Bitcoin Transaction Fee Exceeds 2900 Sat/vb Because Of Halving Event

Key Points:

- Bitcoin transaction fees surged post-halving, hitting $204 per transfer before dropping to $125.5 for low-priority transactions.

- Miners like Viabtc and Antpool saw fee earnings surpass 24-hour norms within a few blocks.

- The fee spike reflects Bitcoin’s dynamic post-halving economy and spotlights the emergence of the Runes protocol for token standards.

Bitcoin transaction fees surged to over 2,892 satoshis per virtual byte (sat/vB), equivalent to more than $204 per transfer, following the recent halving event on Friday, April 20, 2024.

Read more: What is Bitcoin Halving? Why is this event of interest?

Bitcoin Transaction Fees Soar Post-Halving

However, Bitcoin transaction fees have since decreased to around 1,400 sat/vB, or over $125.5 per transfer for low-priority transactions. The surge in fees has been accompanied by a notable increase in Rune protocol activity on the web portal mempool.space.

Data from mempool.space reveals a significant rise in Bitcoin transaction fees across different priority levels. Currently, fees stand at 20 satoshis per byte for transactions without priority, 944 satoshis per byte for low-priority transactions, 1114 satoshis per byte for medium-priority transactions, and 1219 satoshis per byte for high-priority transactions.

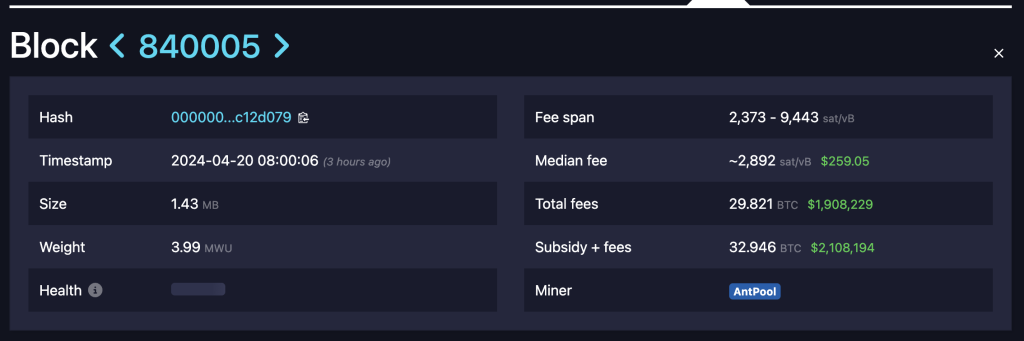

Miners have experienced a substantial increase in fee collection within a short span, surpassing their typical 24-hour earnings in just a few blocks. Notable miners benefiting from this surge include Viabtc, Foundry, Braiins Pool, and Antpool, with the latter discovering block 840,005 and capturing 29,821 BTC, valued at $1.9 million.

Fluctuating Economy and Emerging Protocols

The recent surge in Bitcoin transaction fees surpasses previous peaks, reflecting the network’s fluctuating economic dynamics following significant events such as halvings.

While the recent halving event primarily aims to reduce Bitcoin issuance, cutting the block reward to 3,125 BTC, attention is also drawn to the emergence of the Runes protocol developed by Bitcoin developer Casey Rodarmor. Runes introduces new token standards, including the BRC-20, to enhance the network’s capabilities in issuing fungible tokens alongside the previously established non-fungible features of Ordinals.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |