MicroStrategy Bitcoin Investment Is Now At A $3.5 Billion Unrealized Profit

Key Points:

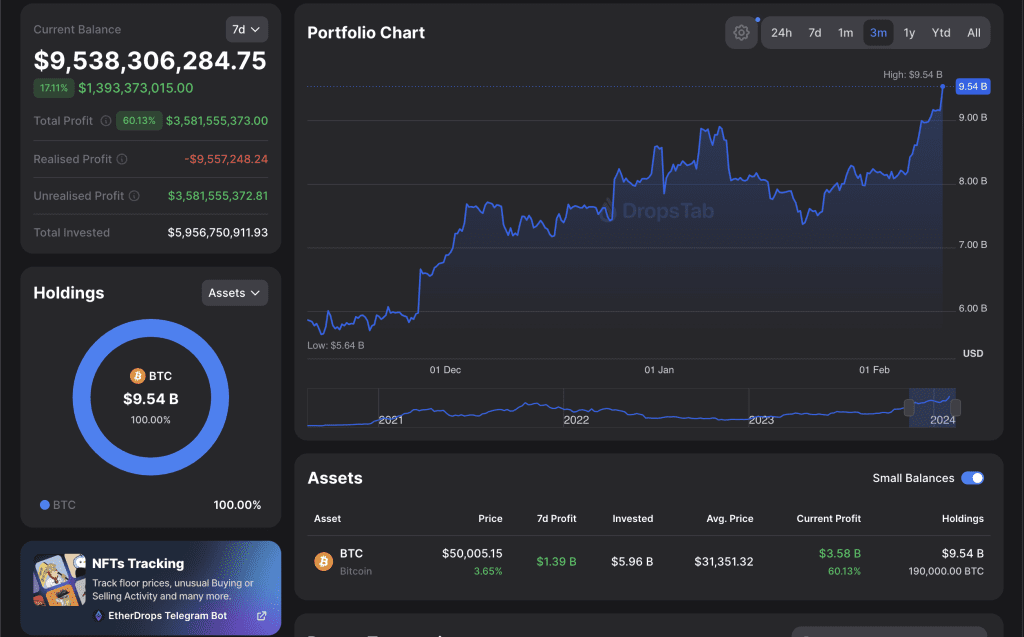

- MicroStrategy Bitcoin investment profit reached $3.5 billion.

- Despite challenges, the firm accumulates 190,000 BTC, averaging $31,464.

- Stocks have risen by 305% since 2020, outpacing Bitcoin and traditional assets.

The company, a major player in the cryptocurrency market, revealed an unrealized profit of $3.5 billion from MicroStrategy Bitcoin investment, showcasing its significant success in the digital asset arena.

MicroStrategy Bitcoin Investment: $3.5 Billion Profit Revealed

This achievement highlights the company’s steadfast commitment to MicroStrategy Bitcoin investment amid market volatility, solidifying its influence in the industry.

The firm’s strategic decision-making, spearheaded by then-CEO Michael Saylor, garnered attention in August 2020 with its initial substantial Bitcoin purchase. Despite subsequent market fluctuations and financial setbacks, including losses and impairment charges during the late 2022 and early 2023 market crashes, MicroStrategy persisted in its Bitcoin accumulation strategy.

MicroStrategy Stock Surges 305% Since 2020, Outpaces Bitcoin and Traditional Assets

Despite these challenges, MicroStrategy’s Bitcoin holdings have now reached an impressive 190,000 BTC, acquired through a dollar-cost-averaging approach with an average entry price of $31,464. This accumulation, totaling nearly $6 billion in expenditure, has proven lucrative, with the company’s stock soaring by 305% since its foray into Bitcoin investment in August 2020.

Comparatively, Bitcoin itself saw a 260% increase during the same period, outperforming traditional assets like the S&P 500 and gold, which saw gains of 48% and 1%, respectively.

Its monumental profit underscores the growing acceptance of cryptocurrencies as legitimate investment assets and reaffirms the potential returns offered by digital assets in today’s financial landscape.

As the company continues to navigate the evolving cryptocurrency market, its success serves as a testament to the opportunities presented by strategic MicroStrategy Bitcoin investment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |