Key Points:

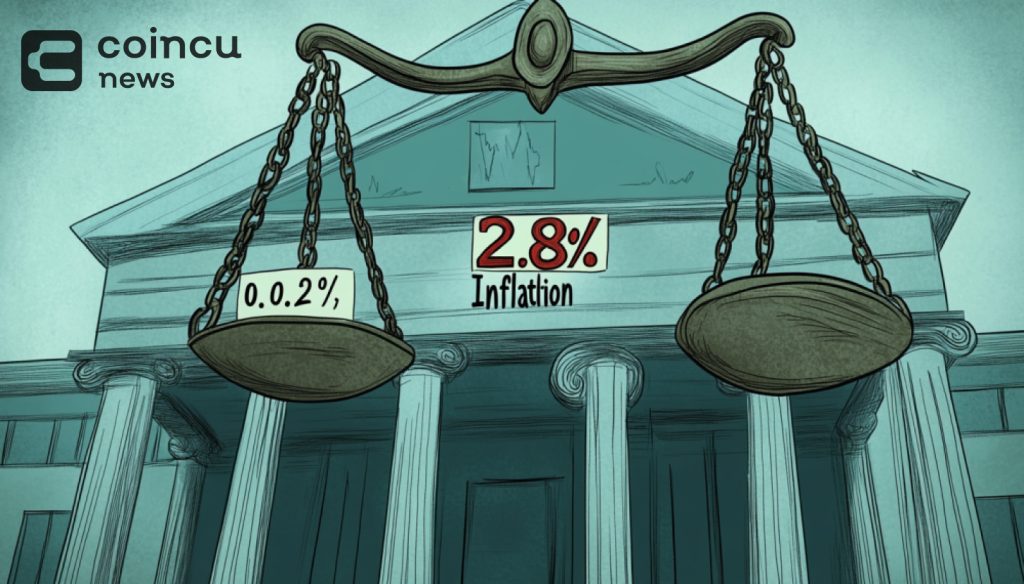

- The US core PCE annual rate remained steady at 2.8% in December, meeting expectations and previous figures.

- The US core PCE monthly rate increased to 0.2% from 0.1%, indicating persistent inflation pressures.

- With inflation above the 2% target, the Federal Reserve may delay interest rate cuts in 2024.

The U.S. Commerce Department released data showing that the US core PCE Price Index, the Federal Reserve’s preferred inflation gauge, remained steady at 2.8% year-over-year in December, aligning with market expectations.

US Core PCE Inflation Remains at 2.8%

This figure matched both the forecasted and previous readings of 2.8%, signaling that inflation pressures are gradually stabilizing. On a month-over-month basis, the US core PCE Price Index rose 0.2%, in line with expectations but up from November’s revised 0.1% increase. The slight uptick suggests that while inflation is easing compared to previous highs, price growth remains persistent in certain sectors.

The US core PCE index, which excludes volatile food and energy prices, is closely watched by the Federal Reserve to assess underlying inflation trends. The data reinforces the view that inflation is slowly moderating but remains above the Fed’s 2% target, potentially influencing future monetary policy decisions.

Read more: New US Treasury Secretary Announced With Big Role During His Term

Federal Reserve May Delay Rate Cuts

Despite the stable annual rate, the monthly increase could factor into the Fed’s approach to interest rates. Markets continue to anticipate potential rate cuts later in 2024, but policymakers may wait for more consistent inflation declines before making adjustments.

With inflation cooling but still above target, analysts suggest that the Federal Reserve will remain cautious in adjusting its policy stance, carefully balancing economic growth and inflation control.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |