Key Points:

- Crypto security incidents surged in Q1 2024, with 224 cases recorded, highlighting a persistent threat to the industry.

- Direct transfers to trading platforms accounted for $220 million of stolen funds.

- Organizations are turning to solutions to enhance compliance, risk management, and anti-money laundering strategies.

The first quarter of 2024 has seen a concerning surge in crypto security incidents, with CertiK Alert reporting a total of 224 recorded cases.

Crypto Security Incidents Surge in Q1 2024

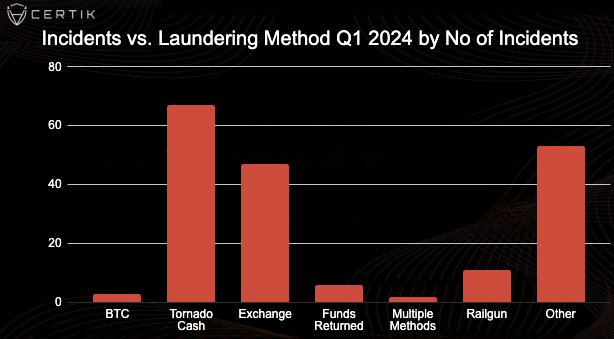

Among these incidents, the favored method for laundering stolen funds remains Tornado Cash, despite accounting for only $69 million of the illicitly acquired funds.

Notably, in 47 crypto security incidents, hackers bypassed traditional laundering methods altogether, opting to directly transfer funds to trading platforms. This direct approach amounted to a staggering $220 million, with authorities managing to freeze some of these illicit assets.

Additionally, a myriad of less popular methods, categorized under “Other,” contributed to the laundering landscape, complicating efforts to trace the flow of stolen funds effectively. The prevalence of direct transfers to exchanges underscores the urgency of real-time incident monitoring and alerting systems.

Strengthening Cryptocurrency Security Measures

To combat the escalating threat of cryptocurrency-related crimes, organizations are turning to solutions to bolster their compliance, risk management, and anti-money laundering (AML) strategies. The necessity for enhanced security measures is evident in the context of the broader cryptocurrency landscape, which has witnessed a surge in hacking incidents over recent years.

According to Chainalysis’ Crypto Crime Report, while 2022 marked the peak year for crypto theft, with $3.7 billion stolen, 2023 saw a decrease in total funds stolen, amounting to $1.7 billion. Despite this decline, the number of individual crypto security incidents actually increased from 219 in 2022 to 231 in 2023, signaling the persistent and evolving nature of the threat posed by cryptocurrency hackers.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |