$111059.002

At CoinCu News, we give both basic and in-depth articles on the latest news in the cryptocurrency and blockchain sectors.

Author

News

RBA Expands CBDC Tests With 24 New Use Cases

The RBA launches 24 new trials under Project Acacia to explore CBDCs, stablecoins, and tokenized

Jul

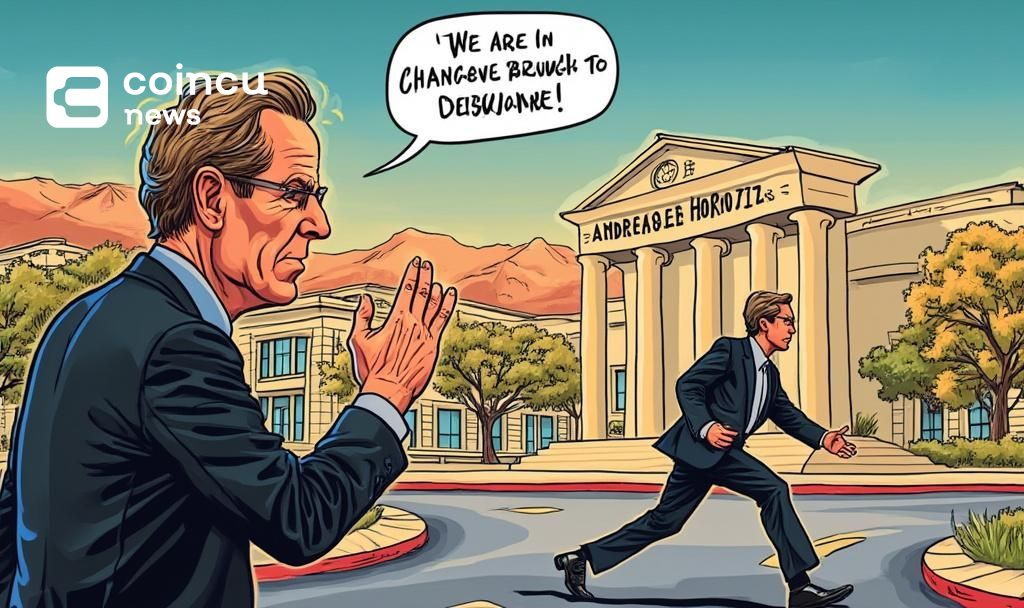

Andreessen Horowitz Moves Main Business Entity to Nevada

Andreessen Horowitz relocates its main business entity from Delaware to Nevada, citing judicial concerns.

Jul

Bitcoin Surge Unverified Amid 159,107 BTC Balance Claims

Claims of 159,107 BTC added to corporate balance sheets in Q2 2025 remain unconfirmed by

Jul

Ant Group Prepares to Integrate Circle’s USDC Stablecoin Globally

Ant Group plans global USDC integration through Ant International, pending US compliance, impacting payments and

Jul

Trump Announces 50% Tariff on Brazilian Imports

Trump claims 50% tariffs on Brazilian goods; Lula refutes deficit narrative. U.S.-Brazil trade dynamics scrutinized.

Jul

Solana Launchpad Market Sees Pump.fun Rise Amid Token Announcement

Solana launchpad Pump.fun rises to 49.6% market share after token issuance news.

Jul

GMX Exploit Results in $42 Million Theft

GMX's decentralized platform faces a $42 million hit after a smart contract exploit manipulates its

Jul

Bhutan Government Deposits 350 BTC into Binance

Bhutan's government deposits 350 BTC into Binance, reflecting strategic crypto market involvement.

Jul

Truth Social Introduces Utility Token in Loyalty Program Initiative

Truth Social's new utility token partners with Patriot Package, enhancing user engagement on the platform.

Jul

[tptn_list how_old="7" limit="5" title_length="0" heading="0" show_date="0" ]

[tptn_list how_old="30" limit="5" title_length="0" heading="0" show_date="0" ]