Binance.US Hit with Revived HEX Manipulation Lawsuit by Appeals Court

Key Points:

- A U.S. court revived a lawsuit against Binance.US for HEX token manipulation.

- The court ruled the plaintiff didn’t need Arizona-specific activities for jurisdiction.

A U.S. appeals court partially revived the HEX manipulation lawsuit against Binance.US, reversing a prior dismissal. The court affirmed Cox’s claims and remanded them for further litigation.

A United States appeals court has partially revived a class-action lawsuit against Binance.US, alleging that the exchange unlawfully manipulated the price of the HEX token.

Appeals Court Partially Revives HEX Manipulation Lawsuit Against Binance.US

The three-judge panel of the Ninth Circuit has reversed a previous court’s decision by a district court, pointing out that the plaintiff, Ryan Cox, had justifiably put forward claims against Binance.US and CoinMarketCap.

The lawsuit was initially filed in 2021 by Cox, alleging his company was being artificially kept at a disadvantageous ranking on the Binance-owned cryptocurrency price tracker CoinMarketCap—compared to Binance’s digital coins—so that other firms’ tokens could trade at a lower price.

Last February, sources were reportedly dismissed at the district court after Cox failed to establish concrete links between specific activities in Arizona and Binance.US.

Read more: SEC Sues HEX Founder Richard Heart For $1 Billion Securities Fraud

Court of Appeals Clarifies Jurisdiction Requirements

However, in its August 12 opinion, the appeals court clarified that Cox did not have to establish “sufficient minimum contacts” between a defendant and the state for a court to be able to establish personal jurisdiction.

The court of appeals determined that the district court could exercise personal jurisdiction over the United States–based defendants as they could be considered to have sufficient contacts with the US more generally. The opinion reasoned that each company is incorporated, or has its principal place of business, within the United States and thus satisfies due process.

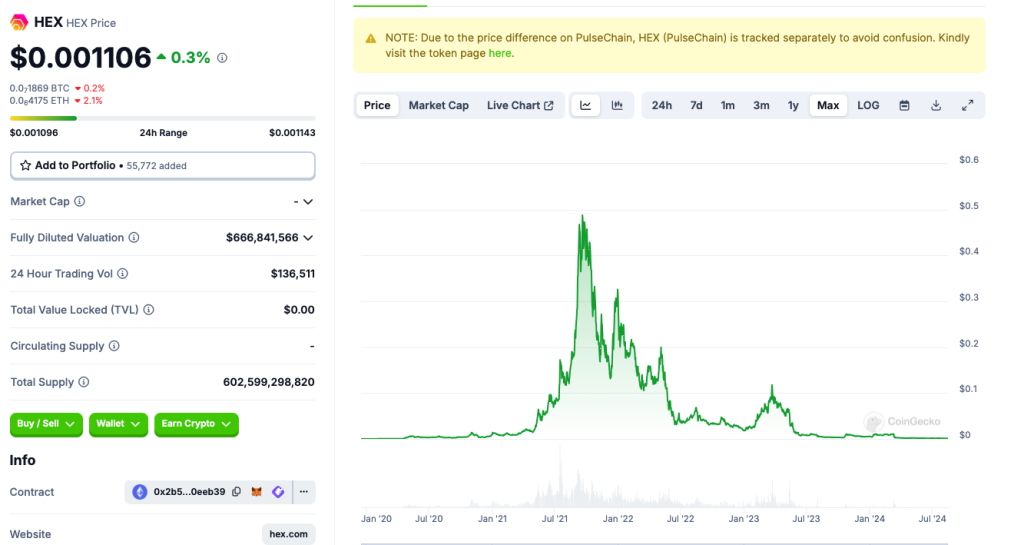

The court of appeals also affirmed Cox’s price manipulation claim against Binance.US and remanded it for further litigation. The HEX token, launched in December 2019, is trading at $0.0011, down over 99% from its all-time high of $0.48 on September 19, 2021.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |