Learn to make money on Coinbase by long-term holding, trading, staking, and other options such as the Coinbase Earn program.

Coinbase is a leading platform offering a host of opportunities for generating income. Whether you are a beginer, an experienced trader, or someone looking to diversify your investment portfolio, there are a number of ways you can make money on Coinbase.

Coinbase is a full-featured platform that goes beyond the buying and selling of cryptocurrencies. This includes staking, earning through learning, cash back on purchases, and even an NFT marketplace.

In the sections that follow, we take a look at each method and explain in detail how you can start making money from Coinbase. So let’s dive in and explore how to get the most from your Coinbase account.

Getting Started with Coinbase

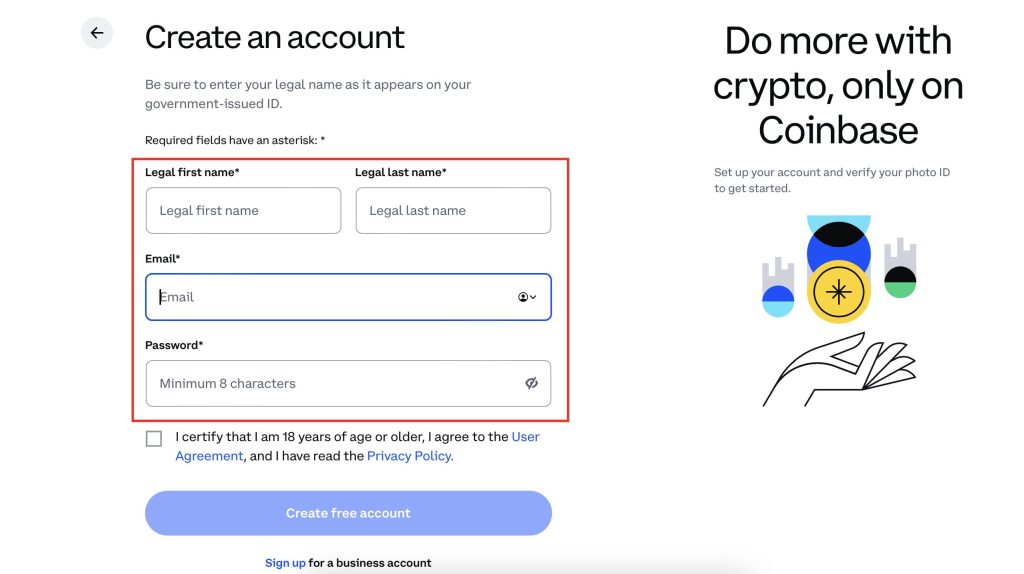

Creating a Coinbase account

Step 1: Go to the Coinbase website from a computer browser; the mobile browser is not recommended. Alternatively, download and open the Coinbase App for Android or iOS.

Users have the choice to start with a new registration or use the Google account to register.

Step 2: After successful registration, there will be a need to verify an email address. This involves opening an email sent by Coinbase and clicking ‘Verify Email Address.’

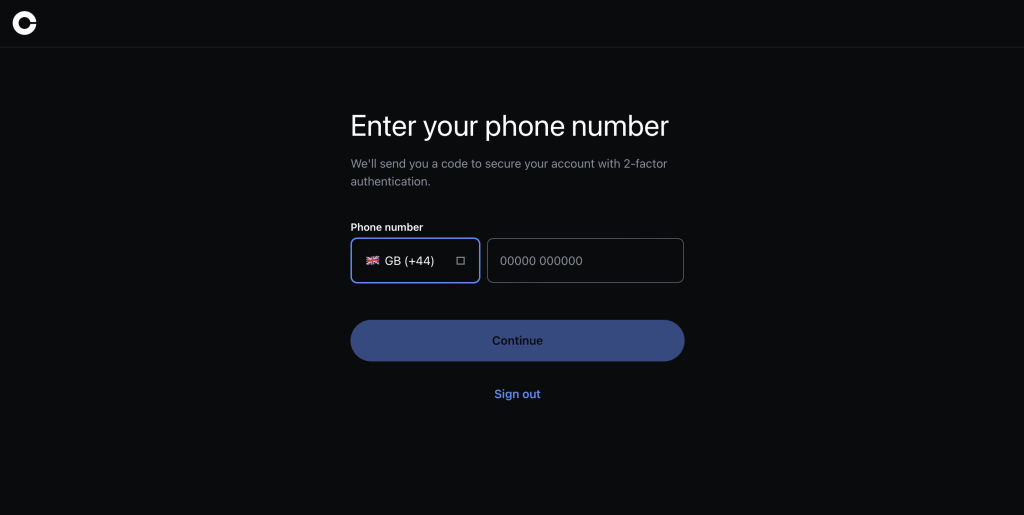

The next step is the verification of the phone number. Users have to log in to Coinbase, after which a window will pop up to add a phone number.

Step 3: Users then select their country and enter their mobile number. The user will receive a seven-digit code via text message, which he/she will input for phone verification.

Step 4: Lastly, users need to add personal information that matches their valid government-issued photo ID, such as their first name, last name, date of birth, and address.

There is also a need to answer questions, including the intention of using Coinbase, source of funds, current occupation, employer, and the last 4 digits of the user’s Social Security Number.

In order for the user to buy, sell, send, and receive supported crypto through Coinbase, he/she needs to verify his/her identity and add a bank account.

Funding your account

Before you do any deposits into the account, confirm that your account:

- Make sure you can add cash

- Link a payment method to your account

Unable to buy crypto or add cash on CoinBase

There might be various reasons why you are not able to purchase crypto or make deposits:

- Your account might be deactivated temporarily.

- The buy/sell feature might be disabled.

- Your account might not be eligible as a trusted source of payment.

Payment methods for Coinbase Users

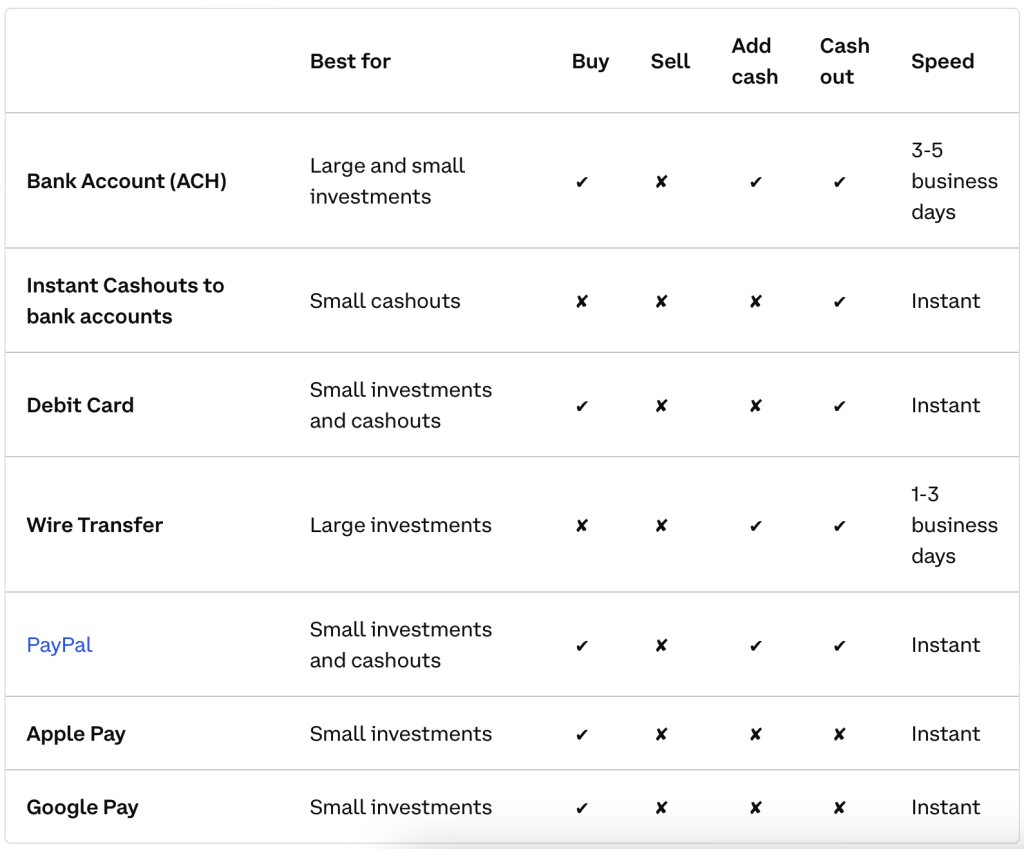

There are several payment methods you can attach to your account, but most payment methods are dependent on country restrictions. In general, you can attach the following methods:

- Bank Account: Used for direct deposits and withdrawals, including U.S. ACH transfers.

- Debit Card: Used for immediate cryptocurrency purchases.

- Credit Card: The option is restricted and hence not available in all countries according to regulations.

- Wire Transfer: Generally used for larger deposits and withdrawals.

- PayPal: Available for withdrawals in certain countries.

- Apple Pay: You can buy cryptocurrencies using Apple Pay linked to a debit card.

- Google Pay: Like Apple Pay, it allows purchases using Google Pay linked to a debit card.

Remember that some of these payment methods can depend on the location and laws around the location of the user. Refer always to the most recent information on Coinbase’s website and through their help center for the specifics of your area.

Once you have done all the steps above, you now can deposit money into your Coinbase account’s USD balance to buy cryptocurrency immediately. Here’s how:

For web browser:

- Log in to your Coinbase account.

- Click on ‘My assets’ in the navigation bar.

- Next to your US Dollar balance, click ‘Add cash’.

- Choose a payment method.

- Input the amount.

- Click ‘Continue’.

- Review your deposit details and click ‘Add cash now’.

For mobile app:

- Tap on ‘My assets’ and select ‘Add Cash’.

- Choose the right balance.

- Enter the amount.

- Pick a payment method.

- Tap ‘Preview’.

- Review your deposit details and tap ‘Add cash now’.

- If needed, press the back arrow to make changes.

Exploring different investment options

Some investment options on Coinbase include:

| Buying and Selling Cryptocurrencies | Bitcoin (BTC): The first and arguably the most famous cryptocurrency. Other Altcoins: There are a huge number of other cryptocurrencies, including Cardano (ADA), Polkadot (DOT), Chainlink (LINK), and many more. |

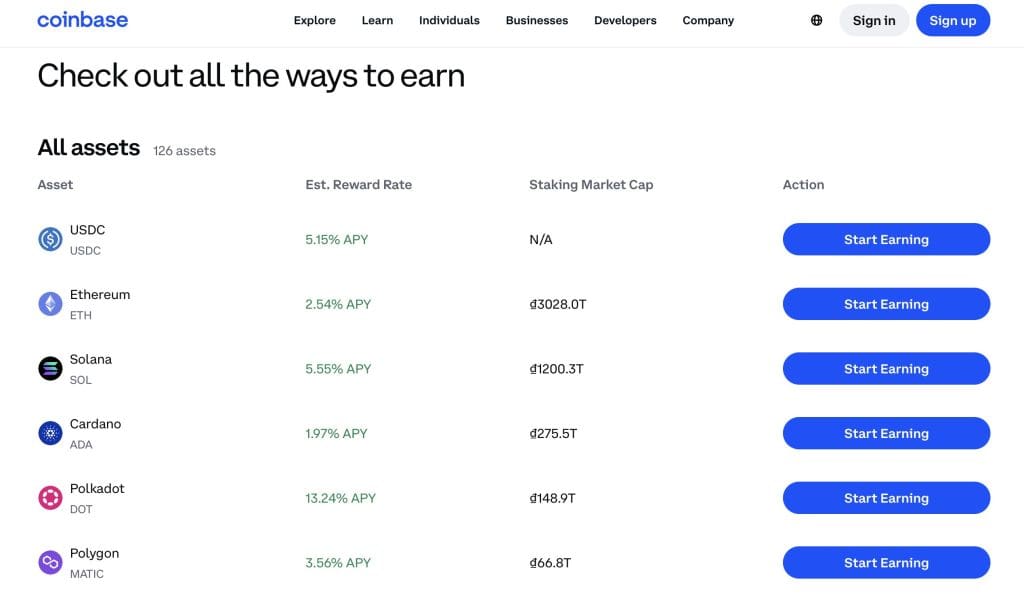

| Staking | Ethereum 2.0 (ETH2): Stake your ETH to get rewards. Tezos (XTZ): Get rewards after participating in the process of Tezos staking. Other Staking Options: Depending on the assets supported, you can stake other coins and get rewards. |

| Coinbase Earn | Learn about new and emerging cryptocurrencies and also earn a small amount of those cryptocurrencies by watching videos and taking quizzes about each one. |

| Coinbase Wallet | Store your cryptocurrencies in Coinbase Wallet; you will be able to explore DeFi apps and interact with any other dApps you want. |

| USD Coin (USDC) | Invest in stablecoins such as USDC, pegged to the dollar for a more stable investment compared with other more volatile cryptocurrencies. |

| Coinbase Card | Spend your cryptocurrencies directly with the Coinbase Card to make purchases and earn rewards in crypto. |

| Advanced Trading | Use Coinbase Pro for a more advanced trading experience with advanced charting and trading tools, lower fees, and the ability to place limit and stop orders. |

| Decentralized Finance (DeFi) | Tap into DeFi protocols directly from your Coinbase Wallet, enabling you to lend, borrow, and earn interest on your crypto. |

| Coinbase Ventures | Barring a direct investment option for most users, Coinbase Ventures further invests in early-stage cryptocurrency and blockchain startups. Keeping an eye on these investments can give insights into emerging trends and potential opportunities in the crypto space. |

Readmore: Bitcoin Mining: How Long Does It Take to Mine 1 Bitcoin?

Ways to Invest in Cryptocurrency on Coinbase

Buying and Holding for the Long Term

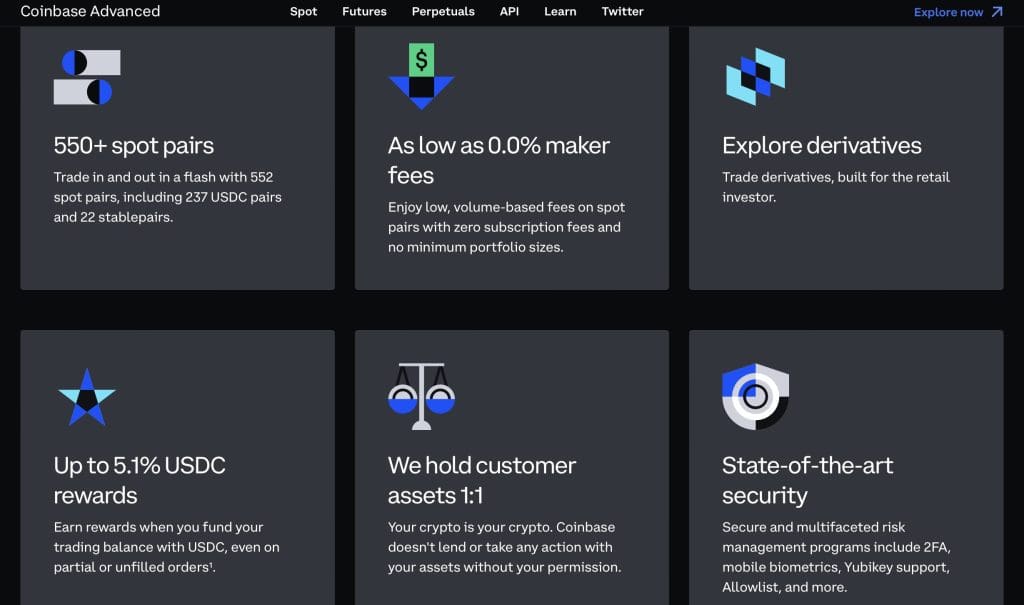

It would not be an exaggeration to say Coinbase is a great ground for crypto enthusiasts who like to buy and hold cryptocurrency for the long term. With over 550 spot pairs, including 237 USDC pairs and 22 stable pairs, trading is fast.

You can enjoy as low as 0.0% maker fees without any subscription fees or minimum portfolio sizes. In addition, funding your trading balance with USDC means that you earn up to 5.1% in rewards, even on partial or unfilled orders.

As a customer, you are in full control of your assets because Coinbase does not loan or use your assets without your permission.

State-of-the-art security features include 2FA, mobile biometrics, Yubikey support, and Allowlist. With $193B in safeguarded assets and a quarterly trading volume of $154B, Coinbase Advanced is a solid and reliable way to invest in crypto long-term.

Short-Term Trading

This kind of trading, where a cryptocurrency is bought and kept only for a very short period—from seconds up to weeks—has the potential to be very attractive because of its high potential for gains resulting from a highly volatile crypto market.

The very same volatility that gives large gains may, however, result in quick changes in prices. As such, short-term trading calls for huge time for market analysis and emotional resilience for potential losses. Not every trade will yield a profit.

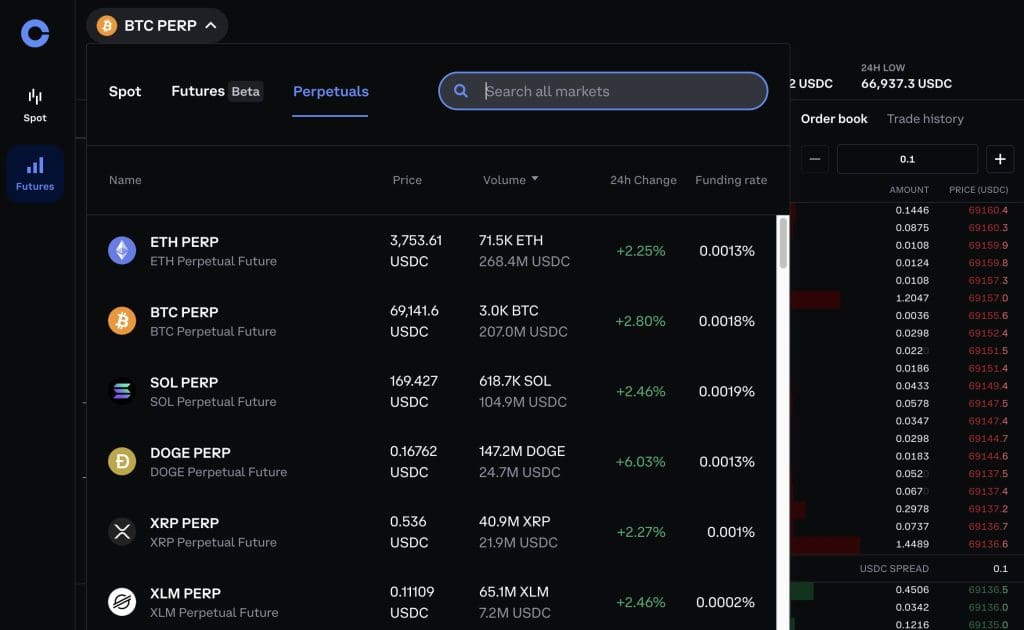

Coinbase offers such features as futures contracts for real-time speculation, trading, and hedging of digital asset prices. These contracts are user-friendly and enable both short and long positions based on market forecasts.

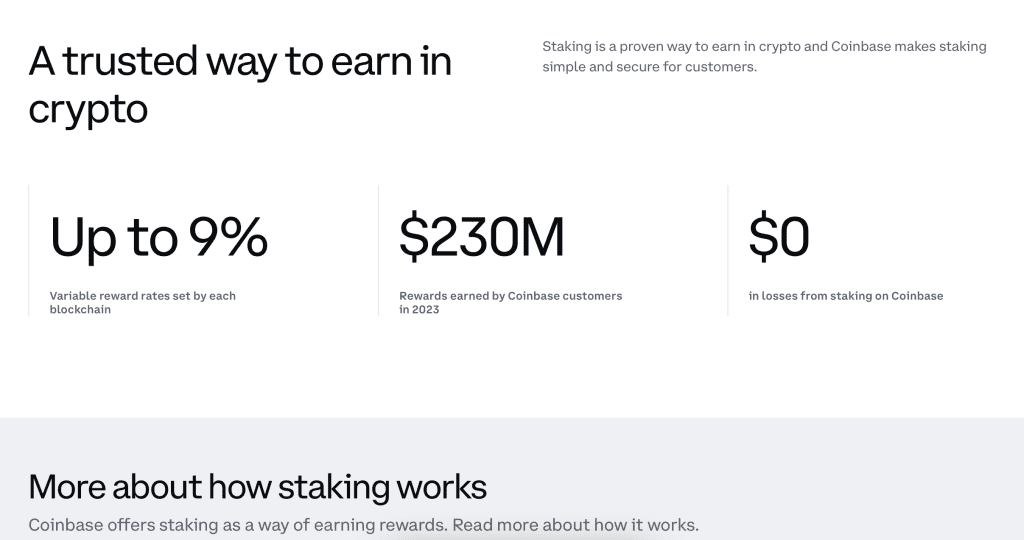

Staking

Staking pertains to holding assets in order to generate passive income. It is also part of the Proof-of-Stake consensus mechanism that guarantees blockchain transactions security and confirmation.

Stakers, or validators, are responsible for adding new blocks to the blockchain and in return earning free cryptos for their services. Coinbase Earn does not charge for staking and unstaking; it only takes a share of the rewards.

However, staking does have its restrictions: it is only available for a few cryptocurrencies listed on the platform, like Ethereum, and the reward rate is subject to the liquidity conditions of the market.

Additional Ways to Earn on Coinbase

Coinbase Earn rewards program

The key ways through which Coinbase Earn rewards users include DeFi Yielding and Learning.

1. DeFi Yield

One of the ways earning through Coinbase Earn is through DeFi Yield. It pertains to yield farming, the strategy used to generate income on cryptocurrencies through dApps and DeFi platforms. Users can lock their crypto in exchange for rewards through DeFi protocols.

These locked assets can then be used by or traded with other users through a smart contract. Coinbase Earn is no different, as it enables users to lend their crypto assets in exchange for interest.

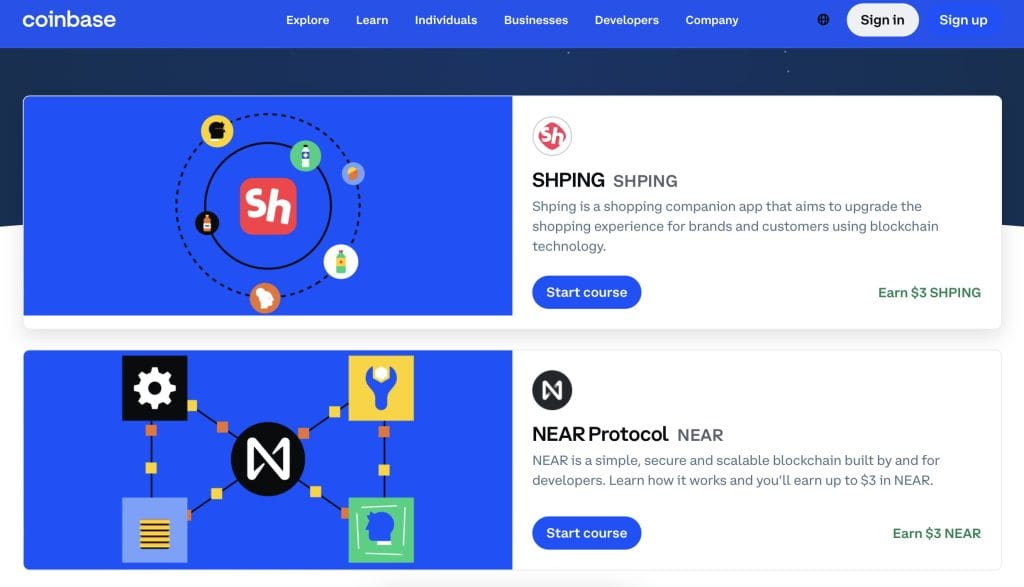

2. Learn and Earn

Coinbase Learn and Earn is a program where users have the opportunity to learn about specific topics and in return get crypto rewards. It provides courses and quizzes on cryptocurrencies and rewards the users with crypto assets upon completion.

Coinbase Debit card cash back

The Coinbase Debit Card allows its users the chance to earn cryptocurrency back on every purchase, and US users can easily accumulate crypto rewards from everyday spending. This card can be used anywhere Visa debit cards are accepted, over 40 million merchants globally.

It comes with no hidden fees, including zero spending fees and no annual fees. It’s a unique opportunity to earn cryptocurrency without directly purchasing it. There are no requirements to sign up, such as credit checks or the need to stake your assets.

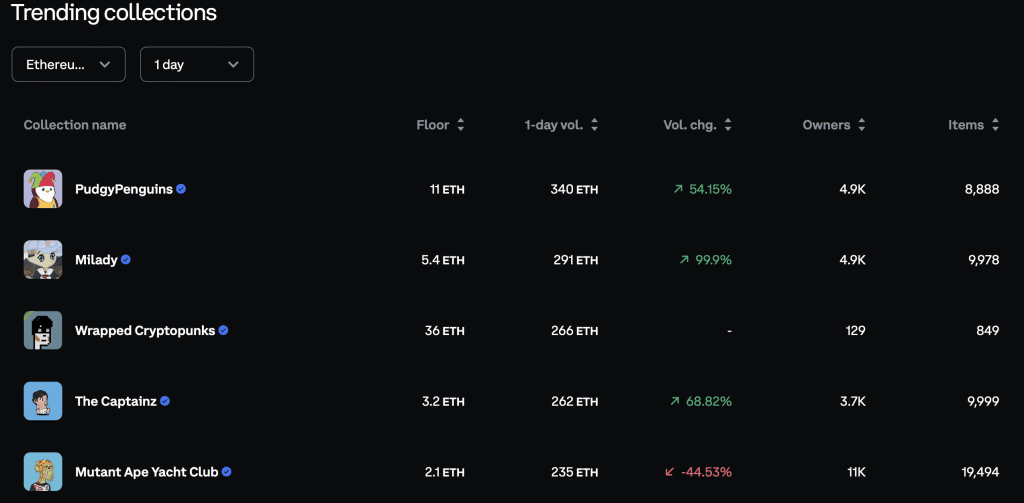

Coinbase NFT marketplace

Coinbase NFT Marketplace is a new, still-in-beta platform for buying and selling non-fungible tokens (NFTs). Emphasizing community, it lets users network with other collectors, too.

With its brand as a trusted crypto brand, the platform initially doesn’t charge for transactions, although users will have to pay Ethereum gas fees. Its interface is clean and user-friendly, which allows social NFT trading.

The functionality remains limited, however, since the platform supports only the Ethereum blockchain and does not support minting NFTs. Also, there is a dearth of payment options. Future plans include adding more means of payment with credit cards and expanding across several blockchains.

Readmore: How To Get Goerli ETH Testnet Tokens: Comprehensive Guide

Important Considerations Before Investing in Cryptocurrency

Understanding the risks involved

Volatility

Cryptocurrencies can experience sudden and significant price changes due to shifts in market sentiment.

Lack of Regulation

As of now, cryptocurrencies are not regulated by governments or central banks, although this is beginning to change as they garner more attention.

Risk of Errors and Hacking

Technical glitches, human errors, and hacking incidents can affect cryptocurrencies, and there’s no foolproof way to prevent these.

Impact of Forks or Discontinuation

Hard forks or discontinuation can significantly influence a cryptocurrency’s value. Traders should familiarize themselves with these risks, as hard forks can cause substantial price volatility, and trading may be suspended if reliable prices are not available from the underlying market.

Technology and Project Risks

Crypto investments are about specific blockchain projects. However, not all of those are reliable or successful. Before investing in a project, it is important to carry out very serious research and evaluation of the project’s fundamentals, credibility of the team, and technology.

Liquidity Risks

Another risk is what is called the liquidity risk, or the capacity of cryptocurrencies to trade without having any appreciable impact on the price of the particular cryptocurrency. Some of the lesser-known cryptos often have problems with liquidity, which can make it hard to get out of a position in a falling market.

Setting investment goals and risk tolerance

Establishing financial goals and a timeline is very important before trying to venture into cryptocurrency markets. The evaluation of personal risk capacity and acquaintance with volatility is also important.

Understanding these components will be able to help tailor an investment approach that complements one’s objectives and risk preferences.

| Set Goals | Have clear investment goals before entering the volatile world of cryptocurrency. Long-term trends and fundamental analysis can provide a sustainable approach. |

| Risk Management | Cryptocurrency investments are high-risk. Know your risk tolerance and use tools like stop-loss and take-profit orders to manage potential losses. |

| Make Informed Decisions | Don’t make impulsive decisions. Be up to date with market trends and regulatory changes, and join online communities for insights. |

| Protect Your Investments | Invest through the use of reputable exchanges, strong security measures, and consider hardware wallets to secure your investments from cyber threats. |

| Consult Professional Advice | If you’re confused, get professional advice. Financial advisors will give you tailored guidance and assist you in making informed decisions. |

Conducting thorough research

In-depth research helps people understand most aspects of cryptocurrencies.

Begin with the basics:

- Principles of cryptocurrencies.

- blockchain technology.

Then, look at the whitepaper to delve into the technical details of the project, objectives, and tokenomics.

Analyze the credibility, experience, and transparency of the project’s team. Analyze the community’s engagement through social media channels and discussion forums.

Deeper insights into the project’s sustainability can only be achieved after a good, in-depth analysis of the technology, infrastructure, and tokenomics.

Keep up to date with news and understand the general market conditions. Also, consider real-world applications, partnerships, and constantly reevaluate your research based on market changes. Remember that in this dynamic world, continuous learning is key.

Readmore: Top Base Meme Coins To Invest

Conclusion – How To Make Money On Coinbase

Coinbase offers a wide range of ways for users to generate income through long-term buying and holding of cryptocurrencies, short-term trading, staking some types of cryptocurrencies, and the Coinbase Earn program, which rewards users for learning about different cryptos and DeFi Yielding.

Other methods of earning include cash back on purchases through the Coinbase Debit Card and buying/selling of non-fungible tokens on the Coinbase NFT Marketplace. Thereby, Coinbase offers at least seven different ways to make money, with their own potential benefits and risks.

Frequently Asked Questions (FAQs)

1. Are cryptocurrencies a good investment?

It all depends on risk tolerance, so to speak, since their volatility and the liquidity constraints are barriers to entry in the cryptocurrency space.

However, they do have the potential to diversify, and they are a new asset class in formation. The novelty of the sector provides a potential for future growth. Despite the thereof, there are risks of fraud and a need for more stringent regulation.

2. What is the best way to make money on Coinbase?

There are a number of ways in which to make money on Coinbase; the best is determined by your style of investment and your risk tolerance.

Note that each of the above carries risk and you should only invest money which you are willing to lose. It’s a great idea to do thorough research and even consider talking to a financial advisor.

3. Is Coinbase safe to use?

Yes, Coinbase is considered really safe. It is a US-based, publicly-traded company pioneering crypto security solutions. This has earned it a regular ranking as the world’s safest crypto exchange and a trusted partner for over 100 million crypto investors.

The world of crypto is dynamic, and with new types of cyber attacks being brought online daily, it’s impossible to completely avoid the risks. However, with a secure, reliable, and highly-regulated platform like Coinbase, one can be better placed to diffuse these risks. In 2024, there is no better platform in terms of safety than Coinbase.

4. How do I get started with Coinbase?

To get started with Coinbase, follow these steps:

- Visit the Coinbase website or download the mobile app.

- Register a new account or sign in with Google.

- Verify your email and phone number.

- Provide personal details matching your government-issued ID.

- Answer some additional questions for verification.

- Verify your identity and add a bank account.

After these steps, you’re ready to start using Coinbase!

5. What are the fees associated with using Coinbase?

The fees associated with using Coinbase involve several aspects. Firstly, there’s your primary balance which may be subject to transaction fees and currency conversion fees. Secondly, trading on Coinbase incurs fees and spread which can vary depending on your location and payment method.

The Coinbase Card, a Visa debit card that lets you spend any asset in your Coinbase portfolio, may have its own associated fees. If you choose to use Coinbase’s staking services, there might be fees involved. Lastly, any asset recovery efforts undertaken by Coinbase on your behalf might also incur a fee.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |