Save Up To 35% With Exclusive Cashback Trading Code From Coincu

Discover crypto trading fees, rebates, and cashback programs and how to save on fees and earn rebates through the Coincu’s Cashback Trading Code.

Overview of Trading Fees in Crypto Exchanges

A trading fee is also known as a transaction or commission fee that many crypto exchanges charge for making a trade, sell, or exchange of cryptocurrencies. There are basically some structures based on what these fees are put on:

- Maker and Taker Fees: In the native order book model, liquidity is added with an order, and the participant is considered a ‘maker’; it is removed by an executed order, with the participant as a ‘taker’. Some exchanges may charge makers less to promote liquidity.

- Flat Percentage Fees: Some exchanges charge the same percentage fee for every single transaction, regardless of what kind of order is being placed. The fee may be somewhere between 0.1% and 1% or even higher, depending on the exchange.

- Tiered Fees: Many exchanges already have a tiered fee structure, meaning the higher your trading volume, the lower your fees. Tiered fees are designed to encourage high-volume trading.

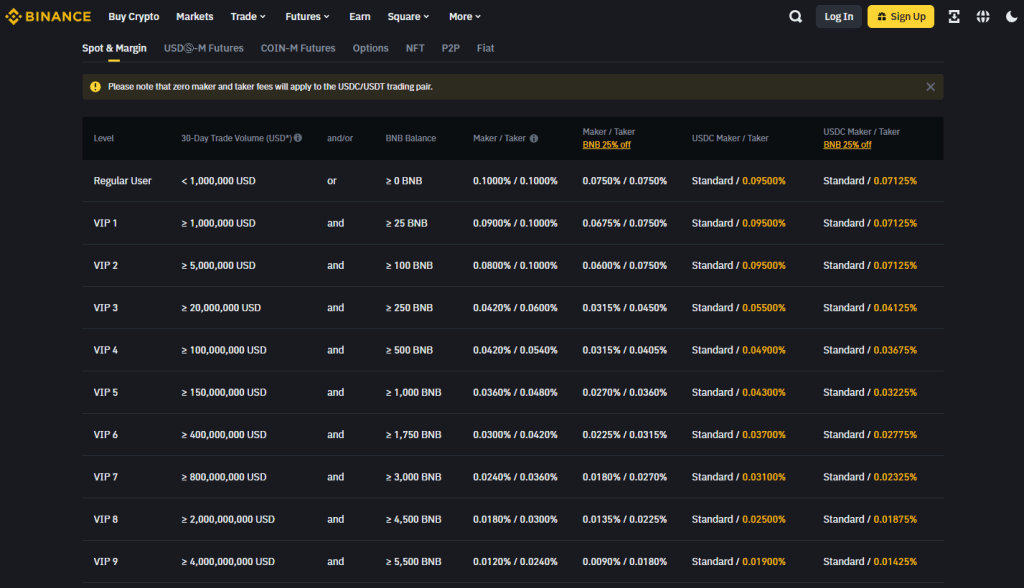

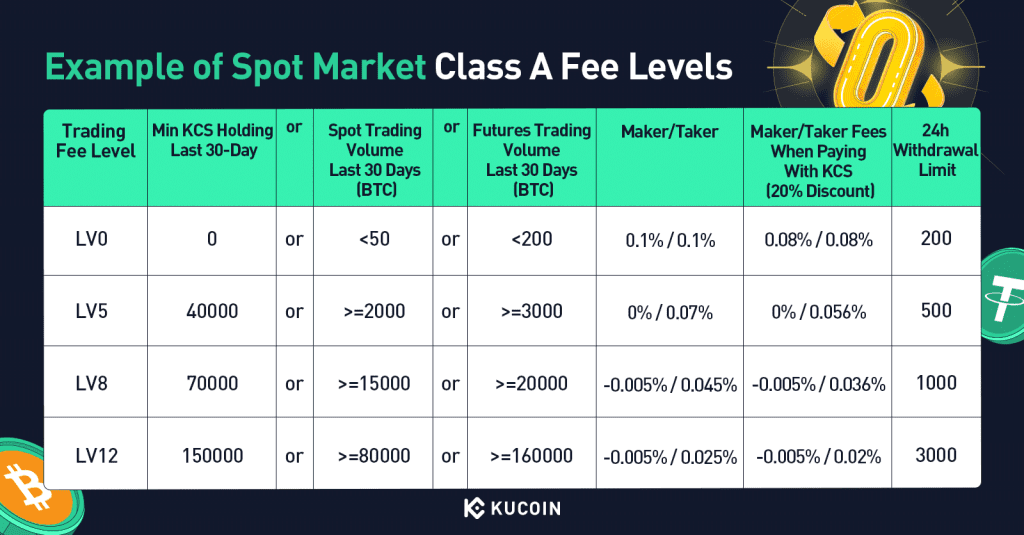

Crypto exchanges like Binance and KuCoin adjust trading fees based on factors like trading volume, account tier, and token usage. Binance’s standard spot trading fees are 0.10% for makers and takers, with a 25% discount for Binance Coin (BNB) payments.

They also offer a tiered VIP system for further discounts. KuCoin’s standard spot trading fees are also 0.10% for both parties. Holding KuCoin Shares (KCS) can provide up to a 20% discount. They also employ a tiered fee structure.

Understanding Rebates on Trading Fees

A rebate under cryptocurrency trading is a financial incentive that the exchange offers in order to induce some type of desirable trading behavior. They are usually given to those traders who are able to add liquidity to the market, or those making. Here’s how it works:

Rebate in Terms of Cryptocurrency Trading

Maker and Taker Model:

- Makers: The term refers to traders who issue limit orders that enhance liquidity on the order book without being matched at that moment with a corresponding buy/sell order. Such developers, thus, “make” the market.

- Takers: Those traders who dispatch market or limit orders which instantly match at least a certain volume of a buy/sell order and, thus, “take” from the market its liquidity.

Purpose of Having Rebates:

- The idea behind having rebates for makers is to stimulate marketplace creators or market makers to provide liquidity to the market. Greater liquidity results in a narrower gap between the buy and sell orders, lower volatility, and thus a more optimal trading environment.

How Rebates Work:

- When a trader posts a limit order, and it is executed by a taker after entering the book, the exchange pays the maker a rebate. The rebate is then a fraction of the trade’s gross value and is usually added to the maker’s account.

For example, an exchange can offer a maker a liquidity-making rebate of 0.01% of the trade’s value. Thus, if a maker places its order for 1 BTC, and it gets executed, the maker will get a rebate equaling 0.01% of 1 BTC.

Impact on Trading Fees:

- Rebates translated to mean a reduction in the potential trading expenditure for the makers. In the more beneficial cases, it could be adequate to cover for all the charges, making it less costly or even possible for the makers to trade.

- Taker fees should typically be higher when compared to maker ones; nevertheless, the latter’s quotes will not contain rebates since the takers consume, rather than provide, liquidity.

Consider the example order book of a cryptocurrency exchange that has a 0.10% fee for takers and a 0.08% fee for makers, with a 0.01% rebate for makers. Urgently making an order on this book for the purpose of taking liquidity, a market taker would pay a fee of 0.10% on the order.

Understanding Cashback on Trading Fees

A cashback is a program whereby a trader gets part of the fee he paid back into his account as a bonus. Such an incentive is mostly given by an exchange to encourage more trading activity and engagement by users.

How Cashback Works on Crypto Exchanges

Payments of Fees and Cashback Accumulation:

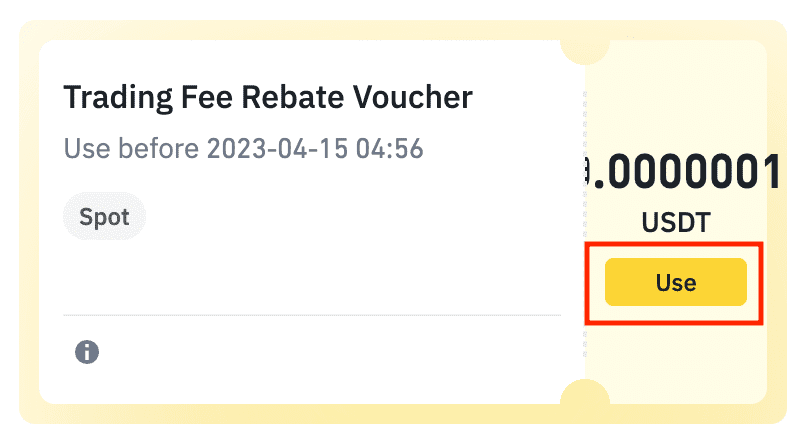

- Whenever a trader executes a trade on any cryptocurrency exchange, they normally pay a trading fee. In a cashback program, a part or a percentage of the fee paid comes back to the trader’s account .

Cashback Calculations:

- Cashback is normally calculated on the total amount a trader has paid as trading fees over a period. This period is normally daily, weekly, or monthly.

- The cashback is calculated by multiplying the total fees times the cashback percentage. Eg. if a trader has paid $100 as fees and the cashback rate is 10%, then they would get $10 back as cashback.

Cashback Is Dispatched:

- Cashback rewards are normally paid back to the trader’s account in the form of the exchange’s own native token, the traded cryptocurrency itself, and sometimes in the form of fiat currency.

- The cashback will be allowed to be used in the exchange for further trading, can be withdrawn as well as you can pay other kind of fees with the credited cashback on the platform.

Eligibility and Conditions:

- Some exchanges also provide tiered cashback rates where either your trading value or loyalty is considered. As trading volumes or holding more of its native token, the cashback percentage increases or decreases.

Promotional and Loyalty Programs:

- Cashback can be part of broader promotional or loyalty programs designed to retain active traders and attract new users. These programs may include additional benefits such as reduced fees, access to premium features, or exclusive trading competitions.

Suppose a trader makes deals valued at $50,000 in one month on an exchange that takes a 0.10% trading fee. A total of $50 in fees will have been surrendered.

If the exchange offers a cashback program of 10%, then $5 would be refunded to the trader. This money can further be used to trade on the platform, from where this particular trader would only have to pay $45 in fees at the.

Introduction to Coincu Cashback Trading Code

Coincu recently launched Cashback Trading Code program providing you with the best, unbeatable codes to enjoy trading rebates and cashback on your trading fees from seven major exchanges.

With these cashback trading codes, you can get up to 35% cashback on a total trading fee. Whether you trade on Binance, OKX, Bybit, MEXC, Huobi, KuCoin, or Gate.io, you stand a chance to save more.

| Exchange | Cashback | Link Ref |

| Binance | 20% Rebate on trading fees 10% to 15% Cashback on total trading fees | https://accounts.binance.com/en/register?ref=F26ND44L |

| OKX | 20% Rebate on trading fees 12% Cashback on total trading fees | https://www.okx.com/join/coincu |

| Bybit | 25% Cashback on total trading fees Up to 10% Additional Bonus | https://partner.bybit.com/b/coincu |

| MEXC | 35% Cashback on total trading fees | https://www.mexc.com/login?inviteCode=mexc-coincu |

| Huobi | 20% Rebate on trading fees 15% Cashback on total trading fees | https://www.htx.co.zw/invite/en-us/1h?invite_code=acdb9223 |

| KuCoin | 20% on Total trading fees 10% Cashback on total trading fees | https://www.kucoin.com/r/af/QBAE69JW |

| Gate.io | 20% on Total trading fees 20% Cashback on total trading fees | https://www.gate.io/ref/AlcRUFoJ?ref_type=102 |

Readmore: Free Bitcoin Code 2024: Easy Way To Own Bitcoin

Submitting Your Details for Cashback Trading Code

To avail yourself of our Cashback Trading Code, you need to sign up with a new account using our referral code. Old or current accounts cannot be a part of this scheme.

Once you have the account created, you can submit your Telegram username, registered exchange, exchange UID, and BEP20 Wallet Address through our online form as below:

Submit your information at: https://forms.gle/PcsAVUpCmyKGEYXy5

Contact our support here: https://t.me/flushtradingcashback

Conclusion – Cashback Trading Code

In summary, grasping the various models that crypto exchanges apply to their fee structure, rebates, and cashback programs can greatly cut your costs in trading.

Common practices are the ‘maker’ and ‘taker’ model, flat percentage fees, and tiered fees. It gives reasons for ‘makers’ to add liquidity—although rebates are more incentives given by the exchange on cashback trading.

A notable one is the Coincu Cashback Trading Code, which offers up to an incredible 35% cashback on total trading fees, making sure that traders truly save in their trade.

FAQs

What is a trading fee?

Some crypto exchanges charge a trading fee at other times a transaction or commission fee for carrying out a trade or the selling and exchanging of a cryptocurrency.

What is a trading fee rebate?

Once the trading requirements are met, users will receive a rebate on their trading fees, which can be used to offset future trading costs.

What is cashback on a total trading fee?

A rebate on a total trading fee, in other words, is a cashback program offered by some cryptocurrency exchanges. It involves returning a part of the trading fees paid by users to them, normally done through the native token of that particular platform, another cryptocurrency, or, in some cases, even fiat money.

How can I access the Coincu Cashback Trading Code?

To access, you have to sign up with a new account using our referral code, after which you submit your Telegram username, registered exchange, exchange UID, and BEP20 Wallet Address using our online form.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |