Market Overview (Sep 30 – Oct 6): XRP ETF Filing Triggers Ripple of Market Interest

Catch up on crypto highlights, XRP ETF filing, Japan’s crypto tax reform, Gemini’s Canada exit, and key Fed updates on inflation and market trends for October 7-13.

Last week’s Highlights Big News (September 30 – October 6)

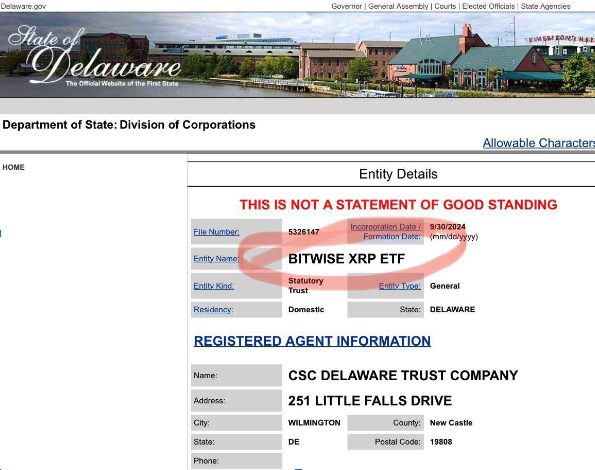

Bitwise Files for an XRP ETF Amid Ripple Case Developments

Bitwise has filed for an XRP ETF, signalling increased interest in XRP as the SEC’s deadline to appeal the Ripple case approaches on October 7. The thereof follows Grayscale’s decision to reopen its XRP Trust, potentially indicating positive sentiment around the outcome for Ripple.

Metaplanet Acquires $7 Million in Bitcoin

Japanese investment firm Metaplanet has substantially added to its cryptocurrency holdings, purchasing 1 billion yen (~$7 million) worth of Bitcoin. Metaplanet now holds 506.7 BTC, strengthening its position in the crypto market.

Japan Reconsiders Crypto Regulations

Japan is taking a fresh look at its crypto regulations, considering reforms that could reduce the crypto tax rate from 55% to 20% and potentially lift the ban on crypto ETFs. If passed, these changes could make Japan a more crypto-friendly environment, attracting more investment into the sector.

Former Chinese Finance Official Advocates for Crypto Research

Despite China’s strict stance on cryptocurrency trading and mining, Zhu Guangyao, former Deputy Finance Minister, has called for further research into crypto and international policy.

Gemini Exits Canada by End of 2024

Gemini has announced that it will close all customer accounts in Canada by December 31, 2024. In a message to Canadian users, the platform has advised customers to withdraw their assets within 90 days, signaling the end of its operations in the country.

Ripple Expands into the UAE

Ripple has received in-principle approval from the Dubai Financial Services Authority (DFSA) to expand its cross-border payment services in the Middle East.

Arbitrum One Surpasses 1 Billion Transactions

Ethereum Layer 2 solution Arbitrum One has reached a milestone of 1 billion transactions since its launch in August 2021. Its competitors, Base and OP Mainnet, have reported 755 million and 347 million transactions, respectively, underscoring Arbitrum’s leading position among Layer 2 solutions.

Aptos Partners with Franklin Templeton on Blockchain Integration

Aptos Foundation and global asset manager Franklin Templeton have announced the integration of the Franklin OnChain U.S. Government Money Fund (FOBXX) on the Aptos blockchain.

This money market fund, which primarily invests in U.S. government bonds and cash, manages over $427 million in assets, showcasing the potential of blockchain in traditional finance.

FTX to Auction 22 Million Locked Worldcoin Tokens

FTX is preparing to auction 22 million locked Worldcoin (WLD) tokens, valued at around $38 million, at a discount. Scheduled for October 3, this sale could offer significant value, with prices expected to be up to 75% off. The tokens are set to unlock gradually from December 2024 to 2028.

PayPal Completes First Corporate Payment with PYUSD Stablecoin

PayPal has successfully completed its first corporate payment using PYUSD, a stablecoin built on Ethereum and Solana, and the payment was made to Ernst & Young.

Read more: Market Overview (Sept 23 – Sept 29): FTX Repayment Rumors Pump Bankrupt Coins

Macroeconomics

Federal Reserve Chair Jerome Powell has indicated that the recent 0.5% interest rate cut should not be viewed as a precedent for future cuts. Instead, Powell emphasized that rate adjustments will be gradual, aiming for a more neutral stance over time.

Following his comments, CME Futures reflected a 57.9% probability of a 0.25% rate cut in November, compared to a 42.1% likelihood of a 0.5% cut.

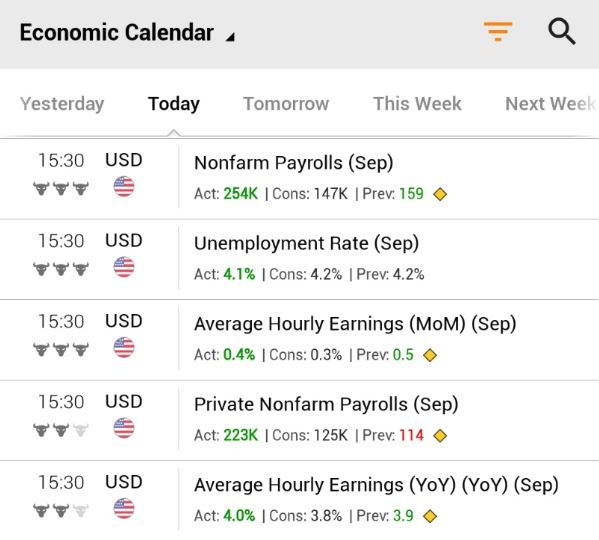

The U.S. labour market showed strength, with non-farm payrolls surging to 254,000, up from August’s 159,000 and well above Dow Jones’ forecast of 150,000. The unemployment rate also fell to 4.1%, beating expectations of 4.2%.

CPI Inflation Report: Forecast 2.3% | Previous: 2.5%

Core CPI: Forecast 3.2% | Previous: 3.2%

Key Economic Events This Week (U.S. Dates)

This week features multiple FED speeches, focusing most on the CPI inflation report.

Monday, October 7

- Fed Governor Michelle Bowman’s speech

- St. Louis Fed President Alberto Musalem speech

Tuesday, October 8

- Fed Governor Adriana Kugler’s speech in Europe

- Atlanta Fed President Raphael Bostic’s speech

- FED Vice Chair Philip Jefferson’s speech

Wednesday, October 9

- FOMC Meeting Minutes for September

- Speeches from Raphael Bostic, Lorie Logan, Austan Goolsbee, Philip Jefferson, and Mary Daly

Thursday, October 10

- Initial Jobless Claims Report

- Speeches from Fed Governor Lisa Cook, Richmond Fed President Tom Barkin, and New York Fed President John Williams

Friday, October 11

- Producer Price Index (PPI) inflation data

- Opening remarks by Chicago Fed President Austan Goolsbee

- Speech by Dallas Fed President Lorie Logan

- Speech by Federal Reserve Governor Michelle Bowman

Market Overview

Bitcoin closed the week above $62,000 and is now recovering to $63,800. The market is becoming active again, with notable gains in altcoins, especially meme coins and AI tokens.

The Aptos ecosystem is more vibrant compared to others. Additionally, over $103 million in stablecoins flowed into exchanges in the past 24 hours, suggesting a potential growth wave toward year-end.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |