June 14 Options Data: Significant Expirations in BTC and ETH Markets!

Key Points:

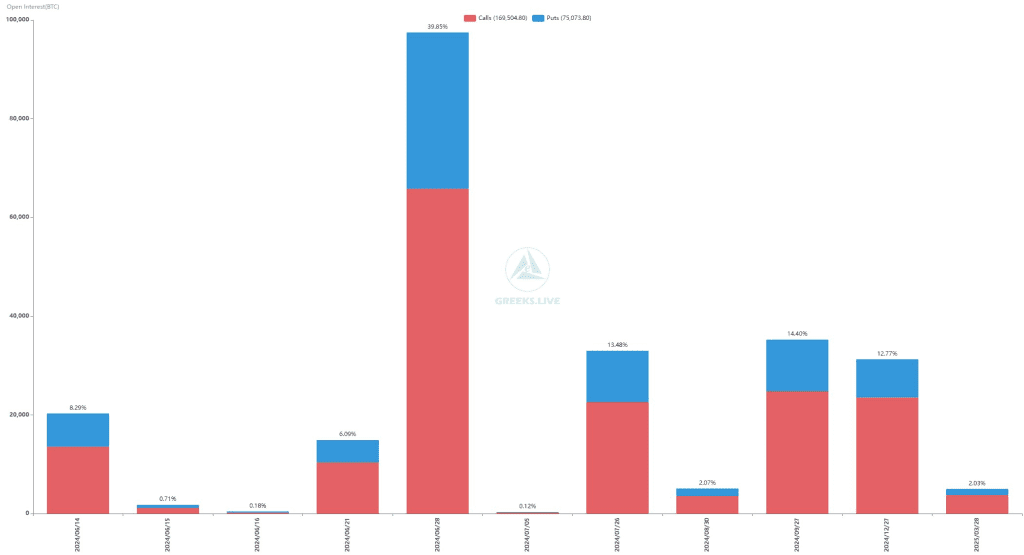

- 20,000 BTC options expired with a Put Call Ratio of 0.49, a max pain point of $68,500, and a notional value of $1.35 billion.

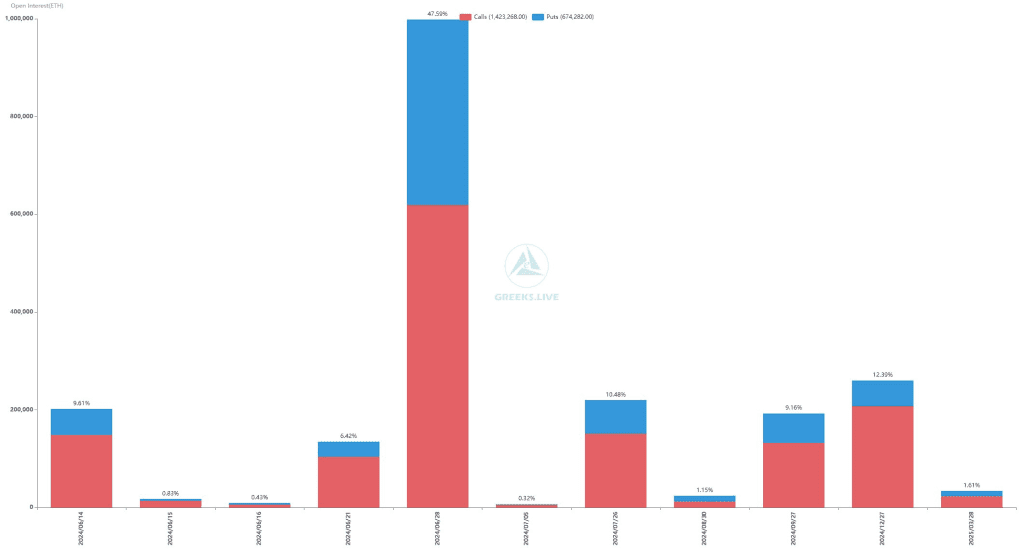

- 200,000 ETH options expired with a Put Call Ratio of 0.36, a max pain point of $3,600, and a notional value of $710 million.

- BTC and ETH’s short-term implied volatility have fallen, with BTC below 50% and ETH below 60%, making buying options more cost-effective.

BTC and ETH markets were affected when millions of dollars worth of open interest in options expired, or EE was obtained from the bears.

The put-call ratio stood at a lowly 0.49. Maximum pain for the same set of BTC options is evaluated at 68500, where the remarkable notional value accounted for $1.35 bn.

SEMrush also concluded that 200,000 ETH options, whose expiration date falls in the same period, have a Put Call Ratio of 0.36. Maximum pain for ETH options was at $3,600, which is a 710 million notional value.

The most critical gauge of sentiment is the Put Call Ratio, and it is below 1. This means the market sentiment is especially bullish since the ratio of BTC at 0.49 indicated that calls dwarfed those to sell and thus was decidedly optimistic. Comparing this to the case of ETH, the 0.36 Put Call Ratio strongly suggests a high possibility of bullish sentiment in the Ethereum market.

Read more: Movement Review: Blockchain project using Move language

Major BTC and ETH Options Expiry and Market Impact

BTC’s max pain point stands at $68,500, meaning that at this price, most options would expire worthless, and the same applies to ETH’s pain point of $3,600.

Another development is that the IV for BTC and ETH options is lower. Actually, each of the major short-term IVs for BTC is below 50%, and for ETH, it is below 60%. From this, one can conclude that a decrease in volatility brings much calmness to the market. Also, option buyers will find themselves in a position to subtract their position at a much cheaper cost.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |