MicroStrategy Bitcoin Holdings Are Now Overtaken By Spot Bitcoin ETFs

Key Points:

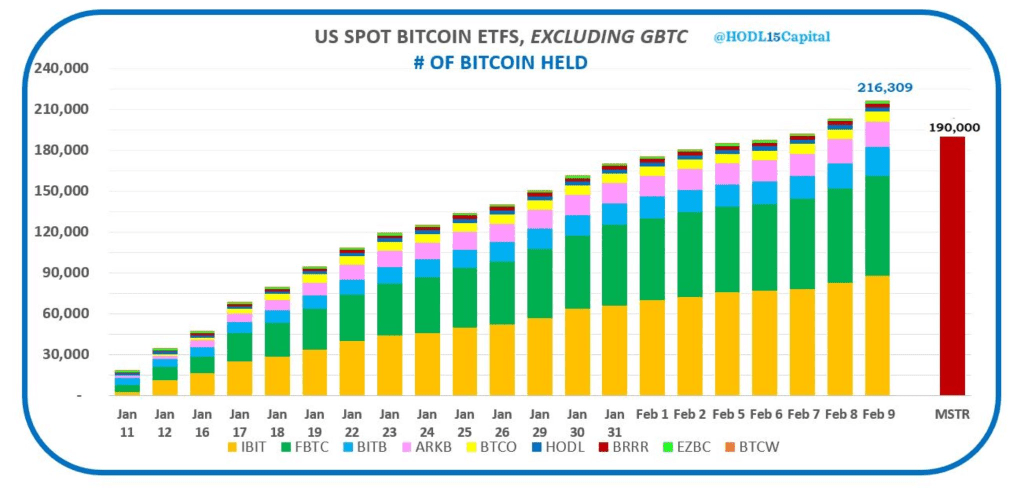

- Spot Bitcoin ETFs gathered $10.3 billion in 21 days, overtaking MicroStrategy Bitcoin holdings.

- MicroStrategy’s Bitcoin portfolio reaches 190,000 BTC, valued at over $9 billion, with an average entry price of $31,464.

- Despite market volatility, MicroStrategy’s strategic move into Bitcoin has seen its stock surge over 400%, with CEO expressing intent to hold onto their BTC reserves for the long term.

A recently launched series of nine spot Bitcoin ETFs has rapidly accumulated 216,309 BTC, valued at $10.3 billion, within just 21 days of their introduction to the market. This figure surpasses the MicroStrategy Bitcoin holdings with 190,000 BTC as of February 5, 2024.

Read more: Bitcoin Spot ETF and Futures ETF: Differences To Make The Right Investment Choice

Bitcoin ETFs Eclipse MicroStrategy’s Holdings in Lightning-Fast Surge

MicroStrategy’s journey into Bitcoin began in August 2020, and it has diligently expanded its holdings since then, irrespective of market fluctuations. Despite facing quarterly losses and significant impairment charges during the late 2022 and early 2023 market downturns, MicroStrategy Bitcoin holdings have steadily grown.

With an average entry price of $31,464, MicroStrategy, a notable NASDAQ-listed business intelligence software company, has invested close to $6 billion to amass its 190,000 BTC portfolio, now valued at over $9 billion with Bitcoin trading above $47,300.

MicroStrategy Bitcoin Holdings Soar

This strategic move into cryptocurrency has also seen MicroStrategy’s stock (MSTR) surge from around $125 in August 2020 to surpass $1,000 within six months. Although retracing from its peak, MSTR closed Friday’s trading at $646, marking a remarkable over 400% increase since the adoption of the Bitcoin-purchasing strategy.

CEO Michael Saylor has reiterated the firm’s commitment to MicroStrategy Bitcoin holdings, indicating that the unrealized profits may continue to remain untouched.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |