Market Overview (Oct 28 – Nov 3): Big Token Unlocks and $42B Plans After October’s End

MicroStrategy to raise $42B for BTC; Metaplanet holds 1,019 BTC; Hong Kong to license more exchanges; Coinbase AI bot tool; Consensys cuts jobs. Notable Token Unlocks: ZETA, SUI, MEME.

Last week’s Highlights Big News (October 28 – November 3)

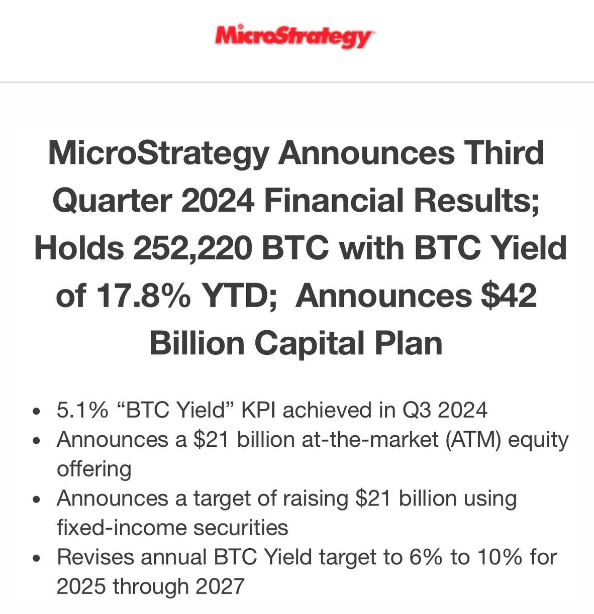

MicroStrategy announced a goal of raising $42 billion over the next three years for buying Bitcoin (BTC), $21 billion each from shares and bonds.

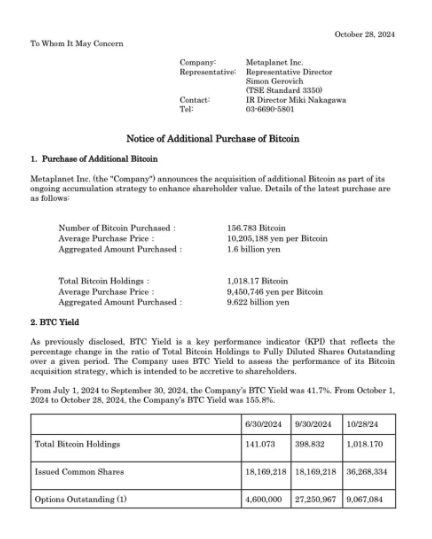

Metaplanet added 156.78 more BTC, taking the total count to 1,019.17 BTC.

After a five-month review period, the Hong Kong regulator is likely to grant more crypto exchange licenses before the end of this year.

Coinbase announced “Based Agent,” an AI bot maker that creates an AI bot in three minutes or less, with which automated tasks are so much easier to set up, including trading, swapping, and staking on the blockchain.

Consensys announced it would cut its workforce by 20%, laying off 162 employees. Consensys mainly develops software for Ethereum (ETH).

Alameda Research, an investment firm from FTX, sued KuCoin in an attempt to reclaim assets estimated at more than $50 million frozen since the collapse of FTX in November 2022. Assets that were once valued at $28 million are presently at a value of $50 million due to market gains.

Visa and Coinbase have reached a deal that allows users in the US and EU to instantly fund accounts with Visa cards when purchasing cryptocurrencies.

Macroeconomics

PCE Inflation:

- Headline PCE Inflation: 2.1%, matching estimates (previously 2.2%).

- Core PCE Inflation: 2.7%, slightly above the estimated 2.6% (previously 2.7%).

Generally aligned with expectations, similar to Core CPI, with Core PCE only slightly higher than anticipated.

Key Events This Week

Tuesday, November 5

U.S. Presidential Election Day. Results are expected within 24 hours unless a recount is required, which would extend the process. Each state will report results sequentially until data from all 50 states are in.

Thursday, November 7

The Federal Reserve’s interest rate decision is anticipated at 11:00 AM (California time) / 2:00 AM (Vietnam time). A 0.25% rate cut is expected.

Market Overview

BTC dropped below $69K as Trump’s election probability decreased. Betting markets show Trump’s odds of winning are falling, with a 54.9% probability on Polymarket and 51% on Kalshi.

The CME indicates a 98.9% likelihood that the Fed will cut rates by 0.25% on November 8, which could lead to a market recovery.

Notable Token Unlocks in November

| Token | Amount Unlocked | Unlock Date |

|---|---|---|

| $ZETA | 53.89M | November 1 |

| $SUI | 64.19M | November 3 |

| $MEME | 3.84B | November 3 |

| $BANANA | 250K | November 8 |

| $XAI | 35.88M | November 9 |

| $APT | 11.31M | November 11 |

| $STRK | 64M | November 15 |

| $ARB | 92.65M | November 16 |

| $PIXEL | 54.38M | November 19 |

| $ID | 18.49M | November 22 |

| $OP | 31.34M | November 30 |

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |