Key Points:

- Bitcoin and Ethereum prices drop below key levels as Israel’s attack on Iran escalates Middle East tensions.

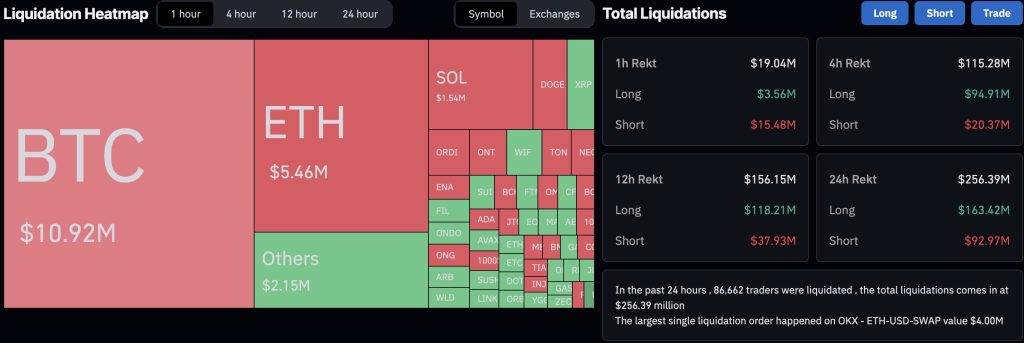

- Liquidations totaling $156 million occur amid the cryptocurrency market downturn.

- Geopolitical conflict prompts investor uncertainty, with crypto prices reacting to reported military strikes between Israel and Iran.

Bitcoin’s price has once again dipped below the critical $60,000 support level amidst escalating geopolitical tensions in the Middle East triggered by Israel’s attack on Iran.

Bitcoin and Ethereum Prices Plummet Amid Middle East Tensions

This news rattled the cryptocurrency market, causing Bitcoin to fall below $60,000 and Ethereum to drop below $2,900.

Coinglass reported that recent liquidations of leverage amounted to $156 million within a span of 12 hours. Despite the initial downturn, Bitcoin has rebounded slightly to $61,833, though it remains down by over 2% in the past day, plummeting from a high of $63,000 to below $60,000 within two hours.

Ethereum’s slide below $2,900 is seen as a significant signal, indicating wavering confidence among investors. The steep drop has even made staunch supporters uneasy about future developments.

The broader cryptocurrency market reflects this uncertainty, with most other tokens experiencing losses of 3% or more in the past hour, suggesting a rush among investors to withdraw from perceived risky assets.

Israel’s Attack on Iran Sends Shockwaves Through Digital Asset Markets

Reports from ABC News and CNN confirm Israel’s attack on Iran around 1:30 UTC, targeting various military bases and airfields. This action follows Iran’s missile and drone strikes against Israel the previous weekend, which also caused crypto prices to plunge.

While details about the conflict are still emerging, the impact on the cryptocurrency market underscores the influence of geopolitical events on digital asset prices.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |