Key Points:

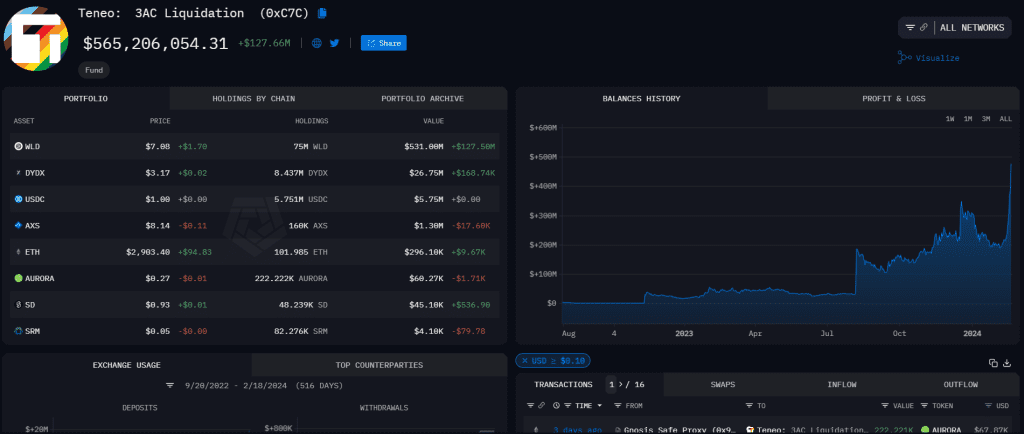

- 3AC liquidator address owns 75M WLD, estimated at US$550M.

- Tokens received from Worldcoin in August 2023, with no activity since.

- Parallels drawn to bankrupt Alameda, sparking intrigue in crypto circles.

In a revealing update from 0xScope, it has been disclosed that the 3AC liquidator address (0xC7…3741) holds a substantial 75 million WLD, standing as the highest net-worth asset in the Teneo portfolio.

The total valuation of this cryptocurrency holding is estimated at an impressive US$550 million, marking a significant presence in the digital asset landscape.

This revelation draws parallels to the situation with the bankrupt Alameda, as both entities received these tokens from Worldcoin in August 2023. However, what distinguishes this particular asset is the apparent lack of activity since its acquisition. The 3AC liquidator address has displayed a remarkable degree of dormancy in terms of engagement or transactions involving the held WLD tokens.

3AC liquidator address holds 75M WLD, valued at US$550M

The 0xScope report sheds light on the intricate dynamics within the cryptocurrency space, where assets acquired from projects like Worldcoin become crucial components of diverse portfolios. The substantial value of 75 million WLD underscores the potential impact that such holdings can have on the financial landscape, even in the absence of active management or interaction.

The comparison to Alameda, a company that faced bankruptcy, adds a layer of complexity to the narrative. It raises questions about the fate of digital assets in the aftermath of significant events within the cryptocurrency industry. The disclosed information invites speculation about the strategic considerations behind holding these assets, particularly in a scenario where there has been no discernible activity since the initial acquisition.

Tokens received from Worldcoin in August 2023, with no activity since

As the cryptocurrency community delves into the implications of such revelations, the 3AC liquidator’s substantial WLD holding serves as a focal point for discussions surrounding asset management, strategic planning, and the evolving nature of the digital asset landscape. The 0xScope report adds another layer of intrigue to the broader narrative of cryptocurrency holdings and their significance within the industry.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |