Key Points:

- MARA Holdings is raising $700 million through zero-coupon convertible senior notes, with an option for investors to purchase an additional $105 million.

- Proceeds will partially repurchase 2026 MARA convertible notes, acquire Bitcoin, and support corporate operations.

On Monday, MARA Holdings announced a private offering of $700 million of its zero-coupon convertible senior notes due 2031.

Read more: MARA Bitcoin Purchased As Holdings Reach 34,794 BTC

MARA Convertible Notes Offering Continues to Boost Bitcoin Investment

These MARA convertible notes, available only to qualified institutional investors under Rule 144A of the Securities Act of 1933, will be without interest, except for special interest provided upon issuance and payable semi-annually.

Aside from the offering, MARA has also given investors the option to purchase up to $105 million in additional notes within 13 days of the offering. The company intends to use $50 million of the proceeds for the partial repurchase of existing MARA convertible notes due in 2026. The remainder will be used to buy Bitcoin and for general corporate purposes.

Record Mining Performance Boosts MARA’s Crypto Holdings

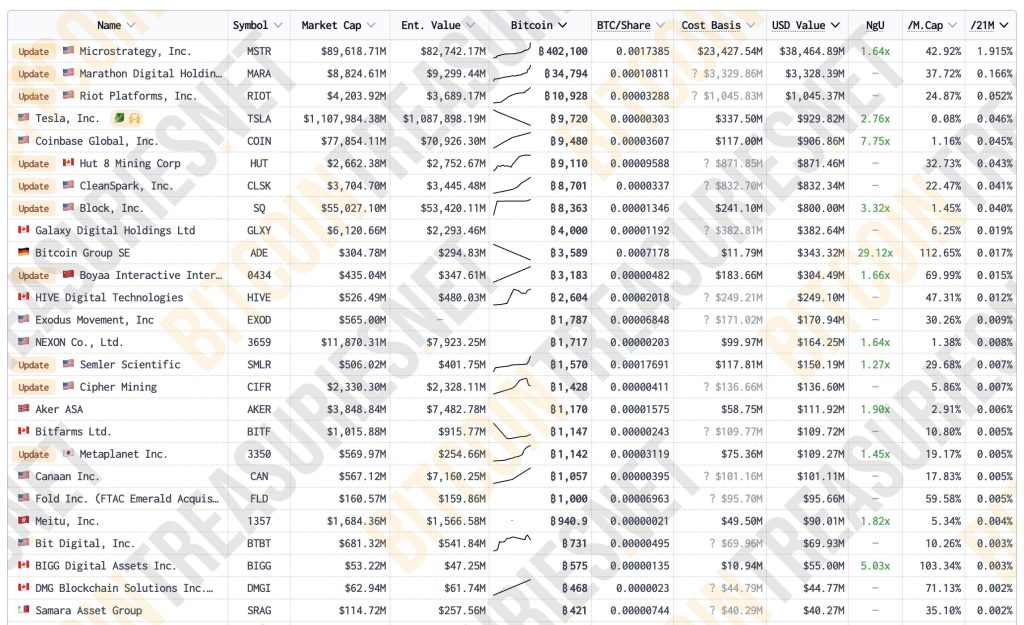

At today’s price of $95,000 per BTC, MARA could buy up something around 6,800 bitcoins with the amount raised. This is not the first time MARA’s movement will be aimed at building the BTC reserve, according to reports, which presently stands at about 34,794 BTC as of December 2, 2024, making it the second-largest after Microstrategy in terms of publicly-owned bitcoin reserves.

MARA recently concluded an outstanding month of bitcoin mining in November, during which it added more than 27% over the previous month’s record to reach a total of 254 mined blocks.

Just like MicroStrategy’s Executive Chairman Michael Saylor, MARA is a firm believer in “HODL,” as it keeps all mined bitcoins and, from time to time, adds to its treasure.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |