Key Points:

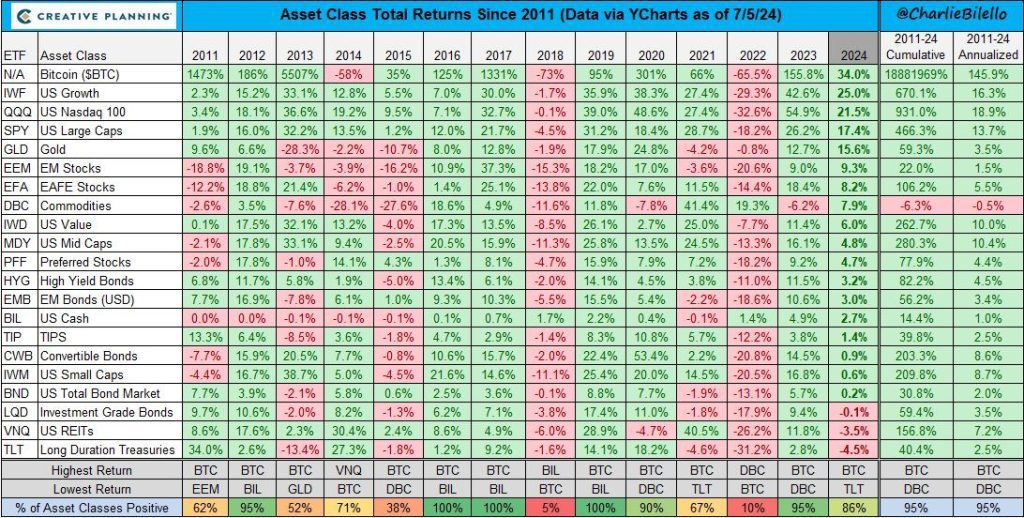

- Bitcoin price performance has led asset classes since 2011, up 145.9% as of July 5, 2024.

- Bitcoin fell to $53,500 due to liquidations by Mt. Gox and government entities.

- Big holders have accumulated 212,450 BTC during recent volatility, now owning 1.05% of the total supply.

MicroStrategy co-founder Michael Saylor recently highlighted the outstanding Bitcoin price performance, asserting that the largest digital currency is engineered to “keep winning.”

Bitcoin Price Performance Tops Asset Classes

Data presented by Saylor shows that, since 2011, Bitcoin remains the best-performing asset. As of July 5, 2024, Bitcoin has surged by 145.9%, outpacing significant other assets such as US Growth (16.3%), NASDAQ 100 (18.99%), US Large Caps (13.7%), and gold (3.5%).

Bitcoin price performance’s growth is particularly notable during its four-year halving cycles, which often leads to substantial value increases. Early in 2024, Bitcoin’s bullish momentum was further supported by the SEC’s approval of US spot Bitcoin ETFs, resulting in a significant influx of capital and heightened interest from investors.

However, the cryptocurrency market has recently faced a correction. In early July, Bitcoin experienced a substantial outflow due to liquidations by the defect Mt. Gox exchange and the US and German governments. This led to a four-month low of $53,500 on July 5. Despite a generally stable weekend, concerns linger about further sell-offs by these entities, potentially impacting Bitcoin’s price.

Large Bitcoin Holders Increase Accumulation

In contrast, a recent analysis from Santiment reveals that wallets holding over 10,000 Bitcoin have capitalized on the six-week market volatility. These large holders, likely exchange liquidity providers, have accumulated an additional 212,450 BTC, now controlling 1.05% of the total Bitcoin supply.

Currently, Bitcoin is trading at $57,643 with a recovery from the $55,000 support level. Analysts suggest that a close above $60,000 in the coming days could signal further upward movement for Bitcoin, reinforcing its position as a leading asset in the financial market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |