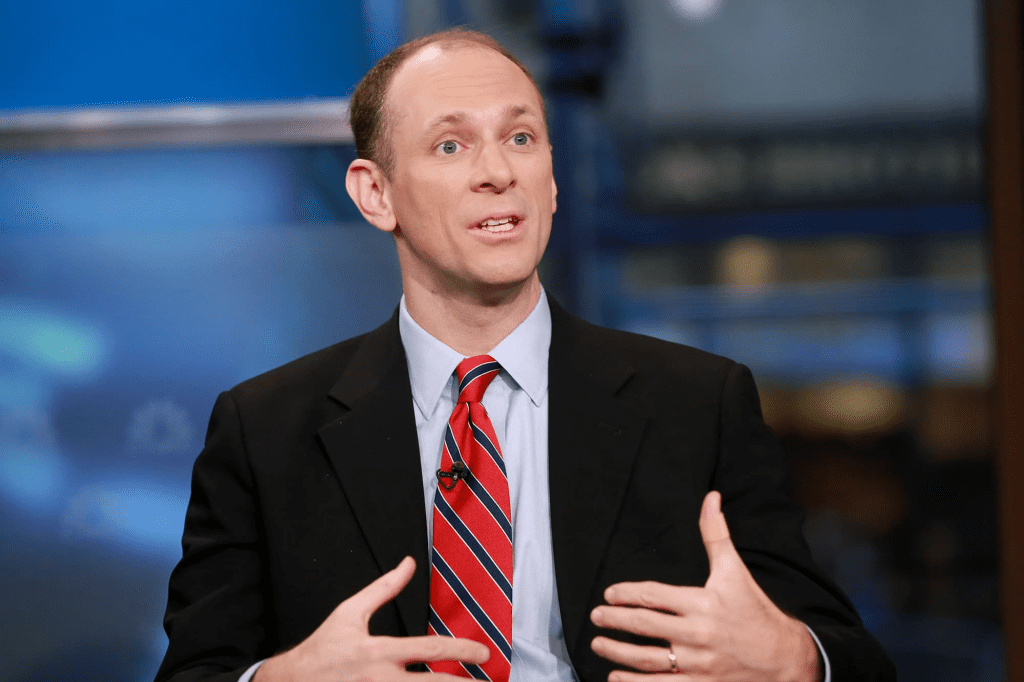

In a recent interview, Federal Reserve Bank of Chicago President Austan Goolsbee emphasized the importance of continued positive inflation data, signaling a potential Fed interest rates cut in March. Goolsbee acknowledged seven consecutive months of favorable inflation reports, hovering around or below the Fed’s target.

Fed Contemplates March Rate Cut Amid Positive Inflation Trend

“We’ve had seven months of really quite good inflation reports, right around or even below the Fed’s target,” Goolsbee stated in an interview on Bloomberg Television. He expressed optimism about the path to normalization if the trend persists.

However, Goolsbee refrained from committing to a specific decision before the March meeting, and he avoided speculation about the possibility of a larger, half-percentage point rate cut. Federal Reserve Chairman Jerome Powell echoed these sentiments, suggesting policymakers might wait beyond March to lower rates.

While Fed officials have maintained unchanged Fed interest rates since July, they have indicated openness to rate cuts this year, albeit without a sense of urgency. Goolsbee noted a tightening of credit conditions over the past 18 months, a concern that aligns with broader economic trends.

Powell Navigates Economic Signals for Potential Fed Interest Rates Adjustment

Powell emphasized the need for sustainable inflation to achieve the 2% target before considering a Fed interest rates cut in March. Contrary to market expectations of swift cuts, Powell hinted at a potentially slower pace. Importantly, Powell assured that neither he nor his colleagues would succumb to political pressure in this presidential election year.

As the Federal Reserve anticipates the release of its quarterly Senior Loan Officer Opinion Survey detailing bank lending practices, the focus remains on the evolving economic indicators leading up to the March meeting.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |