Key Points:

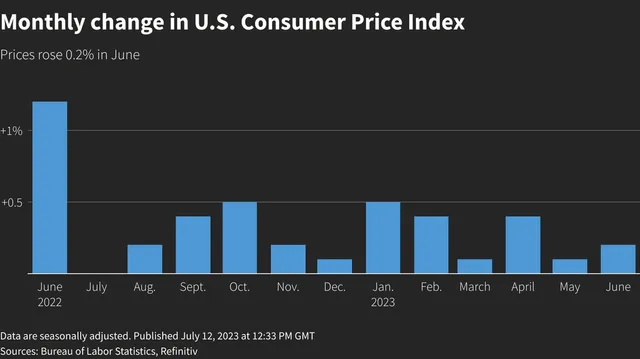

- Unanticipated surge in January US CPI hits 3.1%, surpassing 2.90% projection.

- Speculation rises as March rate cut prospects fade; May cut also questioned.

- Federal Reserve prioritizes vigilance amidst lingering inflation concerns.

United States revealed that the unseasonally adjusted Consumer Price Index (US CPI) annual rate for January stood at 3.1%, surpassing the anticipated 2.90% and marking a slight dip from the preceding value of 3.40%.

Analysts swiftly responded to the data, highlighting the unexpected strength in inflation. This unforeseen surge has cast doubts on the likelihood of an imminent rate cut, particularly in March. The prospect of a rate cut in May is now clouded with uncertainty as well. The Federal Reserve, it seems, is in no rush to implement interest rate reductions in the immediate future.

January’s 3.1% Defies Expectations, Sparks Rate Cut Doubts!

This development underscores a shift in the economic landscape, challenging earlier expectations of a more accommodative monetary policy. The US CPI’s upward trajectory suggests that inflationary pressures persist, prompting a cautious approach from policymakers.

The Federal Reserve’s decision to refrain from immediate rate cuts is indicative of a measured response, indicating a desire to carefully assess the evolving economic conditions.

Federal Reserve Adopts Cautious Approach to Navigate Economic Landscape!

The focus for the Federal Reserve remains fixed on the risks associated with persistent inflation. As uncertainties loom, the central bank is keen on navigating the economic landscape with a vigilant eye on maintaining stability.

The January US CPI figures act as a key indicator, shaping the narrative around the future trajectory of interest rates and serving as a critical factor in the broader economic strategy. Investors and market participants are closely monitoring these developments, preparing for potential shifts in the financial landscape in response to the nuanced dynamics of inflation and monetary policy.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |