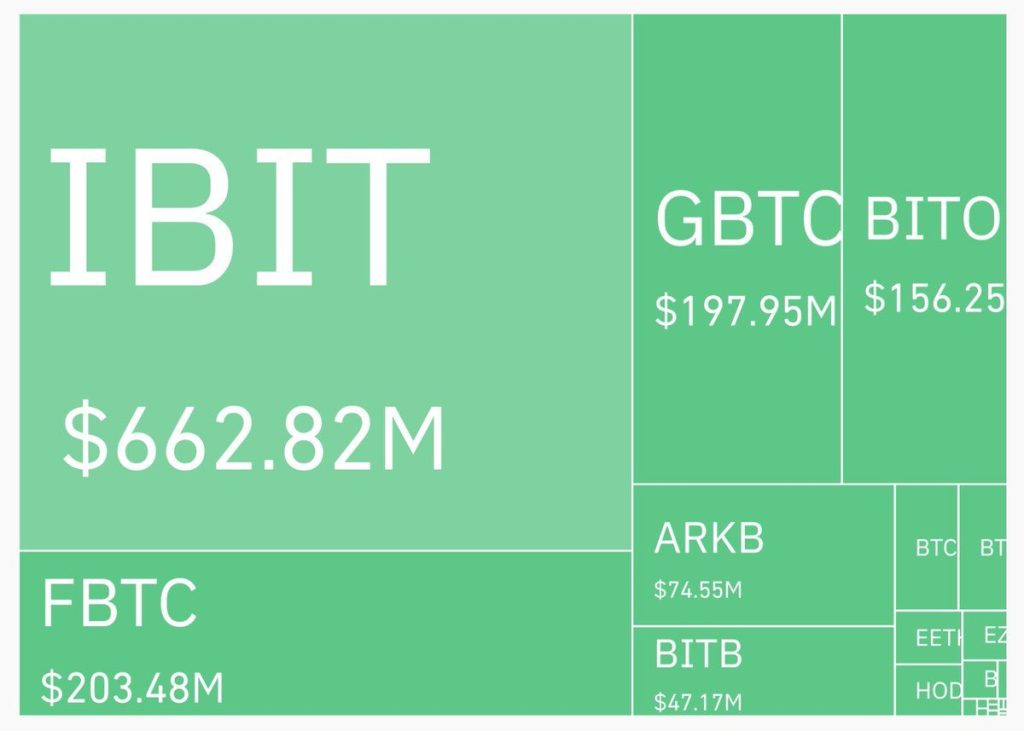

Key Points:

- BlackRock spot Bitcoin ETF (IBIT) achieved an astounding $662M in trading volume today.

- The surge reflects increasing institutional adoption and investor confidence in Bitcoin.

BlackRock spot Bitcoin ETF (IBIT) has held trading volumes above $662 million today.

This trading activity shows that investors are increasing their interest in and faith in Bitcoin’s potential, thereby increasing the cryptocurrency’s stake in the mainstream financial markets.

The BlackRock spot Bitcoin ETF has been closely monitored since listing, but today’s trading volume was special. More critically, this comes against the backdrop of a very volatile cryptocurrency market in price over the past year. IBIT saw impressive trading volumes today, a sign of strong investor demand and a strong appetite for exposure to Bitcoin through regulated financial instruments.

Read more: Spot Ethereum ETF vs. Spot Bitcoin ETF: Investments That Will Explode In The Future

BlackRock Spot Bitcoin ETF Sets New Trading Record

According to experts in this industry, several factors are contributing to this spike in trading activity. First would be that institutional adoption of Bitcoin has been increasing. Institutions are finding a safer and more regulated route to cryptocurrency investments. ETFs like IBIT are affording that much-needed entry point that is accessible to them. Positive sentiment on Bitcoin, driven further by current regulatory clarity and better economic conditions, added to this spike in trading activity.

The success of the BlackRock Bitcoin ETF underlines a broader point: traditional finance is finally embracing digital assets. It stands to reason that the more conventional players involved in the crypto space show how mature the market has become and reach credibility with more conservative investors. This shift should then increase innovation and integrate cryptocurrencies into conventional financial systems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |