Key Points:

- Japan’s Nikkei 225 plunged 12.9% to 31,290.63 points, marking its worst two-day decline ever.

- The drop follows a 5.8% decrease on Friday, reflecting concerns over potential US economic downturns.

- Key Japanese companies saw significant losses: Toyota -11%, Honda -13.4%, Tokyo Electron -15.8%, and Mitsubishi UFJ -18.4%.

Japan’s Nikkei 225 share index plunged nearly 14% on Monday as investors worried the US economy may worsen.

Japan’s Nikkei had dropped 13.6% to 31,010 points; after the index tanked 5.8% on Friday, the slide would put it on course to post its most severe two-day loss ever.

Read more: ETH Price Drop Triggers Massive Liquidations And Market Turbulence.

Historic 12.9% Plunge Marks Worst Two-Day Decline

The current slump in Japan’s Nikkei rivals some of its most infamous crashes. The biggest one-day fall in the index was on October 19, 1987—”Black Monday”—when it fell 14.9% or 3,836 points. Other significant falls include an 11.4% decline during the global financial crisis in October 2008 and a 10.6% drop in March 2011 after devastating earthquakes and nuclear meltdowns in northeastern Japan.

This is the most recent wave of selling in a broader selling response to increased worries over the health of the US economy. Last Wednesday, the Bank of Japan raised its benchmark interest rate. This benchmark now rests at around 4% below what it was a year ago at today’s date, only adding more pressure to the market.

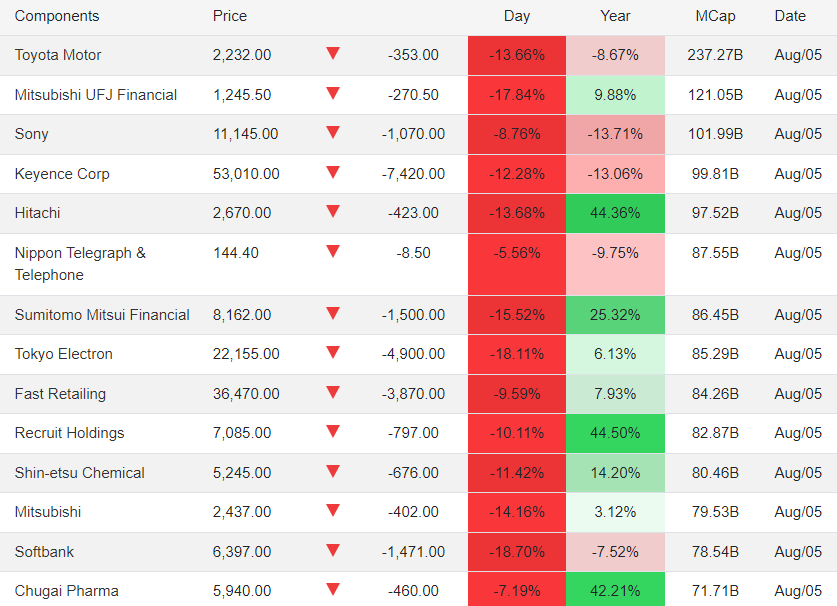

Key Japanese Companies Suffer Losses

The broad sell-off hit Japan’s most prominent companies: Toyota Motor Corp. fell 13.66%, while Honda Motor Co. slid 17.71%. Tokyo Electron, a significant computer chip maker, slid 18.1%, and Mitsubishi UFJ Financial Group lost 17.84%.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |