Key Points:

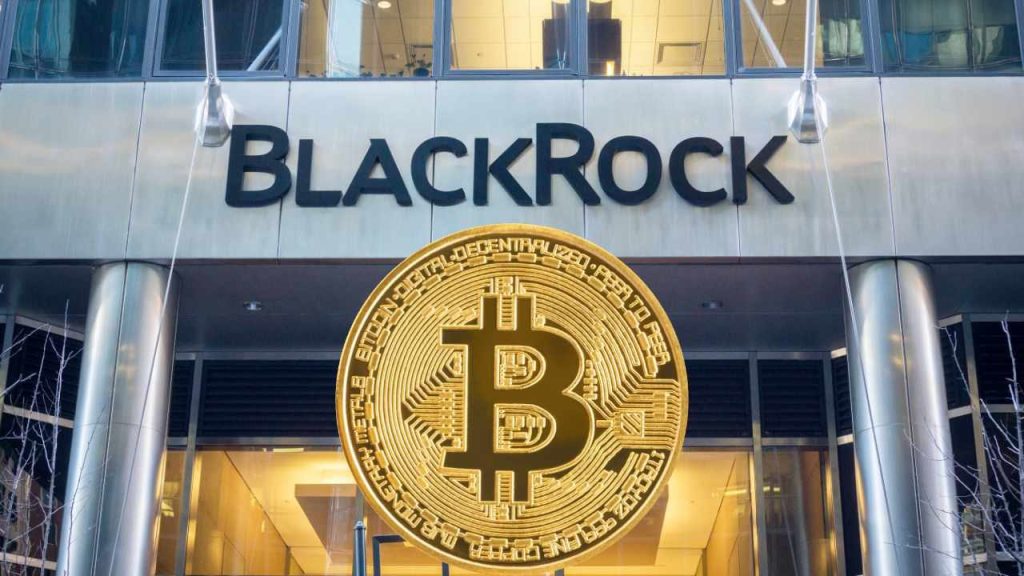

- BlackRock spot Bitcoin ETF now holds a whopping 273,596 BTC, valued at $18 billion, showcasing a significant investment in the cryptocurrency.

- BlackRock’s ETF boasts 59,350 more bitcoins than MicroStrategy, solidifying its position as a dominant force in the crypto investment landscape.

- BlackRock’s massive Bitcoin holding signals growing institutional confidence in BTC as a legitimate asset class, driving further mainstream adoption and investment.

BlackRock spot Bitcoin ETF has cemented its position as a dominant player by amassing a substantial Bitcoin (BTC) holding.

The global investment management firm now boasts an impressive stash of 273,596 BTC, valued at a staggering $18 billion, all earmarked for its spot Bitcoin exchange-traded fund (ETF).

This significant accumulation positions BlackRock spot Bitcoin ETF as a formidable force in the market, overshadowing competitors and solidifying its status as a major player in the cryptocurrency investment arena. Notably, BlackRock’s BTC holding surpasses that of MicroStrategy, another notable player in the crypto space, by a substantial margin of 59,350 bitcoins.

Read more: Best Bitcoin ETFs To Buy In 2024

BlackRock Spot Bitcoin ETF Surpasses Competition

The strategic move by BlackRock underscores the growing institutional interest and confidence in Bitcoin as a viable asset class. As the world’s largest asset manager, BlackRock spot Bitcoin ETF’s foray into the cryptocurrency market signals a significant shift in traditional investment strategies, further legitimizing Bitcoin as a mainstream investment option.

With Bitcoin’s price trajectory showing resilience and demonstrating significant growth potential, institutions like BlackRock spot Bitcoin ETF are increasingly recognizing the value proposition offered by the leading cryptocurrency. This recognition has led to a surge in institutional investment in Bitcoin, driving demand and fueling its continued ascent in value.

Read more: Bitcoin Spot ETF vs Futures ETF: Differences To Make The Right Investment Choice

BlackRock’s Massive BTC Accumulation Signals Mainstream Confidence

BlackRock’s decision to allocate a substantial portion of its portfolio to Bitcoin reflects its confidence in the long-term prospects of the cryptocurrency. As Bitcoin continues to gain traction as a store of value and hedge against inflation, institutions like BlackRock are positioning themselves to capitalize on its potential upside.

The implications of BlackRock’s sizable Bitcoin holding extend beyond the realm of cryptocurrency markets, signaling a broader shift in investment trends and strategies. As more institutional investors enter the fray, the cryptocurrency landscape is poised for further evolution and maturation, paving the way for increased adoption and mainstream acceptance of digital assets like Bitcoin.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |