Key Points:

- Bitcoin surged to an all-time high of $69,045 but quickly faced profit-taking, resulting in a 5% price drop to $64,755.

- The sudden downturn led to over $700 million in crypto market liquidations within 24 hours, affecting over 292,000 traders, predominantly long positions.

- Bitcoin’s recovery since October 2023, fueled by the approval of Bitcoin spot ETFs in January 2024

Bitcoin, the world’s largest cryptocurrency, recently surged to an all-time high of $69,045, marking a significant milestone after more than two years.

Read more: Bitcoin Price Prediction For 2024, 2025, 2026 and 2030: Super Crypto Bull Run

Crypto Market Liquidation Rises as Bitcoin Instantly Drops

However, this achievement was short-lived as the digital currency encountered a wave of profit-taking from investors, resulting in a sudden price correction and widespread crypto market liquidation.

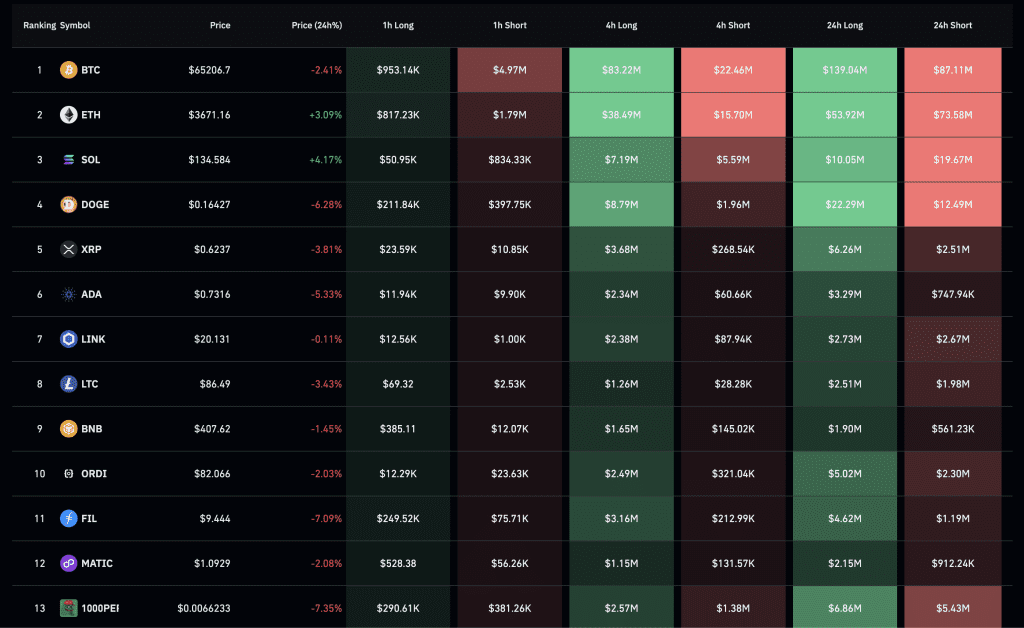

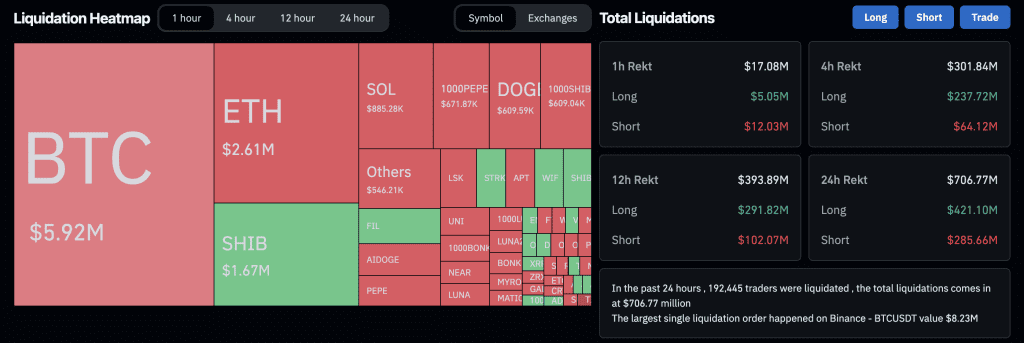

As of now, Bitcoin’s price has plummeted by over 5%, down to $64,755, in what analysts are calling its most significant flash crash since the beginning of the year. This unexpected downturn has also triggered over $700 million in total crypto market liquidations within the past 24 hours, according to data from CoinGlass. Long traders bore the brunt of these liquidations, with over 292,000 traders affected.

Bitcoin’s Recovery Fueled by ETF Approval Amidst Market Volatility

Bitcoin’s remarkable recovery since October 2023, especially following the approval of the spot Bitcoin ETF proposal in January 2024, has been a significant driver of its recent price surge. The approval of Bitcoin ETFs has led to the continuous accumulation of BTC, with daily buying reaching nearly half a billion USD in February. This buying pressure propelled Bitcoin from $42,000 to over $60,000.

Despite the recent price correction, Bitcoin continues to be an attractive investment option for both whales and small-fry investors, contributing to its soaring value. However, the volatility in the crypto market highlights its inherent roughness compared to the traditional financial system it aims to disrupt.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |