Bitcoin Halving Is Coming With Only Less Than 10,000 Blocks Left

Key Points:

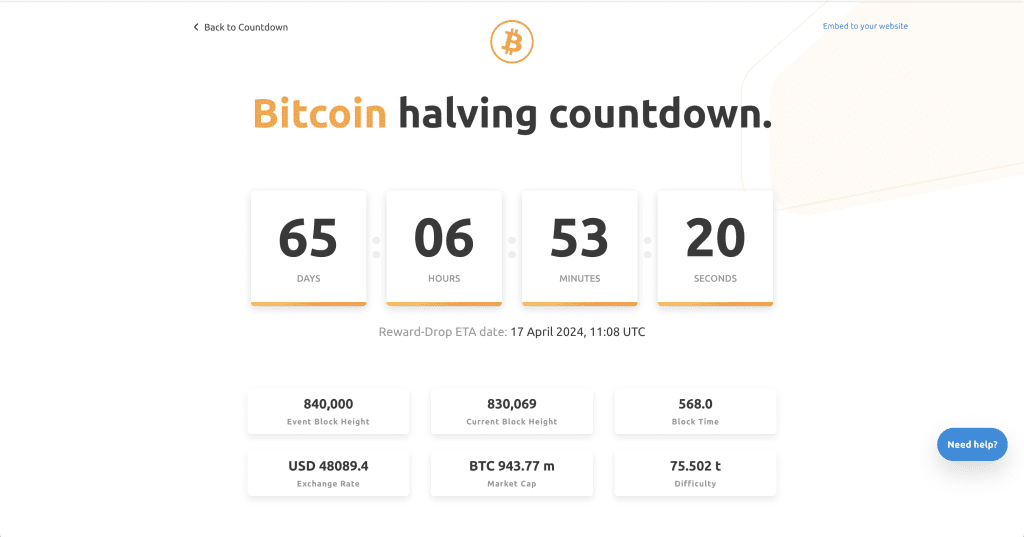

- Bitcoin halving, approaching with less than 10,000 blocks left, may impact prices.

- Scarcity increases as over 19 million of the 21 million Bitcoins have been mined.

- Attention shifts to halving’s historical price impact amid the limited influence of Bitcoin ETFs.

As Bitcoin ETFs fail to attract a surge of new capital to the crypto markets, attention turns to the next potential catalyst: the impending Bitcoin halving.

Read more: What is Bitcoin Halving? Why is this event of interest?

Bitcoin Halving Nears: Potential Price Impact Looms

Recent on-chain data indicates that the Bitcoin halving is approaching, with less than 10,000 blocks remaining before the event. With a fixed supply of 21 million Bitcoins, over 19 million have already been mined, leaving fewer than 2 million to be created.

The halving process, built into Bitcoin’s protocol, reduces the number of new coins earned by miners, aiming to maintain scarcity and counteract inflation. The reduction in Bitcoin issuance theoretically suggests that prices may rise if demand remains constant.

Bitcoin halving occurs approximately every four years or every 210,000 blocks on the blockchain. The upcoming halving will slash the block reward from 6.25 BTC to 3,125 BTC. This event historically triggers rapid appreciation in Bitcoin’s price, as seen in previous halvings in November 2012, July 2016, and May 2020.

Market Focuses on Halving’s Historical Significance

As of now, Bitcoin is trading above $48,000, reflecting ongoing market activity and investor interest.

However, each halving’s impact can vary, influenced by fluctuating demand for Bitcoin and changing market dynamics. Despite potential short-term revenue challenges for miners, experts suggest that fundamental on-chain activity and market structure updates could differentiate this halving.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |