MicroStrategy Bitcoin Holding Now Surpasses Every Country With 214,400 BTC

Key Points:

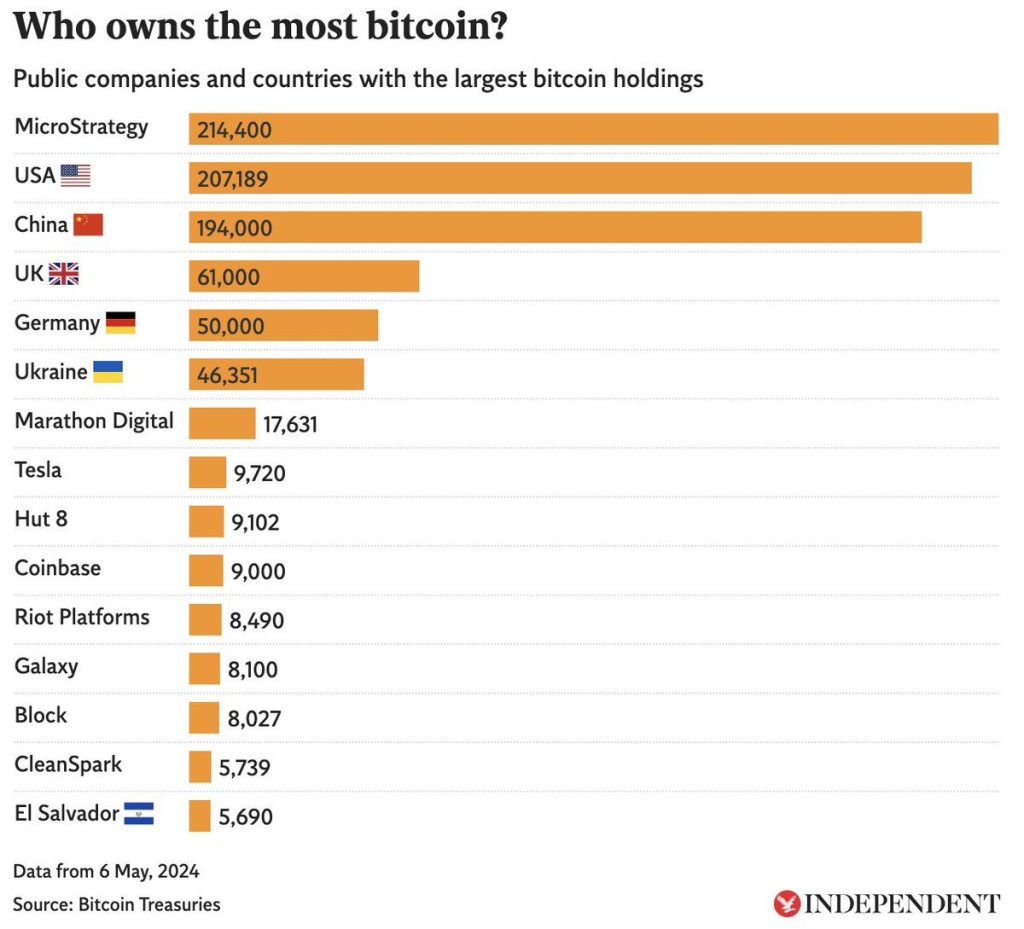

- MicroStrategy Bitcoin holdings are now more than any country, with 214,400 BTC worth $13.6 billion.

- Despite a $53.1 million net loss in Q1 2024, MicroStrategy acquired 25,250 BTC in the first four months of the year.

- MicroStrategy’s focus on Bitcoin as its primary treasure reserve asset has reshaped its trajectory, making it a major player in the cryptocurrency realm.

MicroStrategy, led by CEO Michael Saylor, has solidified its position as the world’s largest holder of Bitcoin, surpassing even entire countries in its cryptocurrency reserves.

MicroStrategy Bitcoin Holdings Surpass Nations

With a staggering 214,400 Bitcoins in its treasury, valued at $13.6 billion, the US software company now boasts more digital currency than any sovereign state. This milestone marks a significant achievement, as MicroStrategy Bitcoin holdings exceed 1 percent of the total Bitcoin supply.

In the first four months of 2024 alone, MicroStrategy added 25,250 Bitcoins to its reserves, further cementing its dominance in the cryptocurrency space. MicroStrategy Bitcoin holdings are higher than those of other corporate entities, with over ten times the Bitcoin holdings of its closest competitor, Marathon Digital Holdings, a prominent mining firm.

MicroStrategy’s embrace of Bitcoin as its primary treasury reserve asset has reshaped the company’s trajectory. Established in 1989 as a business analytics software provider, MicroStrategy’s shareholder value is now heavily influenced by its cryptocurrency investments. Since its pivot to Bitcoin in 2020, the company has been on a mission to accumulate digital assets aggressively.

Bitcoin Reshapes MicroStrategy: Strategic Shift and Market Dominance

Despite reporting a net loss of $53.1 million in the first quarter of 2024, primarily attributed to a $191.6 million digital asset impairment loss, MicroStrategy remains undeterred. Revenue declined by 5.5% compared to the previous year’s first quarter, settling at $115.2 million. However, the firm’s commitment to Bitcoin remained steadfast, with continued acquisitions throughout April.

While MicroStrategy’s strategy mirrors that of a de facto spot Bitcoin ETF, its unique position lacks the market mechanisms of traditional ETFs, leading to potential fluctuations in its stock price relative to its underlying Bitcoin holdings.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |