Strategic Bitcoin Reserve Driven by 5-Year Commitment to Buy BTC

Key Points:

- Senator Cynthia Lummis outlined the Strategic Bitcoin Reserve, which will sell part of the Fed’s gold reserves to fund the purchase of Bitcoin.

- The proposal has gained traction following President-elect Donald Trump’s comments supporting a national Bitcoin reserve.

US Senator Cynthia Lummis has now presented the Strategic Bitcoin Reserve plan, aimed at using some of the Federal Reserve’s gold holdings to create a national Bitcoin reserve.

Read more: Senator Lummis Urges Bitcoin Reserve to Fix Treasury’s Critical Value Gap

Senator Lummis Outlines Strategic Bitcoin Reserve Plan

The proposal, which was initially unveiled in July, gained traction after President-elect Donald Trump hailing cryptocurrency via Twitter and fresh off of an election victory.

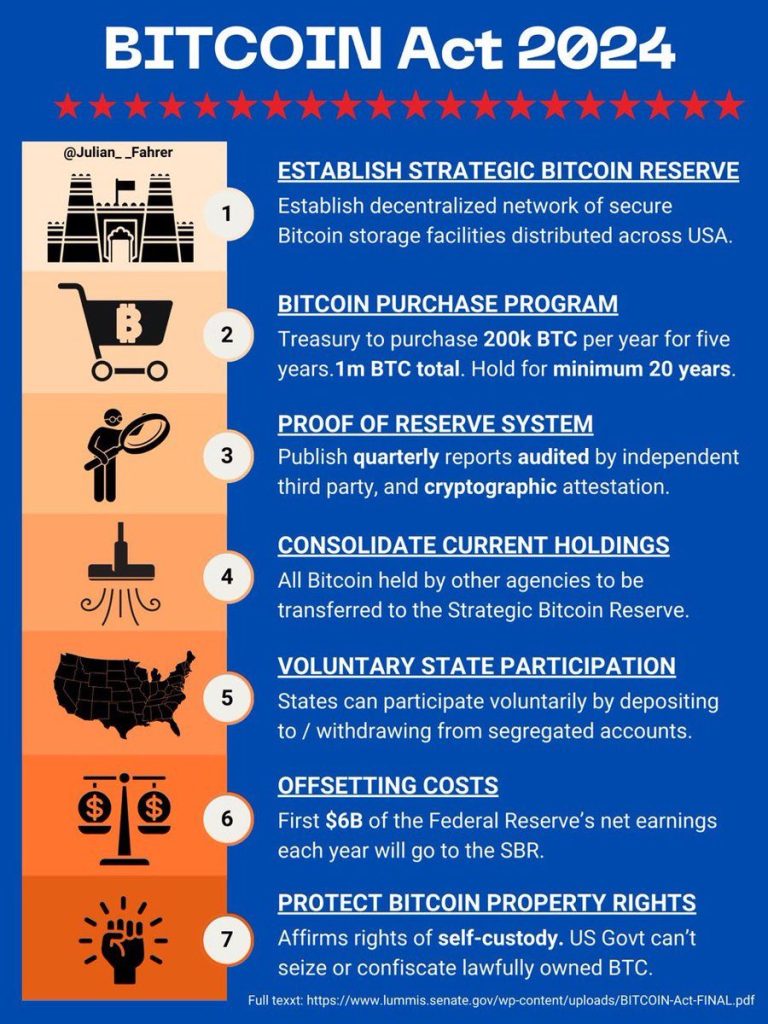

The Strategic Bitcoin Reserve plan calls for selling off a portion of the Federal Reserve’s gold reserves to fund a $1 million program to buy 5% of all outstanding Bitcoin over five years. Bitcoin bought through the plan would be held for at least 20 years, to underline the virtual currency as a long-term financial asset.

Lummis, who is a Republican senator, believes this move can be considered one that modernizes the financial strategy of the United States while reducing dependence on legacy reserves.

Trump’s public support for the idea of a Strategic Bitcoin Reserve has strengthened confidence in the bill’s likely passage. Interest in state initiatives by his administration has also sparked conversation regarding similar proposals among states.

States and Institutions Support Plan for Strategic Bitcoin Reserve

Most recently, Pennsylvania unveiled the Bitcoin Strategic Reserve Act, championed by the Satoshi Action Fund, a group that has been on the front lines of drafting the Bitcoin Rights bill. For now, the organization said it is in discussions with ten other states considering similar legislation.

Meanwhile, the idea has gained traction among institutional players, with BlackRock, a world-leading asset manager favouring the establishment of a U.S. Strategic Bitcoin Reserve. Crypto industry executives, such as MicroStrategy’s CEO Michael Saylor, also demonstrated confidence in the outlook for the sector during Trump’s presidency.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |