The Total Global Cryptocurrency Market Cap Now Surpasses $2.5 Trillion

Key Points:

- The cryptocurrency market cap surpasses $2.5 trillion, hitting levels last seen in April 2022.

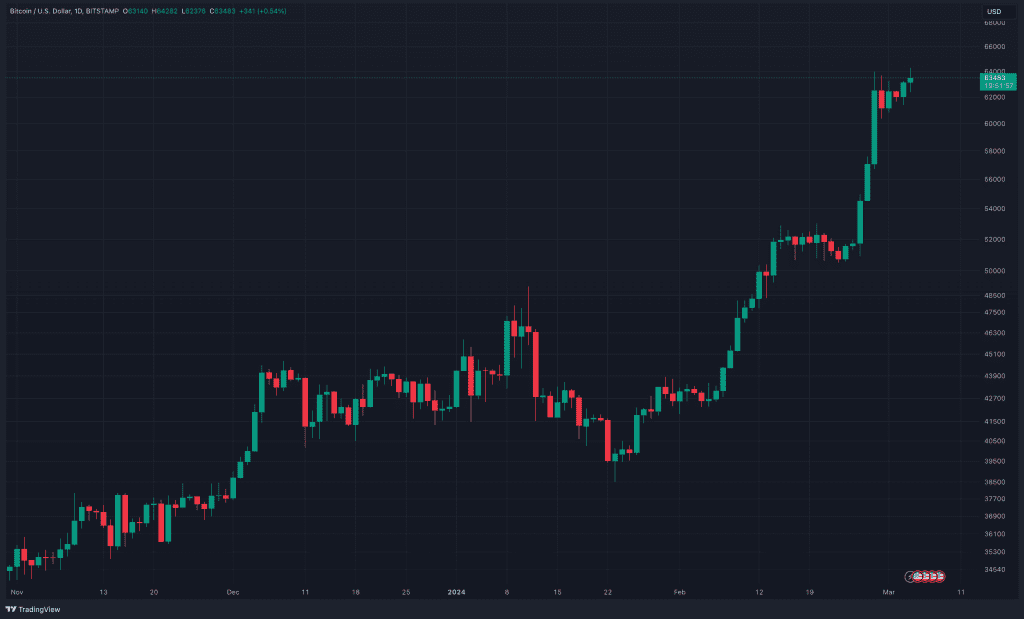

- Bitcoin’s price climbs above $64,000, nearing its all-time high, driven by positive sentiment and inflows into spot ETFs.

- Record-breaking open interest in Bitcoin futures and increasing assets under management in spot ETFs reflect growing institutional interest in cryptocurrencies.

The total cryptocurrency market cap has surged past the $2.5 trillion mark, marking a significant milestone not seen since April 2022.

Read more: Bitcoin Price Prediction For 2024, 2025, 2026 and 2030: Super Crypto Bull Run

Cryptocurrency Market Cap Surges: Reclaims $2.5 Trillion

This surge in cryptocurrency market cap comes amidst a wave of positive market sentiment and consistent inflows into spot Bitcoin exchange-traded funds (ETFs), propelling BTC’s price upwards.

On Monday morning in Asia, Bitcoin’s price surpassed $64,000, coming within 6% of its all-time high recorded in November 2021. This rally pushed the world’s largest cryptocurrency market cap to a multiyear high of $2.5 trillion, while Ethereum also experienced a 3% increase, reaching $3,470.

Remarkably, the current cryptocurrency market cap exceeds the valuation of American multinational corporation and technology giant NVIDIA, which stands at over $2 trillion.

Institutional Interest Soars: Record Open Interest and ETF Inflows

This surge in prices coincided with a record-breaking daily open interest for Bitcoin futures on centralized exchanges, according to The Block. Open interest serves as a measure of the total value of all outstanding Bitcoin futures contracts across exchanges, indicating heightened market activity and trader sentiment.

Simultaneously, spot Bitcoin exchange-traded funds (ETFs) have witnessed a remarkable rise in assets under management. BlackRock’s IBIT alone reached $10 billion last week, signaling increasing institutional interest in cryptocurrencies.

This resurgence in the crypto market underscores the growing acceptance and adoption of digital assets among both retail and institutional investors, fueling optimism for further price appreciation in the near term.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |