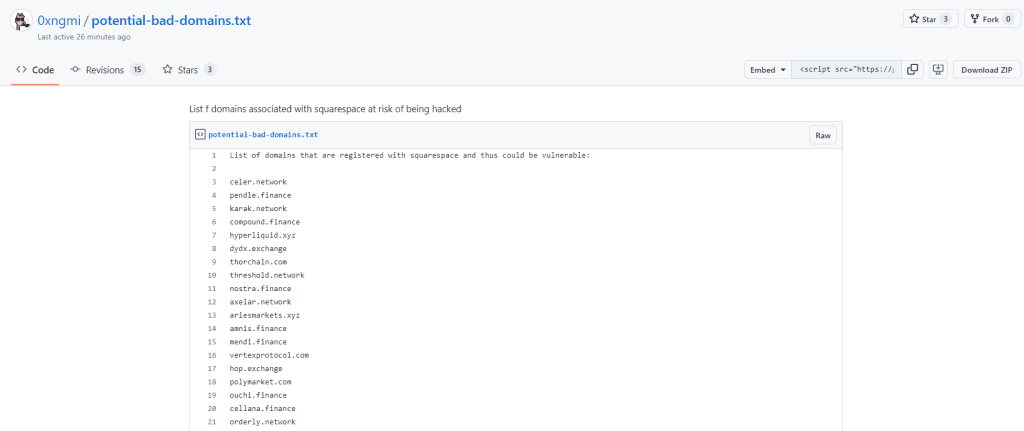

Key Points:

- DefiLlama updates its list with 128 crypto project domains at risk of cyber attacks, flagged due to their association with Square Space.

- The identification underscores the urgent requirement for robust cybersecurity protocols in the decentralized finance (DeFi) sector.

DefiLlama now collaborates with Square Space, a domain name registrar, on updating its list of crypto domains vulnerable to cyber attacks. The updated list adds 128 names, stating that the pace concerning such projects is enhanced at risk.

The list of identified domains from the beginning now adds yielddyak.com, lockon.finance, aloe.capital, starlay.finance, unsheth.xyz, definix.com, stcelo.xyz, satoshiprotocol.org, fractional.art, and stabble.org, to mention but a few. Such newly added domains raise concerns over crypto domains vulnerable, as they are identified along with previously reported malicious domains.

Read more: Hack Seasons Brussels 2024: A One-Day Tech Extravaganza!

Expansion of DefiLlama’s Warning on Crypto Domains Vulnerable

According to DefiLlama, in light of the threat identified, every project utilizing Square Space to register their domains should, therefore, hugely enforce cryptocurrency landscapes with tight cybersecurity measures. The identified domains cut across various sub-sectors within DeFi, from decentralized exchanges and lending platforms to yield farming protocols and synthetic asset platforms.

Moreover, including these domains spotlights continuous vulnerabilities that crypto projects usually face due to their financial nature and high-value transaction capability. Cybersecurity experts continue to impress that having robust security protocols, like secure domain registrations and frequent audits, is very important in mitigating these risks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |