Bitcoin Price Prediction 2024: $90,000 Value Expected By Bernstein

Key Points:

- Bernstein predicts Bitcoin to hit $90,000 (2024) and $150,000 (2025).

- Crypto-based ETFs approval boosts sector optimism.

- Ethereum also received ETF approval from US SEC.

Bernstein reportedly released a Bitcoin price prediction for 2024 and 2025, stating that BTC will reach $90,000 and $150,000 in those respective years.

Bernstein, the asset manager overseeing $725 billion in assets, has forecasted a very optimistic outlook for Bitcoin. The firm has forecasted that Bitcoin will hit a $90,000 value in 2024, followed by a huge jump to $150,000 in 2025.

Bernstein’s Highly Optimistic Bitcoin Price Prediction

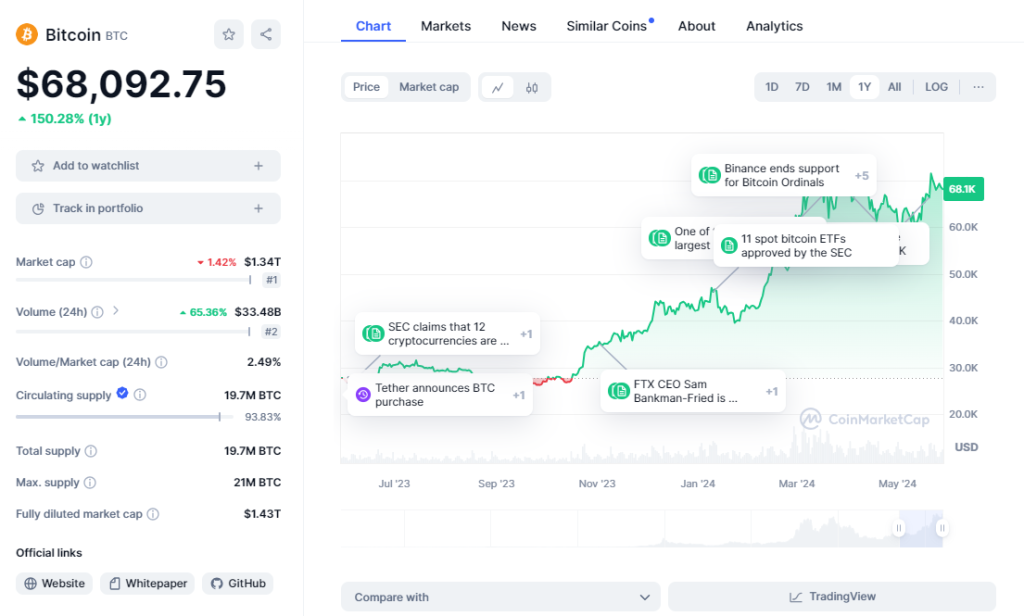

This is amidst an optimistic outlook for the crypto industry, with the crypto Spot Bitcoin Exchange-Traded Funds having been approved early in the year. Bitcoin has registered a more than 150% surge in value since the approval of the ETFs, according to CoinMarketCap.

Bernstein analysts Gautam Chhugani and Mahika Sapra released a research report on Tuesday that expressed high expectations for the market. They said the new investment offerings will see funds of over $100 billion flowing into them in the next two years.

The coming arrival of crypto-based ETFs has been a big source of optimism within the cryptocurrency market. These investment vehicles are expected to give rise to a wave of adoption and institutional investment in the sector.

Readmore: Solana ETF Approval Is Unlikely, Warns JPMorgan: Report

Impact of Spot Bitcoin Exchange-Traded Funds Approval

Bernstein’s predictions mean the firm believes these trends will drive Bitcoin to new highs.\n\nEthereum, the second-largest cryptocurrency, also got ETF approval from the US Securities and Exchange Commission.

The asset has had moderate gains over the past week, with many predicting the launch of the ETF will send it even higher.

The assertion by Bernstein that Bitcoin will reach $90,000 in 2024 and $150,000 in 2025 would mean the asset far surpasses its current all-time high of $73,000, which it set in March, just three months after its ETF approval.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |