Bitcoin Price Crash? Survey Reveals Consumer Fear Of Sub-$20,000

Key Points:

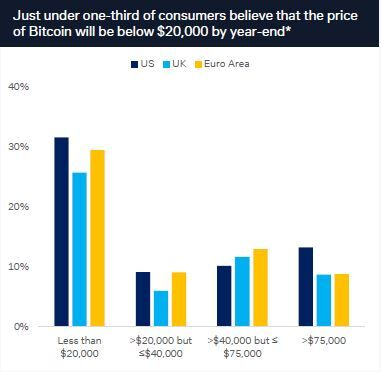

- One-third of consumers predict Bitcoin price crash under $20,000 by year-end, per a Deutsche Bank survey.

- Bitcoin’s 67% surge this year outperforms traditional assets amid expectations of broadening demand.

- Bitcoin’s upcoming “halving” event is viewed by some as a bullish indicator.

A third of consumers expect Bitcoin price crash below $20,000 this year, while 40% trust its longevity, according to Deutsche Bank. Bitcoin’s future remains uncertain.

Bitcoin’s future is uncertain, with about a third of consumers anticipating its value to drop below $20,000 by year’s end, according to a Deutsche Bank survey.

Will Bitcoin Price Crash Below $20,000 This Year?

According to Bloomberg, the steep fall would cut around $50,000 off Bitcoin’s current price, revisiting lows from a significant 2022 bear market. The survey revealed that only 10% of respondents predict Bitcoin to surpass $75,000 by December.

While 40% express confidence in Bitcoin’s longevity, a nearly equal 38% expect it to vanish. Interestingly, less than 1% regard crypto as a passing trend.

Currently, Bitcoin trades roughly 1.4% lower at $70,700, even though it reached an all-time high of $73,798 in mid-March. Bitcoin’s 67% surge this year outperforms traditional assets like global stocks and gold.

Readmore: Bitcoin Spot ETF Inflow Reaches $114 Million On April 3rd

The Impact of “Halving” on Bitcoin’s Market Traction

Fueled by the influx into US spot-Bitcoin exchange-traded funds, Bitcoin’s supporters anticipate the demand for crypto to broaden. Critics, however, argue that Bitcoin possesses no intrinsic value and is merely a speculative venture leading to an impending downfall.

This month, Bitcoin is set to experience a “halving,” a quadrennial event that reduces the new supply of the token. Some perceive this event as a positive signal. Victoria Bills, Chief Investment Strategist at Banrion Capital, noted that the upcoming halving continues to attract market interest.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |