Renzo Review: Binance Labs Backed Cross-chain Liquid Restaking Protocol

Renzo Protocol ranked among the top three LSDfi market projects by TVL and received an investment from Binance Labs on February 22, 2024. This marks the second liquid restaking protocol funded by Binance Labs after Puffer Finance. Binance has recently announced Renzo as the 53rd project to be featured on Binance Launchpool.

What Is Renzo?

Renzo, a cross-chain Liquid Restaking protocol on the EigenLayer, allows users to stake ETH and other liquid staking tokens (LSTs) on platforms like Ethereum, Arbitrum, and BNB Chain. Staking rewards users with ezETH, which can earn ezPoint rewards for future airdrops and restaking.

By optimizing capital utilization, users can maximize their return on investment. Currently, Renzo ranks as the third-largest project in the Liquid Staking segment in terms of Total Value Locked (TVL), reflecting its increasing popularity and user trust.

How Does it Work?

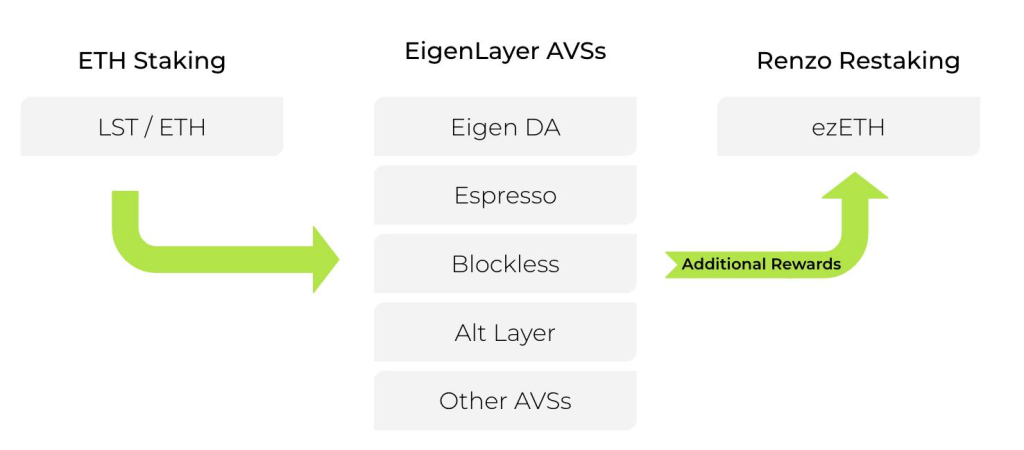

Renzo is a Liquid Derivatives platform built on the innovative EigenLayer blockchain. As a project, it serves as a crucial interface for the entire EigenLayer ecosystem, ensuring Actively Validated Services (AVS) and, in doing so, offering significantly higher returns compared to the returns that come from simple ETH staking.

Renzo mints equivalent ezETH for each LST or ETH deposit to maintain balance. It’s designed for Ethereum restaking, previously an unserved blockchain market area. It uses smart contracts and operational nodes to implement an effective restaking strategy, serving as an on-ramp and off-ramp.

The withdrawal process, influenced by restaking strategies and EigenLayer’s requirements, takes at least 7 days and varies per AVS. Renzo guarantees users total rewards from EigenLayer. User-paid fees are used for the protocol treasury and Renzo node operator payments.

In other words, Renzo is not only a means of ingress into the world of Ethereum restaking, but it also provides an exit strategy. This dual functionality makes it an essential tool for anyone looking to explore the potential of Ethereum restaking.

Renzo ezPoints

Since Renzo’s official Beta launch on December 18, 2023, users who hold ezETH in their wallets earn 1 Renzo ezPoint per hour per ezETH held. Renzo also runs ezPoints promotions, such as an additional gift of 200 ezPoints for every 1 ETH deposited within a specific timeframe.

However, exploiting the system by repeatedly selling and buying ezETH to earn multiple rewards is prohibited, and any user detected doing this will be excluded from the ezPoints program. Liquidity providers earn double the ezPoints. If you provide liquidity to pools on DEX, you’ll receive 2x ezPoints. You can also earn extra ezPoints by referring new users to join and deposit ETH into Renzo. You’ll earn 10% of the ezPoints that your referred users earn.

The system has a points accumulation feature that allows you to earn more Renzo Points. The more active users you refer, the more ETH you deposit into Renzo. The Renzo ezPoints system rewards users based on their activity and participation in the Renzo system, from holding ezETH to providing liquidity and referring new users.

Tokenomics

At the moment, there is no information available.

Team and Investors

The detailed information of the Renzo team hasn’t been disclosed yet, but rest assured that they all possess valuable experience in the DeFi sector. Their collective knowledge and expertise in decentralized finance will likely prove instrumental in their upcoming endeavors and contribute significantly to the industry’s growth and innovation.

Notably, Lucas Kozinski, a Founding Contributor at Renzo, has accumulated a wealth of knowledge and expertise over four years in expanding Web3 projects. His deep understanding and hands-on experience have contributed significantly to the success and growth of various initiatives within the Web3 ecosystem.

- Founding Contributor: Renzo Protocol (July 2023 – Present) and Lunar Labs Inc (Dec 2021 – June 2023)

- Business Strategy and Operations: Tokensoft Inc (Jan 2020 – Feb 2022), Tezos Foundation (Apr 2018 – Dec 2019)

- Strategy and Operations Consultant: Point B (Apr 2014 – Dec 2019)

- Operations Consultant: CACI International Inc (Jan 2011 – Jan 2014)

- Business Operations: Lockheed Martin (Oct 2006 – Jan 2011)

Investors

- 16/01/2024: Renzo Finance raised a substantial $3.2 million in the Seed investment round. The funding was primarily led by Maven 11 Capital, a notable investment firm. Various other key players in the investment sector, including Figment Capital, IOSG Capital, OKX Ventures, and SevenX Ventures, among others, also participated in the funding round.

- 22/02/2024: In February, Renzo Finance secured yet another round of investment. This time, the investment came from Binance Labs. However, the details of this investment round, including the amount invested and the terms of the investment, were not disclosed publicly.

The Future of Renzo

Renzo Protocol’s future, particularly its Liquid Restaking project, looks promising due to the investment from Binance Labs. This venture capital arm of Binance is renowned for supporting innovative blockchain and cryptocurrency projects. This investment provides Renzo Protocol with not just financial backing but also access to expertise and resources within the Binance ecosystem.

Renzo Protocol’s Liquid Restaking introduces a unique approach to staking in decentralized finance (DeFi). It allows users to stake their assets while preserving liquidity, addressing a significant challenge in traditional staking mechanisms. This innovative feature could attract users who want to earn staking rewards while maintaining the freedom to access their assets when necessary.

In summary, with Binance Labs’ support and the unique offering of its Liquid Restaking project, Renzo Protocol is well-positioned for growth and success in the DeFi sector’s future.

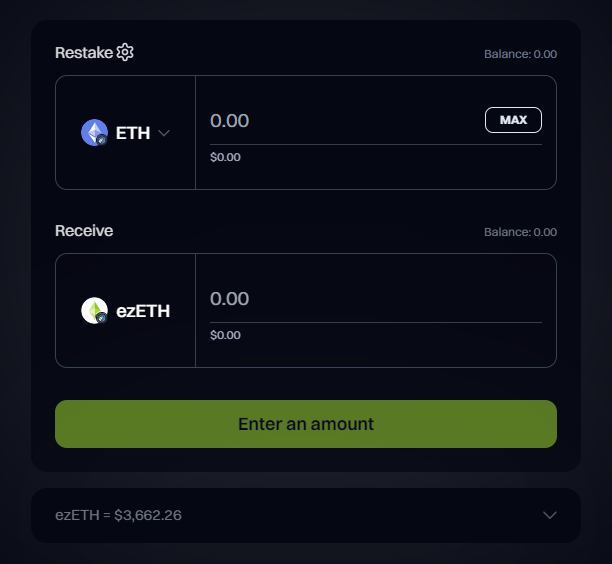

How to staking through Renzo

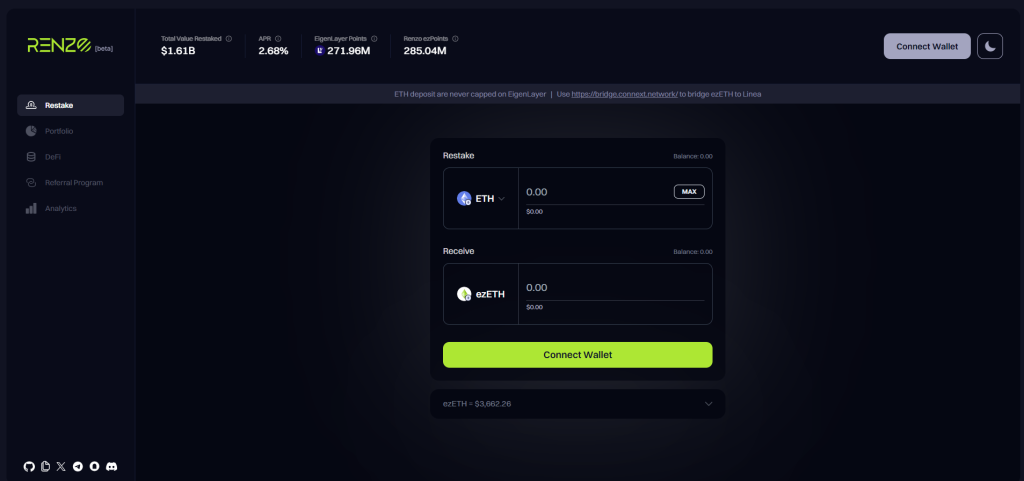

Step 1: Go to this link

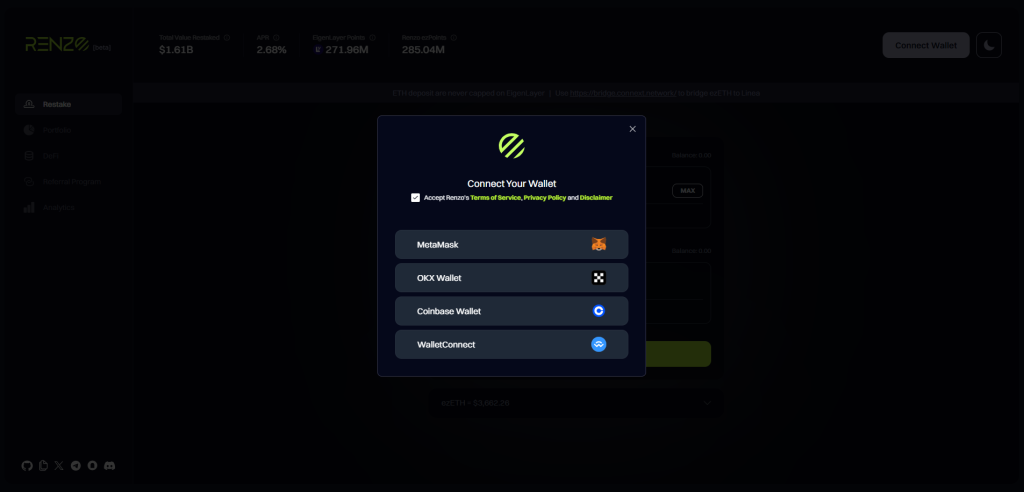

Step 2: Connect your wallet

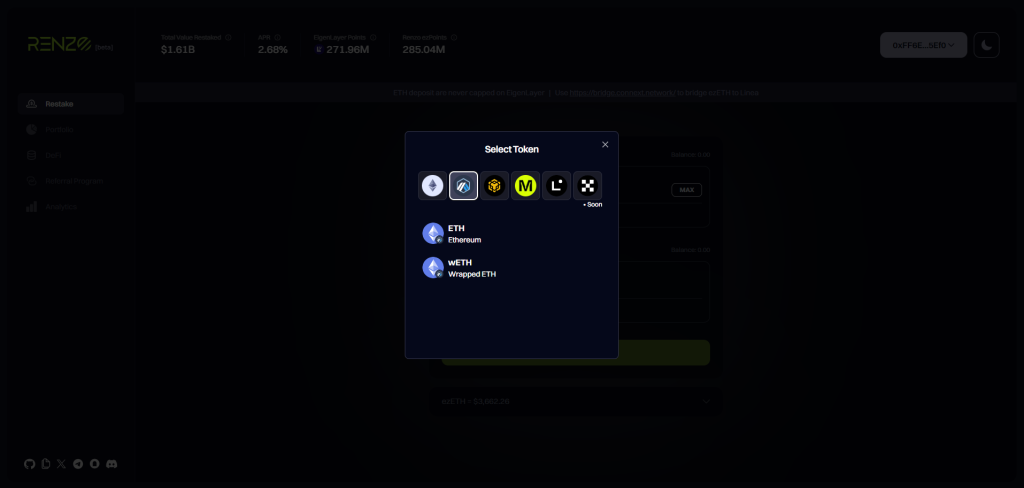

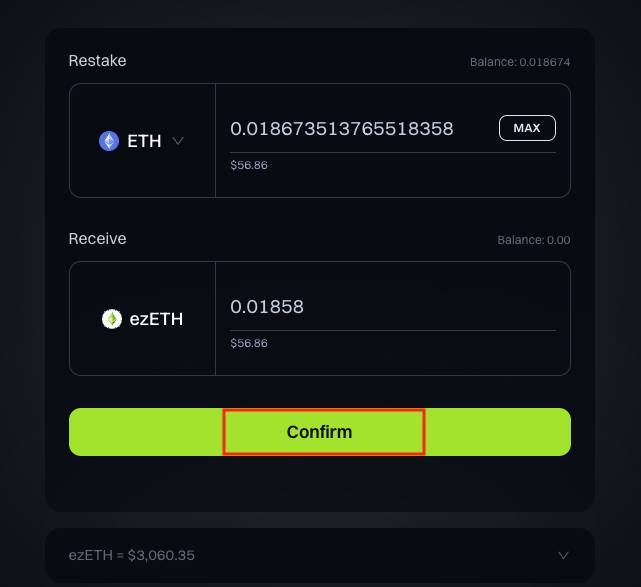

Step 3: Choose the chain and type of token you want to restake. Currently, Renzo supports ETH and 2 types of LST, including stETH and WBETH.

Step 4: Enter the number of tokens you want to restake

Step 5: Choose “Confirm” -> Verify the transaction on the wallet to complete

Conclusion

In this Renzo Review, you fully understood and appreciated its potential. After two funding rounds with the participation of top investment funds such as Binance Labs and IOSG Ventures, Renzo has shown immense promise.

CoinCu evaluates this project as extremely promising in the Liquid Restaking sector. The project’s success relies on EigenLayer’s vision and its current achievements after this Renzo Review.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |