MicroStrategy buys 15,350 BTC; Ripple launches RLUSD; Lido exits Polygon; BTC drops post-ATH; reduced liquidity amid holidays; altcoins lack momentum.

1. Last week’s Highlights (December 16 – December 22)

MicroStrategy purchased an additional 15,350 BTC (~$1.5 billion) at an average price of $100,386 per Bitcoin. As of December 15, 2024, MicroStrategy holds 439,000 BTC (worth $27.1 billion) at an average cost of $61,725 per Bitcoin.

Ripple’s stablecoin RLUSD is officially set to launch on Tuesday, December 17.

Lido has ceased its staking services on Polygon due to:

- Low user adoption and unattractive rewards.

- High maintenance costs and a strategic focus on Ethereum.

Metaplanet will issue ¥4.5 billion ($30 million) in standard bonds to accelerate Bitcoin acquisitions. Debt repayments will come from revenues generated when investors exercise their company stock purchase rights.

Bitwise has launched a Solana staking ETP in Europe under the ticker BSOL, offering participants an annual yield (APY) of 6.48%.

Hong Kong has officially approved four new Bitcoin and crypto trading platforms:

- Accumulus GBA Technology

- DFX Labs

- Hong Kong Digital Asset EX

- Thousand Whales Technology

Deutsche Bank, Germany’s largest lender, is developing its own Layer 2 blockchain on Ethereum using ZKsync technology to address compliance challenges in leveraging public blockchains for financial services.

Mo Shaikh, CEO and co-founder of Aptos Labs, has resigned.

The SEC fined Tai Mo Shan, a subsidiary of Jump Trading, $123 million for manipulating TerraUSD (UST) during its May 2021 devaluation.

2. Macroeconomic News

Fed Chair Jerome Powell stated that the Fed is “not allowed to own Bitcoin.” Whether the U.S. government should hold Bitcoin is a matter for Congress to decide, but the Fed itself has no plans to hold any Bitcoin.

(Note: The Federal Reserve operates as a private corporation and is not part of the U.S. government.)

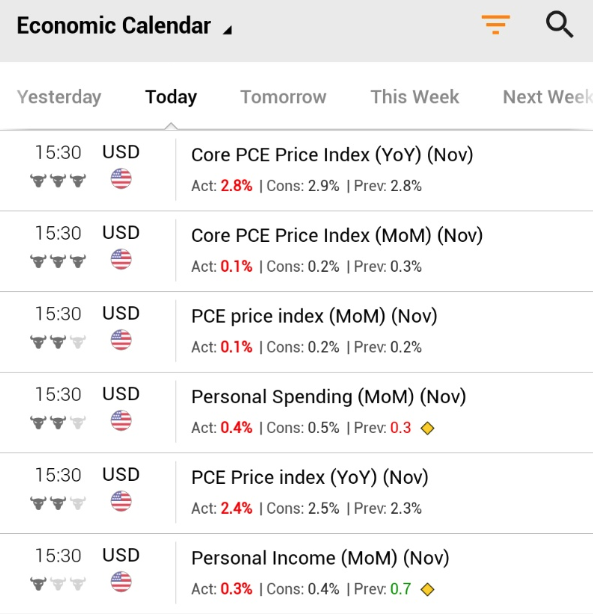

PCE Inflation 🇺🇸:

- Current: 2.4% (Forecast: 2.5%, Previous: 2.3%)

- Core PCE: 2.8% (Forecast: 2.9%, Previous: 2.8%)

PCE inflation performed better than expected.

3. Market Overview

- BTC closed the week in red, with a strong pullback after reaching an all-time high (ATH) of $108K.

- The market continues to trend negatively in the short term.

- The current period is marked by international holidays, resulting in reduced liquidity.

- There are no positive signals for altcoins as of yet.

- Over $251 million in stablecoin net outflows was withdrawn from exchanges in the past 24 hours.

Historical Insights:

During Christmas Eve, BTC Dominance (BTC.D) often decreases, favouring altcoins (Spot trading only).

- 2016 Halving Cycle: BTC.D declined continuously until mid-January.

- 2020 Halving Cycle: BTC.D rose slightly until January 2, then declined sharply.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |