Key Points:

- BlackRock reapplies for Spot Ethereum ETF.

- VanEck, Fidelity, others also seek Ethereum ETFs.

- Ethereum ETFs could boost ETH value to $8,000 by 2024.

BlackRock has reapplied for a Spot Ethereum ETF with the SEC, joining nine firms vying for approval. If approved, experts predict significant inflows and a potential surge in ETH price.

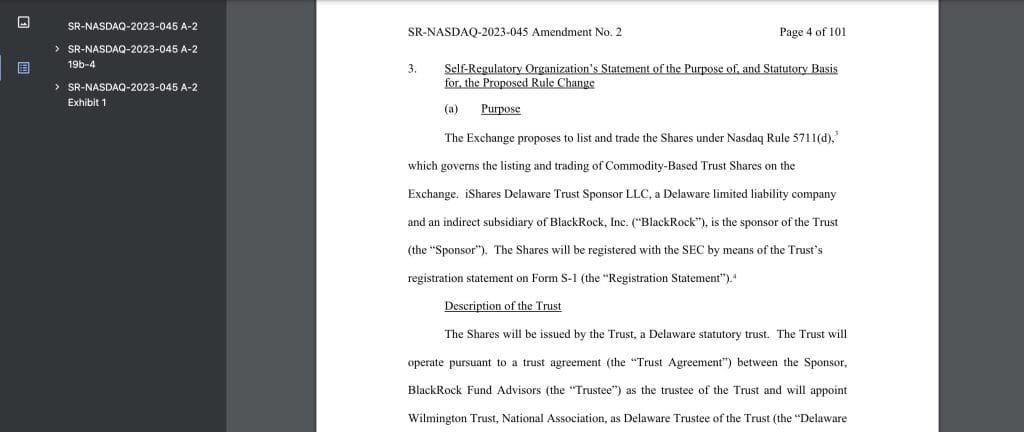

BlackRock has resubmitted its Spot Ethereum ETF application, according to an updated 19b-4 form filed with the US Securities and Exchange Commission (SEC).

BlackRock Resubmits Spot Ethereum ETF Application

Earlier this year, BlackRock joined the ranks of companies filing for spot Bitcoin ETFs. Approval for a Spot Ether ETF will enable BlackRock to maintain a ten-year track record of winning SEC approvals.

Following the SEC’s recent approval of Spot Bitcoin ETFs, investors were already speculating over which other assets could come next.

However, with continued delays, hopes for Ethereum ETF applications began to dwindle. A shift in the SEC’s stance has lifted the approval odds from 25% to 75%.

BlackRock is joining a list of nine firms vying for a spot Ethereum ETF approval. Noteworthy names on that list include VanEck, ARK 21Shares, Hashdex, Grayscale, Invesco Glaxy, Fidelity, Franklin, and Bitwise.

Readmore: Spot Ethereum ETF Approval Could Surge ETH To $8,000 By 2024

Analyst Predicts Significant Inflows Following Approval

Potential Ethereum ETFs could send the value of the asset to the moon. Bernstein, an asset manager that oversees $725 billion, sees ETH ETF approvals potentially sending it to an all-time high of $6,600.

In addition, Geoff Kendrick, an analyst at Standard Chartered, reportedly forecasts the sanction of a Spot Ethereum ETF this week.

He suggests this could trigger substantial inflows ranging from $15 billion to $45 billion in the inaugural year. If ratified, this could propel the price of ETH to $8,000 and Bitcoin to $150,000 by the conclusion of 2024.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |