Crypto Liquidation Tops $2.16B as Trump Tariffs Shake Markets

Key Points:

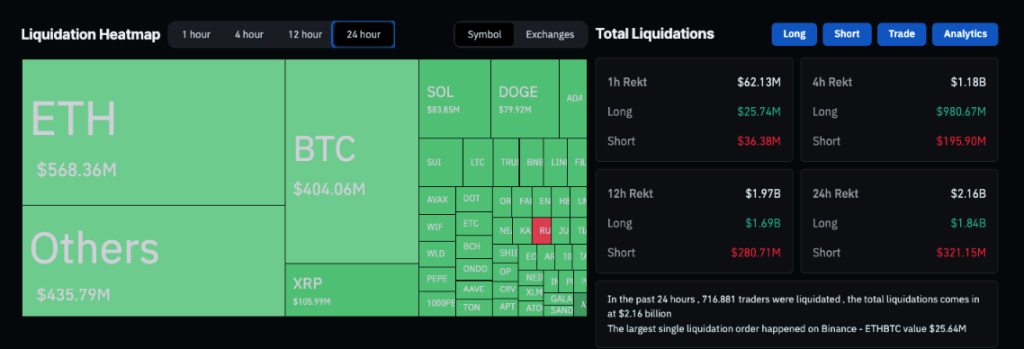

- The cryptocurrency market faced over $2.16 billion in liquidations within 24 hours, triggered by U.S. President Donald Trump’s tariff announcement on imported goods.

- Bitcoin (BTC) fell 10% to $91,329, while Ethereum (ETH) dropped 33% to $2,127, leading to a 16% decline in total crypto market capitalization, now at $3.06 trillion.

The cryptocurrency market experienced over $2.16 billion in liquidations over the past 24 hours following U.S. President Donald Trump’s announcement of new tariffs on imported goods. The policy shift triggered a broad sell-off in risk assets, leading to significant volatility in the digital asset market.

Crypto Liquidation Hit Record Levels

According to data from Coinglass, approximately 716,881 traders faced liquidations, with total market-wide liquidations reaching $2.16 billion. Of this, long liquidations accounted for roughly $1.84 billion, while short liquidations totalled $321.15 million.

The largest single liquidation order occurred on Binance, involving an ETHBTC trade valued at $25.64 million. Liquidations occur when traders’ positions are forcibly closed due to substantial losses or insufficient margin to maintain their trades.

The new tariff plan includes a 25% levy on imported goods from Canada and Mexico, as well as a 10% tariff on Canadian energy and goods from China. The measures are set to take effect on Tuesday. In response, Canada has announced a 25% counter-tariff, while Mexico and China are also expected to introduce retaliatory measures. Analysts have referred to the escalating situation as a “trade war.”

Bitcoin (BTC) fell 10% in the past day to trade at $91,329, while Ether (ETH) declined by 33% to $2,127, according to CoinMarketCap. The total cryptocurrency market capitalization shrank by 16% in the past 24 hours, now standing at $3.06 trillion, based on CoinGecko data.

Exchange Liquidations Breakdown

Exchange-specific data shows that Binance had the highest share of long liquidations at $729.37 million, with short liquidations at $79.96 million. OKX followed with $359.67 million in long liquidations and $56.87 million in short liquidations. Bybit and Gate.io also experienced significant liquidation volumes, with long positions dominating across most platforms.

Ether liquidations led the market, with over $568.36 million worth of long positions closed in the past day, followed by Bitcoin liquidations at $404.06 million.

This movement mirrored a market downturn observed on January 7, when Bitcoin dropped by a similar percentage in a single session. That pullback lasted a week, bottoming at just over $90,000 by January 13.

Major Cryptocurrencies Experience Sharp Declines

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, fell 18.78% in the past 24 hours and 21.15% over the past week, trading at $2,510.65. However, the asset maintains a market cap of $302.59 billion, with a 24-hour trading volume of $72.34 billion, indicating sustained activity despite the decline.

Solana (SOL) dropped 7.75% in a day and 17.70% over the week, now trading at $194.44. Meanwhile, XRP saw one of the steepest declines among major altcoins, falling 22.06% in 24 hours.

Dogecoin (DOGE) dropped 22.53% in the past day and 28.81% over the week, now trading at $0.2351. Official Trump Token (TRUMP) has also faced sharp losses, declining 9.53% in 24 hours and 33.24% over the past week, now trading at $17.92.

The hype surrounding Donald Trump’s memecoin, launched over the weekend, appears to have faded. The token plunged more than 40% in a matter of hours on January 20, following a surge that briefly pushed its fully diluted valuation above $70 billion.

The decline coincided with the launch of a separate token by Melania Trump, which peaked at a valuation of over $13 billion just hours after its introduction on January 19.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |