Key Points:

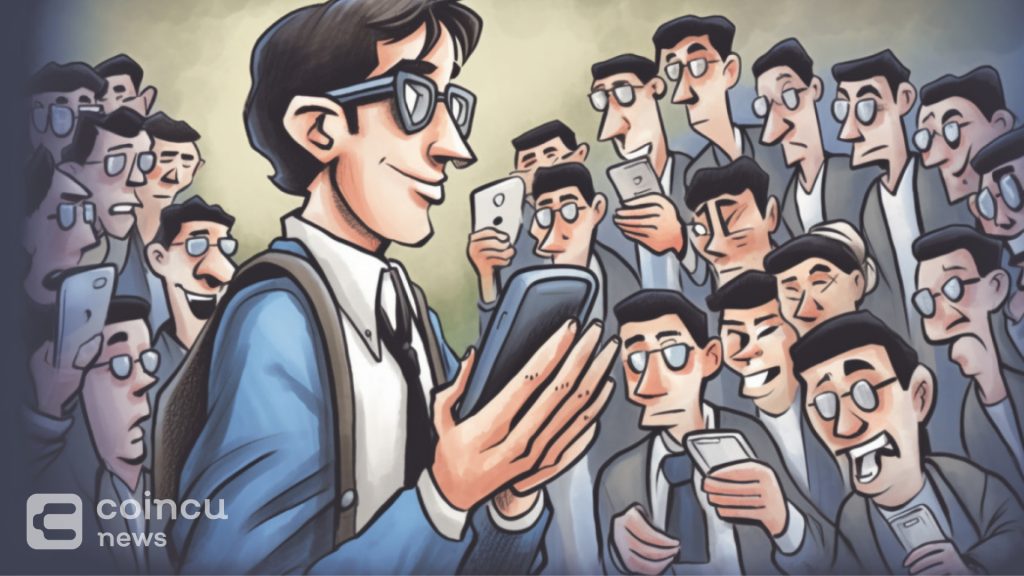

- The FCA finds trading app features like push notifications and sweepstakes increase trading frequency and risk.

- These digital engagement practices most impact individuals with low financial literacy, women, and young people (18-34).

- Trading apps must design services that help users make informed decisions, ensuring vulnerable groups aren’t exploited.

According to the UK Financial Conduct Authority’s website, it oversees the gamification design of UK trading applications.

The UK FCA is concerned that those designs induce users to increase their trading frequency and take on more risks. The findings from this broad experiment, conducted on more than 9,000 consumers, demonstrate that DEPs in UK trading apps—such as push notifications and sweepstakes—can greatly affect users’ trading behaviours.

The research outlines that the FCA used an in-house-developed experimental trading platform to infer how different DEPs might interact with trading behaviour. The research found that these features have a very strong impact on people who have low financial literacy, on women, and on young people in the 18-34-year-old age group. The gamified elements induced frequent trading and high levels of risk-taking in the group.

Consumer Protection Obligations for UK Trading Apps

UK trading apps must ensure their services are designed and tested to meet actual and realistic consumer needs, including that customers effectively, promptly, and informedly make their investment decisions. This becomes very important in cases where consumers have vulnerable characteristics. To the ‘responsible design’ of trading apps, the FCA further emphasizes protection from potential harm for vulnerable groups.

Concerns about gamification in trading applications date back to at least 2022. The FCA warned trading application providers to review their gamification features ahead of the implementation of consumer obligations, whose requirements entail trading platforms protecting consumers and not using design practices that make users increase trading and, therefore, associate risks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |