Key Points:

- SEC sues Consensys over unauthorized MetaMask transactions.

- Consensys accused of not registering as a broker since 2016.

- Further enforcement against Consensys hinted by SEC.

The SEC sues Consensys for unregistered securities transactions via MetaMask, violating federal laws. Over $250M in fees were collected.

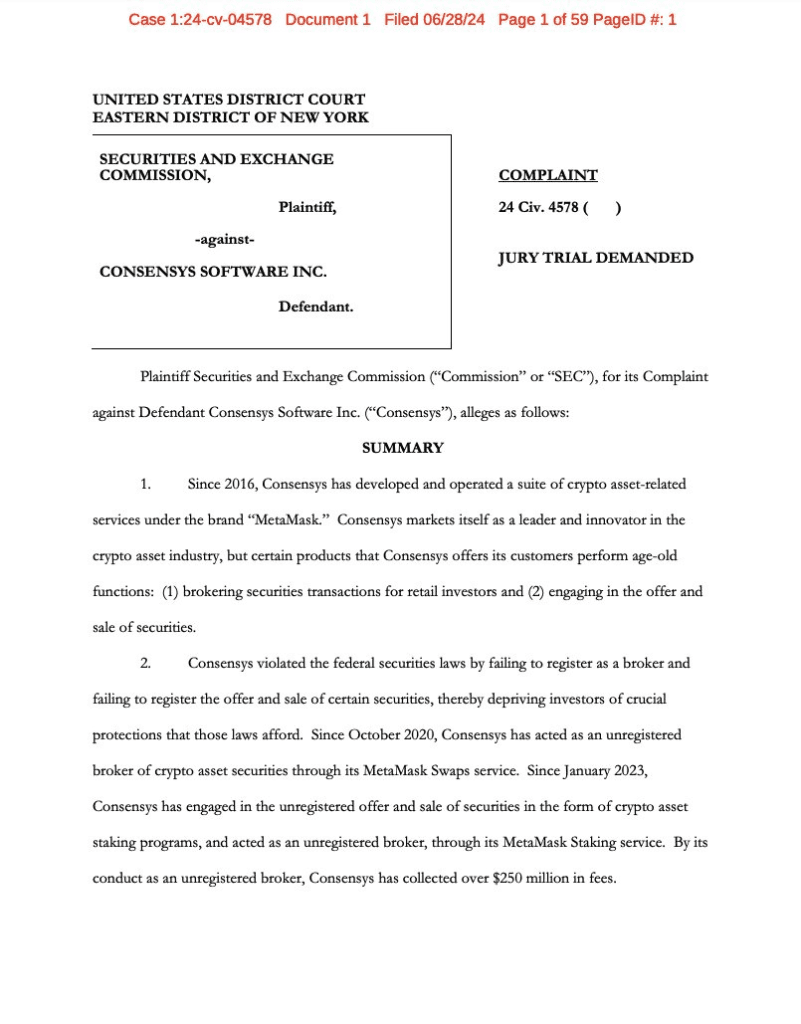

DB reported that the US Securities and Exchange Commission has filed a lawsuit against blockchain software company Consensys over allegations that MetaMask, a crypto wallet provided by Consensys, brokered securities transactions for retail investors and participated in the offer and sale of securities.

SEC Sues Consensys Over Violating Federal Securities Laws

The SEC charged Consensys with violating federal securities laws, as it has never appropriately registered as a broker or registered the offer and sale of certain securities since 2016.

According to the lawsuit filed in the Eastern District of New York, the filing also includes an allegation that more than $250 million in fees, which were paid under these violations, was, however, collected by Consensys.

Readmore: US PCE Inflation Fell To 2.6%, Bitcoin Remains Unfazed In Market

SEC References Unregistered Securities in Staking Services

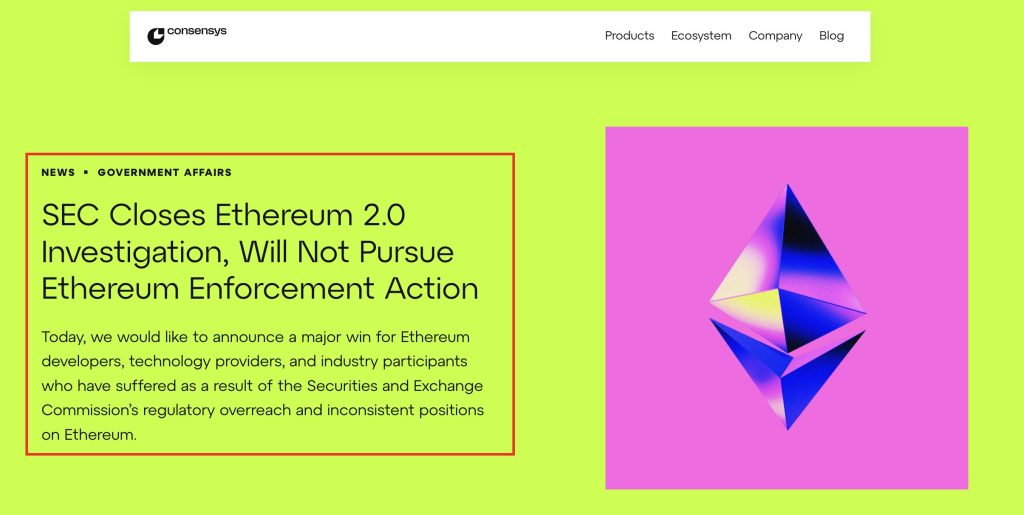

On the flip side, Consensys announced earlier that the SEC had closed its investigation over Ethereum 2.0, a development that was labelled a “major win” for Ethereum developers. However, the letters sent by the SEC to Consensys hinted toward further enforcement actions without mentioning MetaMask.

Additionally, it referenced staking services for Lido and Rocket Pool protocols. According to the SEC, their presentation corresponds to investment contracts, thereby drawing allegations of being unregistered securities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |