Key Points:

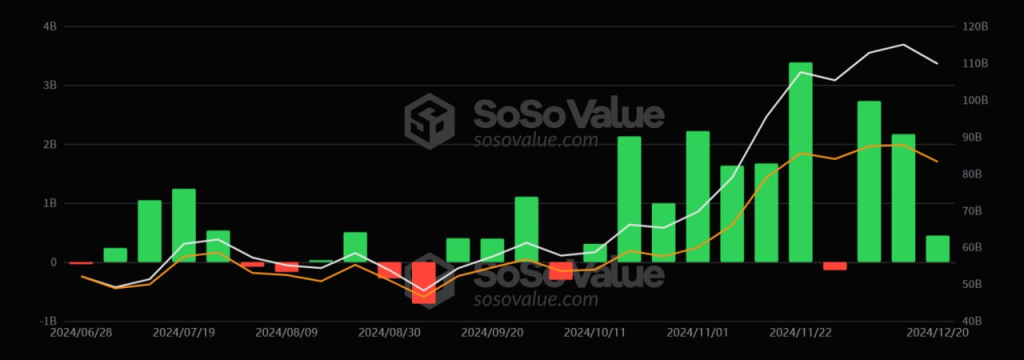

- Bitcoin Spot ETF Inflows totaled $449M, led by BlackRock’s $1.45B contribution.

- Ethereum Spot ETF achieved $62.73M in inflows, maintaining a consecutive 4-week streak.

Bitcoin Spot ETF Inflows reached $449M last week, with BlackRock ETF IBIT leading at $1.45B. Ethereum Spot ETF saw $62.73M inflows, continuing a 4-week streak.

Bitcoin Spot ETF Inflows Surge to $449 Million

From December 16 to 20, Bitcoin Spot ETF inflows surged to $449M, indicating notable investor interest. With a weekly net total of $1.45 billion BlackRock‘s IBIT topped the inflows, therefore supporting its leadership in the crypto ETF market. These numbers show the increasing faith institutional players have in the market resiliency of Bitcoin.

According to Sosovalue, the steady influx into Bitcoin ETFs mirrors the growing acceptance of digital assets as key investing instruments. Rising demand, especially from large-scale investors, indicates a mature cryptocurrency industry as Bitcoin ETFs like BlackRock IBIT continue to draw sizable money.

Read more: Bitcoin Spot ETF Outflows Reach $277M Amid Market Activity

Ethereum Spot ETF Maintains 4-Week Inflow Streak

Last week, Ethereum Spot ETFs revealed a net inflow of $62.73M, therefore confirming their 4-week running of positive inflows. Leading Ethereum-focused ETFs BlackRock attracted $144 million and showed a strong institutional demand in the second-largest cryptocurrency.

This consistent increase in Ethereum ETF investments highlights its increasing importance in distributed finance and blockchain uses. Ethereum’s ETFs are becoming a pillar for diverse crypto portfolios as institutional faith in the network confirms.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |